What is conflict of interest? It is a situation when two are more parties is competing with their own interest in mind. In the beginning of a company, when it is in its initial phases, there are hardly such conflicts. This is because there are not many competitors; the entrepreneur is the sole owner and operator. As the company grows, importance of management comes to the fore and the personal interest of the entrepreneur diminishes. As management becomes professional in its approach, need for managers for different posts arrive. These managers represent the interest of the owner, but unfortunately not all of them works selflessly for the interest of the owner. Most are concerned about their own welfare and wealth development. This situation is described as an agency problem. It is also known as agency-principal problem with the principal being the entrepreneur. Thus it is the principal’s need to oversee the working of management for their own interest.

As the owner’s become older, they are no more capable of efficiently overseeing the working of the management. Thus they sell their shares to investors. These external investors become the majority owners. They share the role of overseeing the management along with the owner. It is generally accomplished with the help of a governing board of members who are responsible for taking care of the need of shareholders.

Over the years, the difference between the owners, board and the managers become more predominant. All these lead to more conflicts. This is due to the fact that large number of shareholders often creates a problem of coordination. Neither the wish of the shareholders is properly communicated, nor are they efficient in overseeing the day to day working of the managers.

Even if the managers are diligent, it might not be always possible for them to act according to the wish of the owner, forget the wish of multiple shareholders. The conflict is not only limited between managers and owners but can be between owners themselves. This makes working more difficult. But it is still possible to tackle the conflicts between a few owners. But with thousands of shareholders holding the share of a company, these conflicts can take on a whole new dimension. One thing that no owners will argue upon is the need for earning more money. Thus the most basic instruction for any management of a corporate company is the need to maximize the wealth. In USA the directions are straightforward. Outside USA, some countries require the managers to look into the interest of the shareholders as well as the employees.

The biggest governance problem in corporate companies is the conflict of interest between the investors and managers. In most companies, the voting right tends to favor large shareholders which indirectly give them the management control. They control the managers and the board. Thus, in these companies, the most common problem arises as the conflict between large and small shareholders.

24.1 A Control Rights and Corporate Design

It is important to understand that it is the entrepreneur who has to bear the responsibility of a bad corporate structure. If you wonder why, it is because an external investor can easily find a more lucrative option to invest in, so the entrepreneur must design an efficient corporate structure with a good capital structure as well as governance structure. If he sets proper price then only the investors will be interested and he will be able to sell the firm at a much better price. An investor will look to invest only in designs that don’t allow the owner to get hold of the shareholder’s money at some point.

To lure investors into investing their money, it is the duty of an entrepreneur to design a system which safeguards the interests of the investors. This is done through providing a fair policy. But what is the assurance that the company will abide by the policy and not violate it some point? This is ensured by granting power to the investors which is known as control rights. With the help of these rights, an investor can get his fair share of the money if they are exploited in any way by the management.

You definitely realize that obligation and value are distinctive as far as their income Control rights vary for obligation rights. Obligation has first rights on the guaranteed installments; value possesses the leftover and value. The control rights they enjoy are altogether different, as well:

Equity: in this aspect shareholders are ostensible proprietors of that firm. Their essential control is their capacity to nominate and designate the board, as a rule once a year amid the yearly meeting. Amid the year, the board is an operator that should follow up in the interest of the association’s proprietors, which are principals in monetary terms. (Legitimately, the board is the main of the enterprise.) In particular, the board members have ability to contract and fire managers.

Debts: Creditors appreciate the privilege to request execution and installments on terms determined when the obligation is initially augmented. The contract not just indicates how much that firm commits it to reimburse later on, additionally determines the quick legitimate cure if the loan specialist neglects to pay or neglects to provide any number of pre specified pledges. This frequently implies the loan specialist gets ownership of that firm or particular insurance to fulfill her cases—almost no uncertainties.

A firm which doesn’t have autonomous board control might not discover speculator willing to buy value shares. Firm in which a huge shareholder can impact the firm in order to “burrow” resources from the general population organization into one’s pockets might not discover small scale shareholders willful to invest in the firm. A firm which doesn’t provide loan bosses the privilege to drive liquidation on default might not discover any leasers willing to loan cash.

Be that as it may, control rights in total are not at all highly contrasting. On the off chance that the firm doesn’t offer flawless security to capital suppliers, it might in any case have the capacity to get capital. Notwithstanding, this will be on more awful terms which would cost giving up of an increased rate of the association’s offers or the installment of a bigger loan fee. All things considered, these rights are not quite great. It is unrealistic to secure capital suppliers splendidly, on the grounds that cost of keeping all administrative advantage would be restrictive. It wouldn’t boost firm esteem if that firm burned through $10 in reviews to avoid $1 in misrepresentation. Along these lines, by need, partnerships and capital suppliers should live with not best results, where there is a steady strain between financial specialist assurance and administrative self-enrichment.

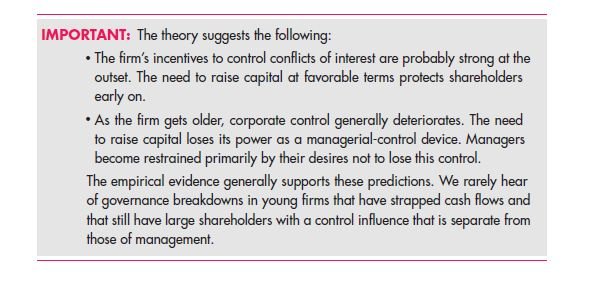

Whatever is left of this area clarifies why administration impetuses and systems are solid when business people initially need to raise outer capital. Quickly, their longing to increase capital is that primary vital motivation behind why they need great corporate administration.

In any case, it likewise clarifies when corporate administration is probably going to debilitate or separate:

- It can separate after the business visionary has officially gotten the assets and finds an escape clause to squirm out of his commitments to outer capital suppliers. Obviously, on the off chance that a business visionary still needs to offer a great deal of offers, treating existing financial specialists severely won’t make it simple to draw in new investors.

- As decades pass and firms develop, proficient administration in the end wrests increased control from owners. Managers’ craving to get sensible expenses of capital may never again be sufficient to control their self-interests. All things considered, once they take control, they might watch over their own selves than for the abundance of the proprietors. For this situation, they may not in any case mind on the off chance that they need to give away a bigger part of that firm from pockets of current shareholders to get better control of cash (from new shareholders).

- More seasoned organizations regularly have enough ventures creating money so that they might not indeed need to tamper with the capital markets anymore. In the event that shareholders can’t adequately challenge administrative control, directors could basically spend this inner money on themselves as opposed to return that back to the shareholders.

These last two focuses propose that supervisors in old firms are not any more compelled by their necessities to increase capital at worthwhile rates. Therefore, any points of confinement to what administrators will do undoubtedly would need to originate from their wish to not lose control.

24.1 B the Entrepreneur’s Original Incentives

How about we accept you are a proprietor of a development which requires a sum of $25million in the form of investment. On the off chance that attempted, its present esteem is $100,000,000. In the event that you could acquire or have $25 million as real money, you wouldn’t have to raise any outside assets and need to manage any administration situations. Your net venture riches commitment would be around $75 million.

Through this illustration, we expect that on the off chance that you can’t pitch offers to increase the cash to begin the venture, at that point you can’t embrace the venture and you don’t have anything. Subsequently, you can appreciate extensive increases just in the event that you can discover financial specialists. This is the reason organizations open up to the world to start about: The additions from enhancement for the proprietor and the arrangement of outer capital exceed the expenses of office clashes. Presently we should consider distinctive situations:

If the investors kept faith in your promise and believed that you wouldn’t act opportunistically, then they will be happy with 25% ownership of the company. It leaves you with 75% which is equivalent to $75 million

If you paid yourself an excessive executive fee, it would be considered as a theft by the investors. For example, if you paid you excess $30 million, and then what will the investors do? They are still willing to part with their share of $25 million. What does this mean? This means they are no longer parting with 25%. Their percentage now becomes 36% approx, since the value of the firm is reduced by $30 million.

The next scenario is that you had to spend additional $10 million to hire special accountants to hide your theft of $30 million. In that case the, the firm value will further go down by $10 million and its present value will be $60. So if the investors part with 25%, then their percentage ownership becomes 41.7% and you are only left with 58.3% which is equivalent to $35 million. Adding to that the $30 million which has been stolen, it gives you $65 million in total. This value of $65 million is less than the original amount of 75$ million which you could have got if there hadn’t been any theft. Thus the $10 million goes to waste and the only person responsible is you, for stealing.

24.1 C Costs Versus Benefits of the Entrepreneur’s Control Incentives

Ex-ante cost of administration: You can utilize our case to consider the part of the expenses of control. On the off chance that it requires a million dollars to submit yourself to not take and you in this manner abstain from squandering $10 million, and thus you are responsible for paying for it. Your total riches would be around $74 million—not exactly the $75 million that you would have had if not for the theft, have if administration were free yet more than $65 million that could have been owned by you in the event that you couldn’t confer yourself. Then again, if controlling it requires $12 million then why not live with the burglary and the misuse of 10 million dollars.

In this present reality, you would anticipate just a few irreconcilable circumstances. As a honing financial analyst, you realize that you should adjust the minor cost of every control against its peripheral advantage. Your new speculators would request more offers to repay them for those office clashes that you haven’t anticipated. What In the outrageous, it could have even been boundlessly costly to establish control. It might be difficult to compose contracts for all future possibilities that counteract you from improving yourself, particularly seeing that future administrative plans are concerned—the human personality can be extremely inventive. Undoubtedly, the commonplace firm contract does not attempt to represent all future possibilities—most are basic standard. More terrible, numerous office control conditions could even wind up being counterproductive on the off chance that they burglarize the firm of adaptability that supervisors could use to increment the association’s an incentive under unanticipated conditions later on.

One other option to nitty-gritty formal administration arrangements and provisos, which endorse what supervisors can and can’t do, is to depend on laws or systems that don’t indicate a considerable measure of points of interest however enable shareholders to recapture control if administration gets truly awful. Obviously, once in control, directors would have all the motivating forces to attempt to take out these instruments.

Ex-ante sizes of far-away clashes: Even in the event that you can compose idealize preventative contracts; your motivator to do as such may now and then be shockingly unobtrusive. Specifically, few organizations are outlined at the beginning for significance in the distant future. At the point when Walt Disney composed the corporate contract of Disney in 1957, it was likely he did not do as such with one eye toward Disney supervisors in the 21stcentury. Without a doubt, most organizations that open up to the world will never confront any vast office issues—most will basically wind up obtained or bankrupt!

How critical is it for the business person to forestall organization clashes in the far off future? A fast back of that envelope count may enable you to see it can’t be excessively vital. Accept that lone 1 out of 100 firms turn out to be extensive enough to enjoy critical office strife of, say, 0.5% of firm value. This point five percentage of a $100 billion organization is $500 million (for say 10% interminability of $50 million per year in unnecessary administrative remuneration, robbery, or blunder). In any case, from the unique business visionary’s point of view, in ex-bet terms, this defective control speaks to just one cost of 1/100th of 0.5% approximately is 0.005% of the company’s total assets.

This contention has expected that financial specialists are impeccably levelheaded and would pay the business visionary this 0.005 percentage increasingly if the agreement is composed to forestall awful conduct. More probable, business people would not catch this 0.005 percentage by composing expectant contracts. Would genuine speculators completely get it better corporate administration controls and pay for them?

What number of financial specialists would have provided Walt Disney more cash for their offers in that year of 1957 on the off chance that he had instituted better motivations for the year 2000? Indeed the most modern financial specialists might not have tried to see completely the far away repercussions. On the off chance that anything, with nitty gritty pledges and controls that go a long ways past the customary, speculators might even be thinking they “notice a rodent” (pondering regardless of whether they ought to construe something about that business person’s character and plans) and request more, not less, remuneration.

24.1 D Do Future Capitals Needs Protect Shareholders?

Our concentration till now has been about organization controls when a 100% proprietor initially brings capital. It has made the motivation for the business visionary to secure financial specialists. It was to his greatest advantage (regardless of the possibility that lone gently so). Be that as it may, does need to raise the capital secure the present shareholder after that firm is as of now public?

Sadly, it is not so. Indeed, an incredible inverse can happen. Give me a chance to illustrate. Update our situation by accepting that the business visionary is never again both the choice creator and the lone shareholder. Rather, accept the inverse for a60 million dollars

Firm: You are its administrator immovably in control and the ones profiting from office clashes, yet you possess zero offers. Suppose you now run over a venture that expenses $50 million that produces money streams of 30 million dollar in shareholder esteem in addition to $10 million in advantages for you. Would you bring $50 million up in money to finance this hopeless venture?

Without this new venture, the firm is worth $60,000,000. On the off chance that you raise finances and take this new venture, shareholders will possess a claim on a sum of $90 million worth firm— out of which $30 million of new venture in addition to 60 million dollars of old venture. To bring $50 million up in capital certainly requires issuing each of them of shares worth 50/90 which is 55.6% of the organization. These offers are sold into market at proper cost; new shareholders dependably pay just the reasonable cost. Be that as it may, your past shareholders now possess just 44.4% of the organization for net of $40 million in new firm, brought down from value of $60 million. As a result, that $10 million with advantages is paid with 20 million dollars from shareholders. This case may even downplay the issue. Truth be told, dreading comparable seizure later on, new shareholders might request even over 55.6% of organization—and you have impetus to give the new shareholders much bigger stakes keeping in mind the end goal to get that 10 million of yours that is in advantages.

In entirety, need for raising capital isn’t an assurance that the administration of a traded on an open market organization will need to control office issues.

On the other hand, this method might lead to managers extracting the money of shareholders for their own benefit. There are multiple scenarios where a company is seen to grow to a large extent, yet not provide significantly to its shareholders. This is due to the fact that managers continue to get new capital for the growth of the company and personal gain but it promises more percentage to new shareholders leaving old shareholders without any improvement.

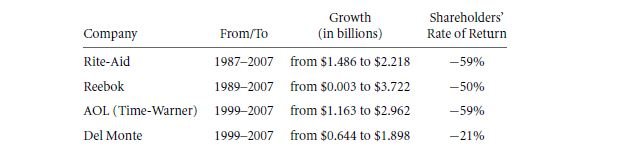

If you aren’t familiar with it, then here is a list of well known companies that have shown remarkable growth but still haven’t provided significant return to shareholders.

With this problematic scenario, it seems the best possible solution is to provide managers with a large share of the company. It seems quite a fair solution but it raises another dilemma. Even though owning a large share would prompt managers to spend funds much more wisely and not rob from them. But with managers holding large share, it is quite evident that shareholders won’t have any influence even if there is any case of bad management. This problem has already been seen in many countries where a single shareholder owning large share of the firm, chipping away funds into his own pocket.

Links of Previous Main Topic:-

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Corporate governance

Links of Next Financial Accounting Topics:-