To lay a backdrop of corporate governance systems the most prominent individuals to focus upon are entrepreneurs. The system is evaluated based on the advantages and disadvantages these personnel face from within. For entrepreneurs while a large diversity of functions and availability of greater capital are massive positives, the aspects of internalized budgets which are lost out due to misbehavior of the executives are a marked negative. However the negatives should not be assumed as greater or equal to the positive aspects. There are situations which cannot be overlooked or eliminated. The presence such obstacles do not mean that they lead to a growth of efficiency neither can the actions be justified on the basis of ethics.

The perspective of engineers and their experiences in the corporate system of governance should be noted. But before that the overall verdict of the corporate system in a country should be conducted. Those countries which govern their corporate sectors efficiently are bound to show a good connect with their entrepreneurs, be able to initiate maximization of funds, ensure that projects with opportunities to expand values can be approved by executives and finally competition with other countries should be healthy. In order to countries to be able to strengthen their economy having sturdy institutions in place is mandatory. However aspiring for a good system does not mean that there will be perfection, getting results which reap 100% positive outcome is impossible. The aim should be to reach the best potential of the country and boost the economy. There are several costs like bribes to politicians, compliance and enforcement costs, costs kept aside in case risks are faced which can hamper any profit margin. Equilibrium should be strived by the system of governance.

24.6 A Runaway Dynamics, Self-Regulation, and the Market

Economists often question whether it is possible for the market to come with a regulatory system of governing the corporate or whether there is a necessity of interference from the government to ensure the system is fair and efficient. It is by principle that most persons with experience in economics choose that governments should be kept away from the process of creating a system. Usually government intervention is thought synonymous to inability to adapt to changing circumstances, useless creation of hierarchy, regulation agencies being set up to prevent incumbent activities and interference of political entities which can be greatly recessive. Hence determining whether corporate governance is demarked as a territory free from governmental interference is still in question.

As mentioned at the beginning of this chapter it becomes crucial for new entrepreneurs to set up a strong, stable, effective constitutional basis that can withstand the phase after the IPO. New start-up initiatives are in need of the best governance and for such governance systems the market is the essential place to rely upon as government dependence is unlikely to yield better results.

The backlog to this assumption of start-ups being more organized implies that older, richer and better established firms lack the same sense of organization in their top leadership. Further problem arises if the executive members are not external shareholders, there claims and need for good governance is reduced due to lack of incentive. Usually as a result of the same leadership being unchanged for a long duration leads to a static condition which is harmful. In such cases the shareholders control over management will decline, the shareholders will be unable to leave an impact with their demands of raising capital or changing the design of the entrepreneur.

The phenomenon of corporate governance is pivotal to economy; it is wise to understand this concept by assuming that this governance in the corporate sector is like a water dam preventing havoc by letting loose tons of water. A single crack quickly widens to cause destruction. This can be better understood with an example; a CEO appoints acquaintances or trusted companions to the board of executives. The manager can easily manipulate decision making in such a situation and increase the number of executive shares granted for preceding years. Hence if the board of executives fails to control the manager, then the manager could quickly weaken the entire organization.

Instances when the management is good are not the matter of debate here. The circumstances which are focused under this topic is the cases where the management is corrupt and spends time weakening the governance systems for the motives of self-interest. The issue of focus here is good governance and not good management. If management is good and serves the purpose of owners then the governing body will hardly matter. The situation where both the management and the governance is corrupt and inefficient is called the perfect storm.

If there are situations where governance is deemed inefficient to control, power shifts to management. There could be attempts made to put restrictions of the powers of management, however despite efforts by the entrepreneurs it becomes difficult to make such a framework that management cannot override. The corporate charter is a sole weak barrier that can protect the firm to some extent from bad management. Again, it should be noted that the charter is subject to change by the management.

These ideas enumerated under runaway dynamics clearly state that trusting the company to ensure stable systems of governing corporate is not full proof. Under section 24 the two points made must be reiterated here:

- Smaller firms which are yet to expand govern better

- Older more successful firms lack good governance.

Both these observations state the rate of success at an initial stage of the organization is easy. At this stage both the management and governance seek for increasing the incentives for owners and raising the wealth of shareholders and reaching goals is the main concern. At this stage if good governance is not applied than competition will render the start-up into a failure. As time progress the greed of management increases, there is hardly any protection which can be ensured against incapable management. A few tools in hand which can resist ineffective management include the takeover defenses, fiduciary duty and other legal limitations such as shareholder votes.

Observations carried out on a casual basis have revealed that the assumption made in this section have rendered true, those companies which have crumbled due to lapses in governance are those which were old firms that had immense flow of cash. For most firms this is not a problem from an economic standpoint but some institutions often feel a social responsibility. For example the Disney Firm annually appoints persons and pays millions of dollars, it is the social responsibility to help these firms running well.

24.6 B My Opinion: What Works and What Does Not Work In the United States

Comparatively economists feel that the system of corporate governance in the United States is not in complete shambles. However many firms which are old and have large free flowing cash could be identified facing problems of governance. In truth, those firms that face governance issues can overcome the problem provided a strong management exists.

The capitalist mode of production despite its drawbacks of theft and misbehavior and several problems in the system of corporate governance put in place will not collapse. The primary reason for a lack of change in the system is that despite the disadvantages the resources the major multi-billion dollar firms produce are much greater than the destruction caused by the system defaults. However, when a close look is taken of the corporate sector the defects begin to glare. For example, the profits made by some individuals are much more than others. The problems are not simply related to money but also in the massive inability to produce jobs. Over the years hence it is assumed by even though capitalism will not collapse, several companies will plunge. This will force United States to lose its position of dominance over other economies.

A lot mechanisms are involved in the functioning of economies, the solutions to problems faced by firms are not direct. There are several considerations involving a mixture of legal solutions, obligations of an informal and ethical nature, contract limitations. Despite all the functions being needed, some functions work better than others. To understand which element reaps maximum results an analysis surrounding personal opinions is required.

Internal governance: Unless the situation is unique internal governance provided by the executive board is ineffective.

External governance: external threats are a powerful tool which can keep governance under check. The laws of United States are the root to reaching out to the raiders with riches who can bid for companies facing losses. Often financial conditions are not ideal for takeover but the interference of external elements prevents the board from isolating themselves.

Informal social constraints: The press and social norms of society despite having their roles molded over time continue to be important elements influencing decisions.

Formal legal constraints: The biggest support and protection to firms are provided by laws. Not only are laws subject to change according to requirement but they also ensure the opportunity to privately contract. These laws prevent corporations from initiating arbitrary decisions.

Investors are heavily dependent for legal protection on the IMHO. Despite not originating from the firm, they are binding on management. The protection the IMHO provides ranges from ensuring that firms cannot declare specific shares void, drive away existing shareholders, stop elimination of outsiders, organizes meetings for shareholders. The body has also prescribed annual meetings and the presence of directors in the firm. With the help of the prescribed rules laid down by this body it becomes possible for external shareholders to buy the larger portion of shares and control the affairs of the organization in spite of unwillingness of the board. One of the main restrictions still faced by older firms is the aspect of hostile takeovers by an outside entity. Even though all these several implications are rigid, some firms have managed to find their way around the laws put into force. For example till date in the United States when a board declares itself to be staggered no successful takeover by a hostile external party could be orchestrated. Even if the takeover could be performed a minimum of one year would pass before the possibility could arise. In this one year immense drop in value would occur.

United States has been stipulated as the number one in locales for investing equity. The framework of the laws has ensured comprehensively strong corporate governance to be put in place. The several requirements of presenting fiduciary responsibility, prohibiting theft by employing effective measures, preventing fraud, trading with insiders, having liability within legal aspects and enforcing stronger laws which have been a result of the legal setting in the country.

This is a paradoxical stand compared to common experience. In the case of U.S the interference of government has led to improvement rather than failure. In most other cases contracting privately or simply depending on the market is the best solution. However using the tools of government laws is what reaps beneficial situations for share holders. What can be concluded in this discussion is that, despite popular disagreement, in the case of United States interference of government should be encouraged as it has only benefited the mechanisms and overall outcome of firms.

ANECDOTE

Investor Rights outside the United States

In order to fully appreciate the situation of corporate governance in the United States, similar governance systems in other countries should be studied.

Germany: This country has a unique web of firms which are knit together. The banks of Germany ultimately own the firms. Marginal shareholders are deprived in terms of facilities compared to majority shareholders. Executives have an obligation to employees and shareholders under law.

Russia: In this economy the boards are deemed all powerful and can declare shares void without notice, share owners with a majority cannot make proposals to the agenda of the corporation. In addition cases of threats posed by shareholders to the continuity of the board are non-existent.

24.6 C Where Are We Going?

It is wrong to believe that just because a system has worked for several decades that it has been untouched by change. New managers always find their way around the system and tend to mold it for self-interest. This system where managers bring about new regulations and mechanisms for self profit could lead to potentially harm in the equilibrium if there is nothing done. The most significant repercussion which might occur at this juncture is that the loyal investors could leave U.S for better prospects.

Corporate governance needs to work on its regulations and systems and this has been stressed upon through several guidelines which have been put into place. These guidelines are called the best practice and have been suggested through significant sources. The most common names are the American Law Institute Principles enforced since 1992, OECD Principles reported in 1998 and Conference Board Recommendations applied since 2002.

The gravest issue with the authenticity of these reports is that they lack authoritativeness. There are no general prescribed rules; instead each firm can almost select the rules which they wish to prescribe. This where the role of FASB is prominent as it has been able to give a general outline. The need of the hour is ensuring a union of principles and cancelling the multiplicity of opinions.

SARBANES-OXLEY

Scandals in the corporate sector such as Enron over the last few years have instigated the need for reforms. It is interesting to note that the scandals were not the problem but a manifestation of a far greater issue. There is no full proof way to ensure a stoppage on scandals. However steps can be taken for preventive purposes.

In the backdrop of several scandals in the corporate sector being exposed, a law was passed which could be incorporated in the multi-layered corporate system of United States. This law was popularly known as SOX law or the Sarbanes-Oxley Act of 2002. The provisions of the act aim at strengthening functions and independence of boards regarding the system of auditing, creation of committees and boards. Some examples of the improvements noticed in the field are as follows:

- The position of independent director has been clarified as an individual who has no material connection to the organization.

- These independent directors are expected to meet at regular intervals without the supervision or presence of persons from management.

- It is expected that committees of executive compensation and board-nominations will be independent fully or by a majority. However the members can be selected by the company.

- The CFO and the CEO are bound to disclose all the financial company reports as per section 302 of the act. However this clause was in place before SOX was applied.

- If any laws regarding security or fiduciary duty are breached then attorneys are bound to inform the SEC

- Since audits were a huge part of the scandal that remains the focus of the act:

- The membership of the committee should consist of only independent directors who can analyze the financial reports. Special mention about bulk shareholders can be found as well.

- Company auditors are an element of importance under the clauses mentioned. Additional auditors can be employed. In case of any whistle blowers or complaints procedures need to be instituted.

- The financial committee must contain at least one financial expert and the individual must be mentioned.

- The responsibility of the committee stems from the ethics code.

- Auditors hired externally are mere consultants and any non-audit work they do must be approved by the audit committee

Except the point of external auditors the clauses of the Act are not at all expensive from the point of view of corporate. Starkly the SOX Act has led to increase in corporate costs and that has caused controversy. The justifications are:

- The auditors are expected to be changed every few years in order to prevent building of personal relation. New auditors require time to settle in and might not be equipped in detecting suspicious activities. There is a lack of accounting firms in the Fortune 100 and this poses problems in asking bids.

- The Act has clauses which require records to be kept, however the manner of record keeping remains unclear. Sections 103 and 802 state all information related to the auditing process should be preserved for 7 years. Information could mean several sources and is beneficial for IT sectors and lawyers.

- Section 404 states that the internal controls and their effectiveness must be attested in the financial annual reports. This process has made the costs of auditing double, and is a burden especially for small firms. Fees of auditing often exceed the annual income of these firms and are an excessive burden.

BETTER ALTERNATIVES

There are arguments regarding the utility of SOX. A good reform of governance should be cheap and effective but the Act lacked these qualities. The authors of the act admit in present circumstances the act would be written differently. The provisions were passed hurriedly and do not express sound conceptualization. The process was refined while outcome was overlooked; burden of paperwork multiplied under the Act and it got the tag of being a windfall of profit act for accountants. Coincidently it was accounting areas which caused the scandals in the first place. After SOX was passed the top firms gathered greater profit.

It is wrong to conclude that SOX was completely useless and render it without value. This act was a positive one compared to the laws which preceded it but more thought was required to smooth its flaws. It cannot be ignored that the Act hindered small business to a great extent. There were alterative steps which could have taken that would have a better impact.

The first step which could have been applied requires no law. It is true that the SEC is the enforcement and regulatory agency of the corporate division and looks after the smooth processes in this sector. These bodies advice and monitor Congressional committees as well. The committee is run by lawyers who instinctively turn to the task of enforcement before regulation and this possess major problems. Regulatory activities ensure mechanisms to be instituted which are effective as well as cheap to apply. The chair of the committee of SEC should be changed from lawyers to economists.

The change of leadership should be followed by placing a board which is authoritative and independent. This body can be similar to FASB and should state the best policies of governing the corporate. The aim of creating such an institution is to ensure timely changes as the environment fluctuates. When firms, managers or executive committees follow the method of best practice they should receive safe harbor legal consideration against action of regulation and lawsuits by investors. Following set rules determined by committees would be forced by firms in this manner. In case not following a norm leads to greater financial success them companies should be allowed to resist. This method is one of nudging safe harbor rather than strict legal enforcement.

Some recommendations which can be adopted by firms in order to ensure good governance are as follows:

- The position of chairman and the CEO should be separated. When the posts are conjoint it leads to an inability of the CEO to efficiently control management and look after interest of shareholders. Ira Millste in advocated this view strongly. Currently having two different positions is seen as a sign of weakness but this should not be the case.

The argument made for joining the two posts is the lack of time and effort wasted to communicate and collaborate with a separate chairman. This is a weak argument; a more strong view is that cost of keeping two heads is expensive. Countering the point of cost it can be said that efficient governance helps save a lot of money by keeping management under control. Governance and management are not to be confused and both need capable handling.

- Internal directors can be part of the board yet must refrain from casting their votes in decision making. This creates a distinction between the board supervising the management and ultimately management running the company.

- Each director must be approved and not selected in bulk. This allows proper scrutiny and gives shareholders a chance to express their sentiments. Taking a note from dissatisfaction of shareholders decisions can be altered. Several firms have begun this process voluntarily.

- Provisions allowing a staggered board should require approval of a majority of 2/3rd of shareholders including those without voting privileges.

- The holders of shares should be given a chance to express their views, much like proposals.

- Information regarding insider trades should be revealed before the trade not preceding the process. This would make CEO’s apprehensive to own shares. This has both positives and negatives. It also allows those against insider trades to become aware.

- The large companies which have a capital of $100 million must be asked for full disclosure of finances. This reduces the incentive to overstate earnings. The disadvantage here is that it blunts the edge of companies but the same rules apply in disclosures of GAAP.

The above points could be more economical and beneficial compared to SOX. Individual companies could however opt out due to risks.

Individual companies tend to face problems in implementing these suggestions because of the following reasons:

- Individual firms are competing against others and cannot deviate from the strategies implemented by others.

- Having a different method in application raises doubts. This makes investors question the relationship between the board and the managers.

- Restrictions implemented voluntarily can work in firms that are well organized and require no restrictions. Firms with poor management will override the voluntarily rules.

It might be argued that improvements are better implemented on a wide basis.

Having similar opinions on all topics in this discussion is hard. Readers might disagree and question. It is justified to have an individual viewpoint as long the opinions can be backed with reason. The corporate situation in United States creates wide disparity of opinion and it is time you picked a side!

ANECDOTE

The Corporate Governance Consulting Industry

A trend of hiring services for consulting to improve consultant rankings has been noticed. There are prominent governance consultants that publish their ratings regarding the way different firms govern. Evidently this method of improving rankings by hiring such services has its own flaws.

SUMMARY

KEY TERMS

SOLVE NOW! SOLUTIONS

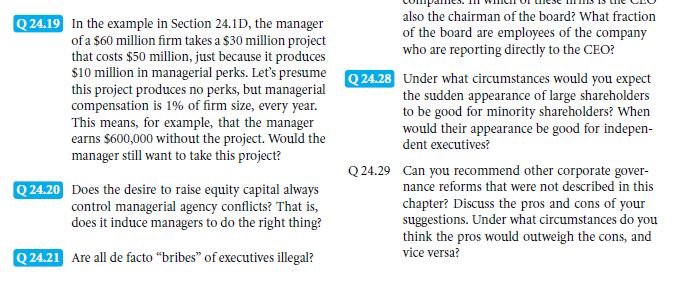

PROBLEMS

Links of Previous Main Topic:-

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Corporate governance

- Managerial temptations

- The role of social institutions

- Debt the right of creditors to force default

Links of Next Financial Accounting Topics:-