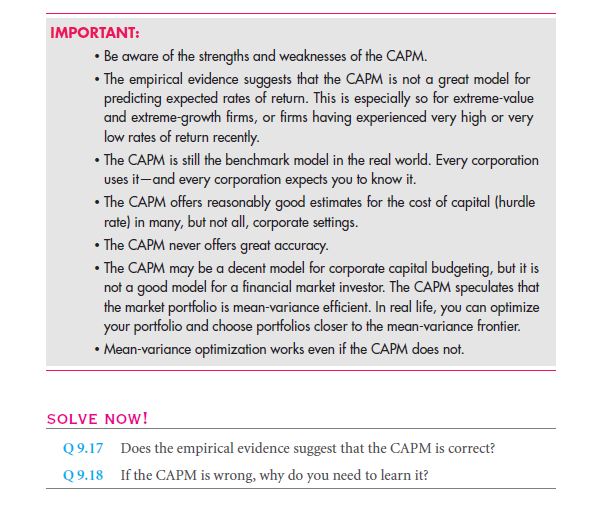

I hope you now understand how the securities are priced on a perfect level in the CAPM formulas. So do you have any evidence that the CAPM will not be the absolute right depiction of the reality?

9.5 A The SML If the CAPM Does Not Work

If a stock offered the more value that a rate of return that are expected, the investment body will have a large economy to invest in and to also make a purchase that is worth the stock market. There is a bountiful investment option that is available for all the work economy. This is sure to make a good investment and hence can be an attention driver. Investors can all assemble for the battle to get a hold of the most profitable match. The return rates are so great that any investor will be able to make a good deal out of the invested project.

If in any case, the stock price goes down, there will be an opposite reaction of the investors. No one wants to make an investment that is not going to give a good arte of profit percentage. Hence all the stock will be worthy of none and might not even sell up fast.

You must make sure that none of these above conditions occur to your company. The investing body is smart and active. As for the company that they keep is very monetary oriented. Hence, you can expect them to back off at any given moment.

This is why the CAPM formula must be diagnosed to check on to the right formulas. The rate of return that you get a working hold on will determine your fate in the world of current market. With the fall in the current situation, there can be very wide variations that are used to get a working demeanor. Stocks that are offered are mostly used up in the deals. So, if you are taking a project the very first thing that you must look forward to is whether it received any sort of bad reviewing from the previously interested brands.

If you happen to be the very first one, that is the first investing body, then the deal happens to be a very first one. The CAPM value is a must thing to be determined and assumed before activating the area of future investment.

The stock formula that is accounted for a great number and this adds up to the variances that are created by the formula. When a brand name is invested it remains engraved in the world market. Anyone can look up the variant to make a recollection of the decisions that you make. so, you can never be too careful. If someone finds out that the money relative decisions were made without discussing the investment or without the right market research, it will affect the investments that you will want to make and under go in the future. This is not a very good effect that the company makes.

If the stock is too high or low compared to your investment rate, then it is better to wait. It is better to make a real nice format of what you are about to do before making any decision. If the CAPM value is found out it will make up for an easy decision and will save you from all the heart trouble that is.

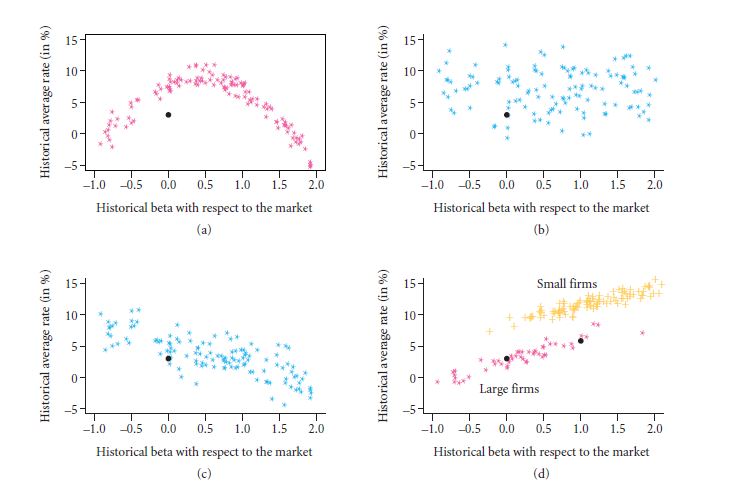

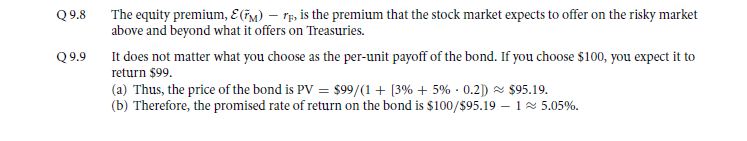

So would you lose your faith in the formula of CAPM? In the figure 9.4, you are depicted about the market, the relations that you can look at the CAPM formula.

The market value that you make a constant factor is a very weird alternative factor. The best thing that is presently circulating the market is the other method. Assuming that the market portfolio that you can indulge on is a better an inclined to the stocks that are added to the contemporary filed. The stocks having a really good recollection are subjected to the most appreciation. As for the money making coupons, there could be a great ideal working. There can be many complicated options and make a variation of the certified level. As the market portfolio makes and takes a steep curve inclination beings to happen in the market field. The market that had a better active CAPM formula that works with the tilting of the portfolio and induce a better option that you can help into make a stock tragedy and this will get a better. The relationships that you can contribute on to will make the rate of returns seem very casual and very attentive. There is a better way of explaining, that is if you take a look at the plots that are created in the figure above.

So take a look at the thing and determine the explanations. The historical data that was used in the particular category makes a great attention thriving area. It gives off possible explanations and makes a good point. The real measurement can be directly calculated in the plots that are represented in the formulas.

9.5B The Historical Estimated SML

In the part veto understand the reflection that is made in the name there is to get the greater deal. The certain activity that you get a hold on the very extensive methods is that the model figure that is depicted. As for the CAPM method, there can be a good explanation for the method that is adapted.

The correct formulation that you make in the formation is a great value. The secret to a good formula is that the situation might be complicated, but what you have to do is that you need to make a sure shot definition.

The Empirical Evidence: Where It Works

Looking back at the figure depicted in 9.4, you can understand that the evidence is made out of many academic papers which are of 3 important plots. The evidence suggests that the CAPM will inevitably fail when there is a grave sense to it. There are more idealized versions that need to be used in this way.

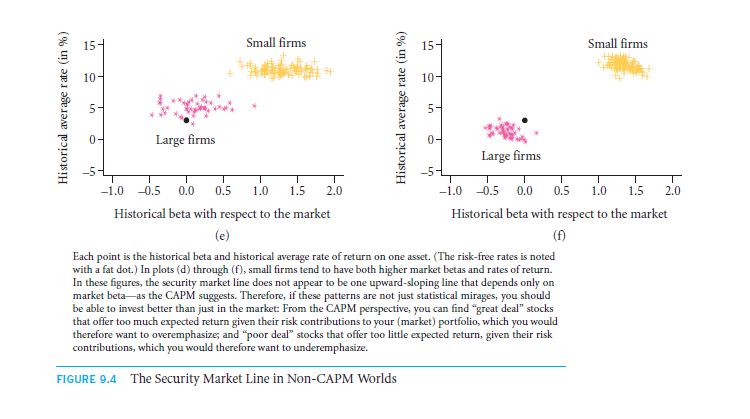

There are many alternative formulations that are used to get a clear view of the CAPM value. in the figure 9.5, you can get how and in which conditions the CAPM formula fails. This is the best example that you get for winning the main target. There will be exciting values of the growing firm calling the attention to get a handful of the idea that you made. When the view point will get shifted on the aspects of growing firms there is going to be a steep rise on the aspects of beta value being negative.

The figure 9.6 you can get the rightful illustration with the help of the types of bonds that are created. As for the many weakened reasons that make a very low return rate, it is very usual for anyone to feel the need to jump on or opt for some other investment bond. However, just because a project is not giving off a low rate of return, it does not mean that it is worthless. It might be the most stable investment area. So, my advice would be to stick around for the real game.

There can be many rationalized explanations that rule out the distinct level of gem like reasons that you give. It is kind of funny to predict the future without making the right amount of research and get a hold of the good level of CAPM formula based answer. In comparison to the collective sample, there is a very motivating factor that drives the interest of an investing body. Must the managers be advised to make the pretense as the growth of the firms be over the top and get the derived attention of the salvation region? The investors’ money, when your brand gets a hand on it, you must tell your manager to learn the investment procedure to avoid incurring major losses.

9.5 C What Do You Do Now?

The main question comes down to this that if the economy bounded value derived by the CAPM formula crashes, then who will be able to get the right answer?

Reasonable cost of capital estimation that is done very often: market beta value proves to be the most important factor in measuring the cost of capital. So you need not worry about the CAPM formula does not work. The entire cost of capital can be managed entirely to give the corporate finance that your manager was not able to decipher.

Let us all assume that the size of the firm is really the matter that is expectant of the rate of returns that are incurred. If you are able to figure and entourage the beta value of 1.5, there is a maximum likely chance that the firm is small in size. That too with a rate of return that is expected not to be more than 10% extending to a maximum of 15%. If the beta comes around to be 0, you are guaranteed to get a rate of return within the values of 3 to 7 percentage.

The beta value will provide for the most sensitive part of the investment help. Using a poor logical method and model may help you to con the investors but, it will not help in the long run. As for the most important part of effort, corporate managers will be right upon the way to get a good clarity on the CAPM model value. This in fact will give serious motivation to anyone who wants to build a cost effective method. The cost of capital will be appointed along with many informative assurances.

Good intuitions that anyone gets: with the CAPM, there can be many twists and turns possible. The entire character is taken on by the very fact that there will be a focus on the matter that we should and must take into account. The factor being diversification.

If you only clear and make your mind a sharp alternative version, then you could understand the reason why the variation is needed. CAPM is indeed easy to use and has a relative alternative that you can get a hand in the upcoming section that is 9.8.

Alternatives that you need to get hooked with: it is important to learn the alternative version and get addicted to it. The model to get a hook on is the one that gets a prominent hold on the alternative version. When you learn the importance of the good version, there you get place the attention on a project. This is why it is very important to get a hold on the CAPM model.

One example that can be placed here in context to the subtopic, there is an alternative method that is needed. The growth rate that can be estimated for the sum value, you get to choose the sub context version. It might not be clear as to where and when the risks can be taken. There is a better hurdle rate evaluation that is available to make a certain progress.

There are imperfect situation in a market that needs to be hauled upon and hence you get a better access to the policies. There are many wide variances that you can handle if the world turns into a bunch of hoax markets.

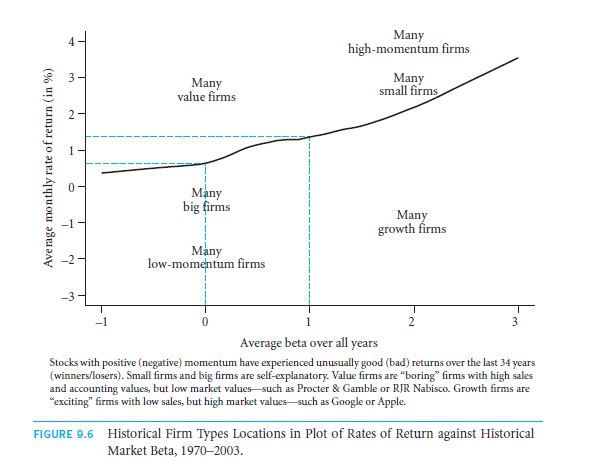

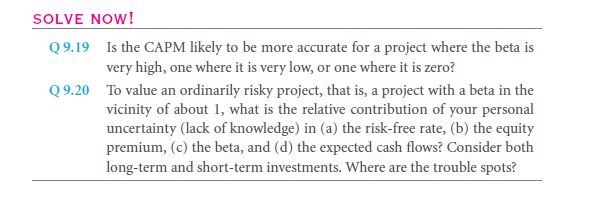

The entire populace affliction uses it:as you can note, the table labeled as 9.1 depicts that everyone uses the formula. About 73% CFOs use the formula of CAPM. There is no notable use of other alternative methods. There is always a choice that is given, the calculation is of course not the most necessary thing that is used globally.

So, this makes CAPM the most effective method of use. Hence, there is a general drive to use the formula and get a well accounted standard for it. In other words, CAPM is the standard and bench mark for a model that is used to make the use of statement. You must remember that all the values are jotted down and calculated the chance to get a handful of the variations.

The investment manager group works with their employees to attain the better of the project information. Here I will like to add this point that there are many different aspects that are involved in the conciliatory terms and hence become very efficient to learn on that. So before you start gobbling up the values, you must stop and wonder as to whether the CAPM is the one that you will use randomly or not. It after all is a very fragile calculation and must be always handled with caution.

The accuracy level that you earn of is very enlightening and precious. However, the CAPM can be easily messed up while calculating. So, it is essential to make a good accurate calculation to get the thing flowing and working.

You must work even to the decimal point if need be. Yes, it is that precise in nature. The CAPM is that offer rate that you get when you try to get a hand full of the best rates in the market.

There are however no certain model type that are included in the form of accuracy. Hence, there cannot be an absolute estimation that is made for the point. With the better factor, you can get a good hold in the valuation.

Investment purposes in a company: there is not a single need for the corporate CFO to make a project look extraordinary by making the hurdle rate to be amazing. My financial advice states that the investor who is looking forward to get a hand full of the CAPM method, that there will be no doubt about the conflictions. CAPM gives the rightful will and assurance to invest money on any project. When you get ahead by calculating and assuming the risks, there is no doubt about the need for a great change.

There will be better strategies that are used in the investment plans. As for the market index, it will only rise higher and higher. You must not have any confusion with the use of CAPM along with the frame working strategy of mean variance. The optimization level that you reach forward to is a mere technique that is developed to understand the psychology behind the individualized situation. Regardless of how and whether CAPM formula works or does not work, any value that is put forward can be used and that too in an effective way.

Summary

Key terms

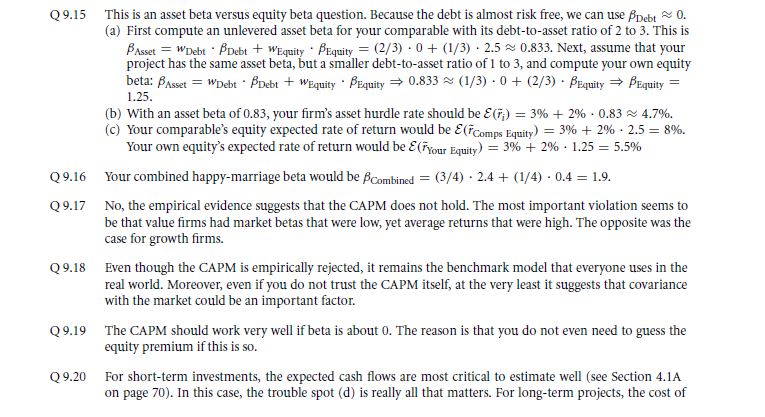

Solve now! Solutions

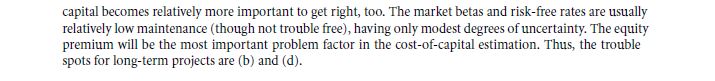

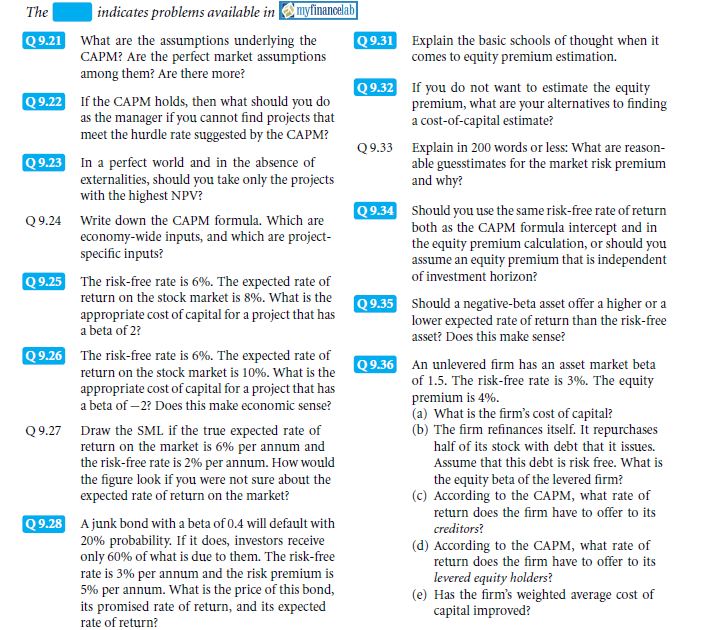

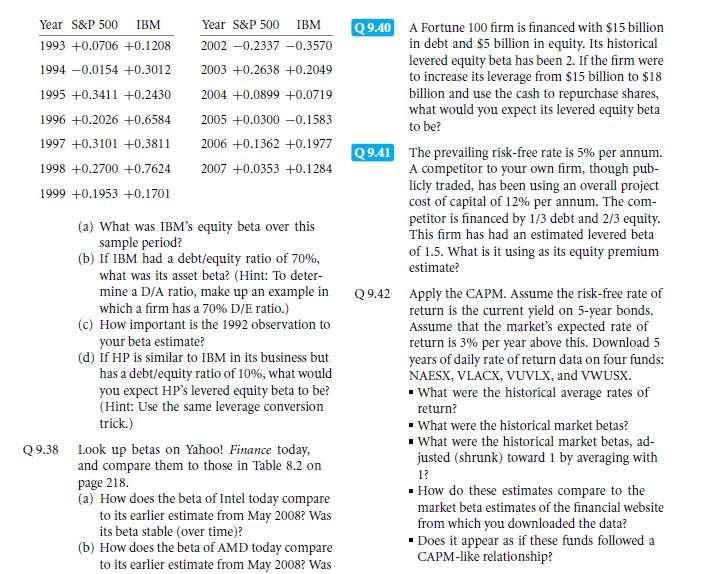

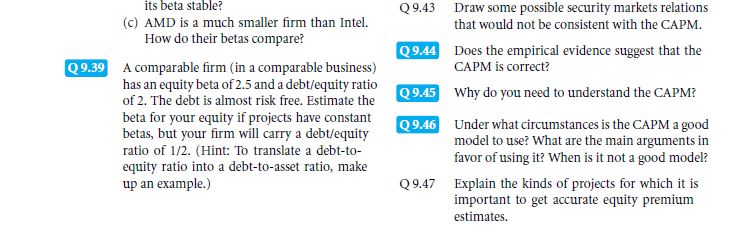

Problems

How Bad Are Mistakes?

How robust is the CAPM?

You must have realized that there is no perfect input of the CAPM formula. All that anyone can make is a couple of guesses. Even that cannot make a sure shot assumption. How is robust done for the CAPM then?

By making risk free methods. The risk less ways can help in the determination of the value that is obtained in this method. There is a typical cash flow that is assorted along with the time value.

The market beta value must be qualified and the estimates are generally made in the form of getting a positive or even a negative value. This means that only when properly exercised, can it be used in the serial error free method.

There is a qualified method that calculates the equity value like the ones that I hand discussed with you before. There are much estimation that you get to make. with the CAPM value, every potential investor gets the hope to make a reasonable profit. Making such a scrumptious amount of profit will only benefit the conditions of the investor body.

The CAPM model itself is not a very practical one. Sure you can get an idea about what and how you wish to get the work done, where you want to invest, but, what you do not know is that there are practical minor changes that effect the market fluctuations, hence, making it difficult to randomly predict the pretenses.

ANECDOTE

“Cost of Capital” Expert Witnessing

Baby bells were forced by the congress to open up a local telephone line to lie in competition with the other brands. This resulted in the wealthy returns to the infrastructure of the very brand. $10 – $15 billion was the total net worth of telecommunications business in the USA. The difference of equity premium of 1% might sound a lot less, but trust me, it is a huge amount. For small telecommunications industries and firms this value meant a total of $100 – $150 million dollars. That too every year.

Appendix:

Certainty Equivalence, CAPM Theory and Background, and CAPM Alternatives

Links of Previous Main Topic:-

- The capital asset pricing model

- What you already know and what you want to know

- The capital asset pricing model capm a cookbook recipe approach

- The capm cost of capital in the present value formula

- Estimating the capm inputs

Links of Next Financial Accounting Topics:-