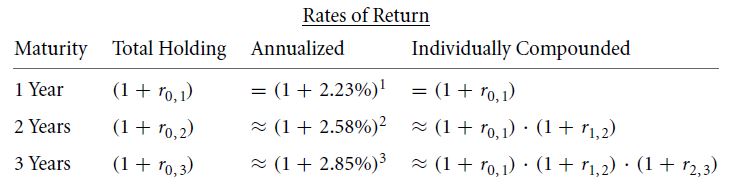

Let us follow the table given below:

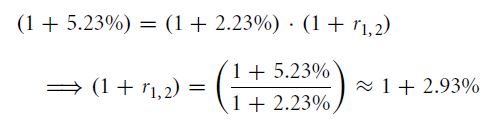

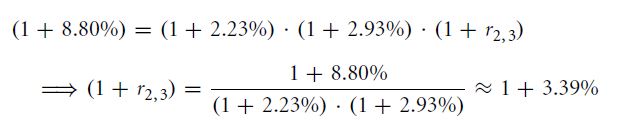

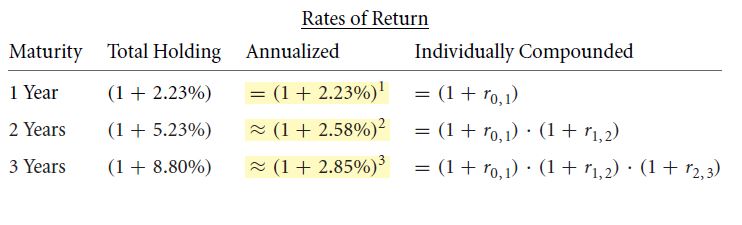

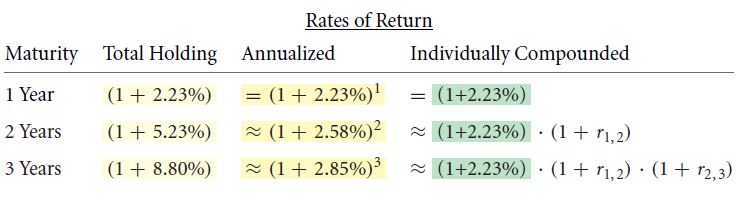

Let us refer to our discussion of yield curve and recall the values. Substituting those values, we get:

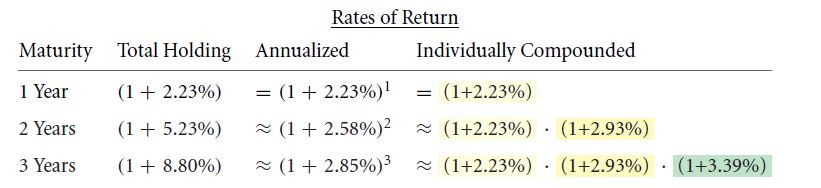

Calculating the holding rates of interest in the second column, we get:

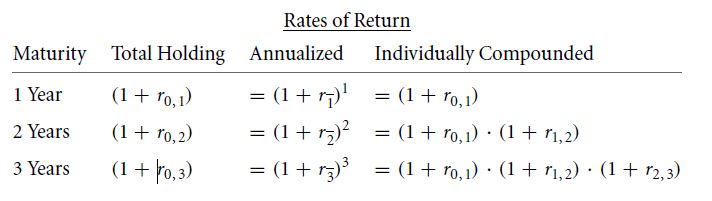

Putting these values in the table, we get:

As all the forward interest rates have been obtained, the yield curve can be plotted. The annualized interest rate is the geometric average of all the years taken into the calculation. If we know the average interest rate and the first half of the average, then the second half can be calculated.

Links of Previous Main Topic:-

- Working with time varying rates of return

- Inflation

- Study of treasury bills and yield curve in time varying interest rates

- Why is the slope of yield curve upward

Links of Next Financial Accounting Topics:-