People don’t like taking risks. Instead of taking risks by choosing a career where there are ups and downs in the income, they will definitely prefer that kind of a job which will give them a fixed salary at the end of the month. Still, there are a few people who are not afraid of taking risks. These people invest in assets such as stocks, bonds, and other kind of assets that may or may not carry some amount of risk while giving return. In spite of risks, people still prefer to invest in stock market without being worried about losing some or almost all part of their investments. How can they be so sure about their decision? There must be some rules associated with taking risks. In order to know whether people investing their money in stock market are doing the right thing, we need to understand the how the risk of assets works.

Assets

An asset is defined as a thing that provides money to its owner through the services rendered by it. Anything which can bring money to its owner, either through its value or through its services is defined as an asset. Some examples of assets are: a house, a savings or current account, bonds, jewelry or any item or service owned by an individual which provides a flow of money to an individual.

Let us see how assets provide a flow of money. A home or an apartment, when it is not used by the owner can be used for earning money by giving it out on rent. Similarly, a savings or a current bank account pays interest which adds up the amount previously present in the account.

Monetary flow i.e. the flow of money can be of two types: explicit payment and implicit payment. Explicit payment is the one which a person receives from the ownership of an asset, for example, the rent which is given by the tenants occupying an apartment is an example of explicit payment. Rent is an asset which is received every month. Explicit asset is a fixed amount of money which is obtained after a fixed period of time. The time period can be a day, a month, 3 months etc.

When there is a change in the price of an asset, either the value is increasing or decreasing, it is known as implicit asset. It depends on the situation that the value of the asset is increasing or decreasing. If there is an increase in the value of an asset, we term it as capital gain; if there is a decrease in the value of an asset, we say that the asset has suffered a capital loss. For example, the value of an apartment building in a crowded city may be high. The building’s owner will earn a capital which is more than the normal rent of an apartment in an uncrowded city. So, we can see that implicit asset rate depends on surroundings and situations. This is an example of implicit monetary flow. Simply put, when an asset changes price from day to day, depending on situations and circumstances, it is an example of implicit payment.

Risky and Risk less Assets

A risky asset is one which provides an inconsistent monitory flow. An investor after investing in a risky asset cannot be completely certain whether he will be able to earn a profit through that investment. In a risky asset, the price will rise or fall over time. You can’t even be sure about the fate of the Company and its shares. Almost all assets have some risk factor associated with it. Stock market is not the only asset which is risk-prone.

Other assets are also there which are quite risky.

One particular example in this context which will help us to study about risky asset is an apartment building. The land values keep on fluctuating; you don’t know whether the value will upsurge or it will drop; whether the building will be on rent all along,or the occupants will pay their rents on time.Government bonds are another of risky asset. The rate of inflation might increase at times unexpectedly and make it difficult for paying interest in the future. Ultimately, the value of the principal amount will decrease, thus the value of the bonds will also decrease.

In contrast to this, there is another type of asset which is risk less.

This asset provides a steady monetary flow. There are no cases of uncertainty. Treasury bills of the Government are the examples of risk free assets. These treasury bills mature in a few months, so, the risk factor arising from inflation rate increase is not taken into consideration. Other examples of risk- free assets are savings accounts and short-term bonds.

Asset Returns

The return on an asset is defined as the monetary flow it collects from its investments.If the value of an apartment was $10 million last year, and the value has increased by $1 million this year, and it produces a rent of $0.5 million, the total value of the asset is coming to $11.5 million, which is an increase of 15% from the last year.

Asset returns is used to compare the value of assets- it helps to draw a comparison with the monetary flow and the value of an asset. When people make investment in bonds, stocks or other assets, a return is expected which is more than the rate of inflation. If these people wait for few years and save their money, make their investment larger, they will be able to spend more money in their future investments.

The real return on an asset is there turn gained by it which is less than the rate of inflation. In the example given above, the annual inflation rate was of 15 percent, and the apartment gained a real return of 5 percent.

Expected Versus Actual Returns

It is impossible for a person to know beforehand about the fluctuation in the value of an asset. Most assets are risky, and no one has an exact idea about what the asset will be yielding in a particular year. The example which we had taken into consideration earlier showed an increase in value.

The estimated return on an asset is said to be the expected value it earns on its return.There is no hard and fast rule whether the value should increase or decrease in a particular year. But, generally, over a period of time, the average return should be close to the expected value of the return.In a chosen set of years, the definite return of an asset can possibly be much higher than its expected return and in some years, it can be much lower.

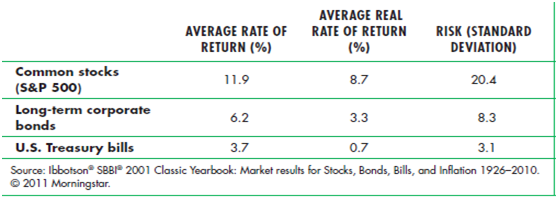

Expected returns are different for every asset. Let us take an example of a U.S. treasury bill, common stocks and long term corporate bonds, the comparison of which is illustrated by

Table1. The table shows that, while the expected return is 0.7 % for U.S. treasury bills,it is 3.3% for long term treasury bonds and 8.7% for common stocks. As we can see, the expected return is the highest for common stocks and the least for treasury bills. Now, the question arises that why would anyone invest in a Treasury bill, as the expected return is the least. People should invest in common stocks as the expected return is the highest. But, this is the reason. An asset’s demand depends not only on its expected return, but it also depends on its risk factor. With the expected return of the Stocks being higher than U.S. Treasury bills,the risk factor is also higher in Stocks.

Table 1: Investment- Risk And Return (1926-2010)

We can draw relationship between expected return on an investment and the corresponding risk associated with it. As we can see in Table 1, higher is the expected return on an investment, the greater is the risk involved. So, a risk-averse investor must keep in mind a balance between expected return and the risk against it.

The Trade-Off between Risk and Return

A person has decided to invest in two assets:some portion in stocks and some in Treasury bills. Treasury bills are risk free but stocks are not. A proper decision has to be taken that how much investment has to be done in each of the assets.

Let’s denote the return on the Treasury bill by Rf, which is risk-free. A point worth noticing is when there turn of the assets is risk free, it has been found that the expected and actual returns have the same value. Let Rm denote the expected return from investing in stock market and let rm be the actual return. The actual return, rm, is risky. Expected return will be higher for the risky asset as compared to that of the risk-free asset. So, Rm is greater than rm.

Investment Portfolio

For calculating the amount of money that should be invested in each asset, let us assume the value of the fraction of the savings that have been placed in the stock market be “b”. So, (1 – b) will be the fraction which is used in the buying of Treasury bills. Rp, which is the expected return, is the weighted regular of both the assets’ estimated returns.

Rp= b*Rm+ (1 – b)*Rf(5.1)

Putting Rf=.04,Rm=.12, and b= ½, we get the value of Rp=8%. The standard deviation of the return is the measurement of riskiness. The risky investment’s standard deviation is represented by σm. The portfolio’s standard deviation, σpis the fraction of the portfolio which is invested in that risky asset (b) multiplied by that asset’s standard deviation:

σp= b*σm(5.2)

The Choice Problem of Investor

The fraction of portfolio invested in the risky asset is given by b. To find b, we have to consider that a risk-return trade-off is taking place. Equation (5.1) can be written as:

Rp= Rf+ b *(Rm- Rf)

From equation (5.2) b=σp/σm, so

Rp= Rf+σp(Rm- Rf)/σm(5.3)

Risk and the Budget Line

The(5.3) equation is called a budget line equation because it gives a relation between the trade-off between risk (σp) and expected return (Rp). This equation is in the form of a straight line equation(y=mx+c) where, x and y are the x and y intercepts, m is the slope and c is constant. Rf is constant, Rp and σp are the y and x intercepts respectively, and the slope is given by

(Rm− Rf)/ σm. The equation gives the relation that the portfolio’s expected return Rp should increase as that return’s standard deviation σp increases. The slope of the equation, (Rm− Rf)/σm, is the price of risk.The slope of the equation gives the value of the risk.

If no risk is to be taken, we can assign the value of b as 0, on the contrary, for receiving a higher expected return, some risk has to be taken. For example, the person is investing all the funds in stocks (b =1), and so earns an expected return Rm. Or funds may be shared between the assets while investing, which in turn, will earn an expected return between Rf and Rm. This will lead to a standard deviation, the value of which will be less than σm, but it will definitely be greater than 0.

Risk and Indifference Curves

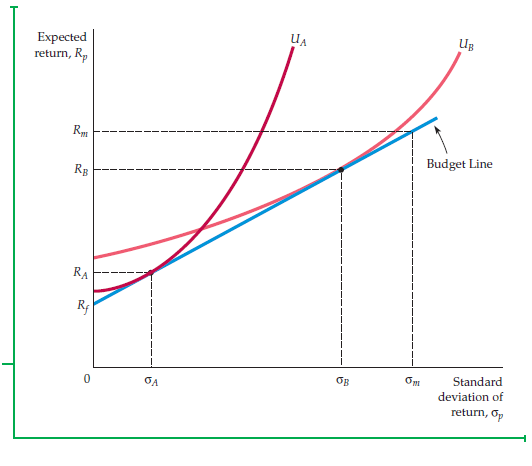

We need to arrive at a solution to the problem of the investor. Figure 1 given below shows the answer to the problem of the investor. 3 indifference curves have been shown in the figure. Each curve explains the risk and the return associated with it. The slopes of the curves are upwards. More is the risk, more should be the expected return to increase profit. Curve U3 has the highest expected return and so the amount of satisfaction is the greatest andU1has the least expected return and so gives the least amount of satisfaction.The point where the indifference curve U2 is a tangent to the budget line is the utility-maximizing investment portfolio.

Fig 1. Choosing between risk and return

Different people take risks differently. Figure 2shows in which strategy, the 2 investors will choose which portfolios.Investor A does not like taking risks. He will invest all of his funds in Treasury bills because that is safe and he will get an expected return RA. Investor B likes taking risks. He will invest most of his funds in stocks, so that the return on his portfolio will give greater expected value RB. When the degree of risk is greater, greater is the expected return value. If someone is willing to take risks, he will earn a greater expected return value than a person who doesn’t want to take risk.

Fig 2. The choice of two different investors

Example 1.Investing in the stock market

Let us consider an example. The 1990s saw a shift in the investing pattern of Americans. Investment in stock market was a new thing for people. They started investing in stock markets. In 1989,32% of families in the United States had invested in stock market, directly or indirectly. The percentage rose to 49 by 1998. Much of this shift was because of the participation of younger investors, who had started investing in stock markets right from the age they had started earning. Participation of middle aged people increased from 22 percent to 41 percent in 1998. By 2007, the percentage had increased to 51.1.

Stock market investment was also seeing participation of older men. By 2007, the percentage of people aged 75 years and above investing in stock market was 40 percent. The percentage of people investing in stock market was increasing with every passing year. What was the reason for this paradigm shift? Why was there an increase in the participation of people in stock market investment? The reason was the advent of internet, which made investing much easier. The pattern of increase convinced investors that prices will not come down.

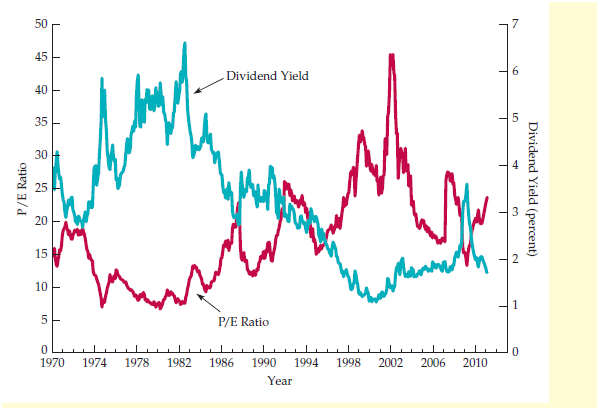

Fig 3. Divident yield and p/e ratio

Figure 3 shows a graph where we have plotted P/E ratio against a period of time. This graph gives a relation between the dividend yield and price/Earnings ratio, i.e. P/E ratio. In order to hold the expected return on the portfolio on the stock market, the investor has to borrow money to invest wealth in the stock market of assets which are risky in their portfolios.

There are a number of psychological motivations which explain the behavior and give an idea about bubbles in the field of stock market. These psychological motivations explain manager and consumer behavior in a wide variety of circumstances.

The next section talks about these behavioral aspects elaborately and explains how the expansion of traditional models can be done in order to help us in understanding the behavior.

5.5 Bubbles

The mid 90s was the age of development of Internet. With this, from 1995 to 2000, the stock prices of many Internet companies increased. As high speed internet was available to the common people, they started investing in online companies. Internet was used in ways which were not taken into consideration earlier. People indulged in Internet for a variety of reasons. Online shopping became the rage. There was a tremendous increase in the number of goods as well as services bought online. Furthermore, people increasingly started reading online news instead of magazines and newspapers. People began to depend on Internet sites for getting information rather than on books and magazines. As a result, instead of advertising their products and services in newspapers, magazines and televisions, the Companies now opted to showcase their advertisements on Internet. So, Internet became the heart and soul not only for the sellers but also for the buyers.

The advent of Internet in the daily lives of people changed everything.People, especially investors began to feel that if they do not associate themselves with the Internet world, they would be doomed. What they failed to realize was the risk associated with linking their business with Internet. So, investors purchased internet companies’ stocks at higher prices, the costs which were even more challenging for justification if one considers the basic fundamental.People became whimsical and didn’t even care to think once. They assumed that whatever was related to Internet will give them profits. This gave birth to Internet bubble.

The Internet bubble basically refers to a situation where there is an increase in the price of an asset, which is contrary to the fundamentals of business profitability; the increase in the price is merely a coincidence. This coincidence is considered a pattern, particularly a growth pattern by people. They assume that the price of the asset will keep on increasing, irrespective of the circumstances. The bubble burst when people starts to realize that the profit promised by these companies, or rather the profits which they have assumed that they will get, was not a certain thing and that , those prices that went up can also come down. The Internet bubble creates a mirage for people. They fail to see reason or logic. People get so engrossed in the Internet bubble that they don’t see the fact that the prices might fluctuate.

People were so caught up in the Internet world that they stopped thinking rationally. Bubbles are the result of irrational thinking of people. Without thinking straight, they purchase something as the price continues to upsurge and they are made to believe by their friends and relatives that the price will keep going up, so they will definitely make a profit. They fail to keep track of the fluctuation in price. They feel that when the prices are about to go down, they will sell their asset but that doesn’t happen. They sell the asset after the price has dropped, and as a result, they lose at least some part of their investment. The only positive thing about the bubble was it taught people a lesson. Experiencing a loss will perhaps teach people something. They will learn better economics from their past experiences where they have suffered a loss.

Bubbles might or might not be harmless. It depends on the situation. Bubbles are often harmless if we consider the situation from the point of view of the economy. Individuals might suffer loss but if we think about the collective effect of the loss, there is hardly any, or little damage to the economy.

But that is not always true. Sometimes, the economy of a nation is greatly affected by bubble investment. The housing price bubble was responsible for the USA economy loss in 2008.

Example 5.7 The Housing Price Bubble (I)

The prices of U.S. housing were rising sharply around 1998.After this year, the prices started rising much more rapidly, with around 10percent increase in each year. It reached its peak value of 190 in2006. In this time period, people thought that housing was one such investment which would bring only profits and that the prices will always continue to accentuate. A lot of banks too were caught in this trap and started offering loan to poor people with the promise that it would take back the principal payments and interest/month in the long term. A lot of investment was made in housing during that period of time hoping that people could change their fortune overnight.

Since, there was such a huge demand for housing; naturally, the prices were increasing at a high rate. But, a thing happened in 2006 which was beyond expectation and the rise in prices stopped. Rather, prices started falling down in that same year (2016). Then, in 2007 prices started falling rapidly, and by 2008, it was clear to everyone that investing in housing was a bubble, which had burst. In the period between 2006 and 2011, housing prices fell by almost33 percent. In some states of US, havoc was created because the prices were falling by over 50 percent.

The United States was not the only country to experience a housing price bubble. Similar things happened in many European countries at the same time. Some Asian countries also met the same fate.This was an example how investors suffer loss when a bubble burst.

Informational Cascades

An assessment of an investment which is based on the information provided by others, which in turn is based on the information provided by others and so on, is known as informational cascade. Now, let us understand this with an example.

Ajax is a biotech company. Suppose you are planning to buy shares of this company. The price of each share is $20 which appears to be quite a reasonable one. However, now this can be noticed that the price is once again upsurging from $21, $22, with a jump to $25 every share. Now the price becomes as high as $30. So you decide to buy the stock at $30.

Was the stock of Ajax bought at a price of $30justified by rationality or you fell prey to a bubble? It could be rational because the price of the share was increasing. Other investors too were investing into the share of this company and so you might say your decision was rational. Other investors, after all, might have gathered information about the company before investing and their analyses were probably detailed and accurate. You are depending on the judgment of others to justify your decision.

In the aforementioned instance, as you didn’t know anything about the company, hence, the decisions of your investment were certainly not on fundamental information. Rather, your investment choice was based more on others’ decisions.

There are both positives and negatives associated with informational cascade. If the information provided to you on the basis of which you are acting is indeed true, you are on the right track and you will definitely earn profit. However, there can be negative consequences too. There is a high percentage of risk associated in investing in assets based on informational cascade. It might be possible that some people earlier in the chain had suffered losses and you might not get that information and you might suffer a loss.

5.6 Behavioral Economics

Human behavior varies greatly with respect to each other. On the basis of their behavior as well as their needs, their choice of goods vary. In order to understand about customers demand and how their demand will affect the business market, we need to understand behavioral economics. Behavioral economics is a part of microeconomics which studies human behavior and with the help of the result results of these studies, explains economic decision-making.

Most of the times, consumer behavior is explained with the help of assumptions made on utility-maximization. Following are the assumptions:

(1) Some particular goods are preferred over others

(2) Consumers always see to it while shopping or investing that their initially planned budget doesn’t get disrupted.

(3) Consumers buy those products which gives the maximum of satisfaction.

Let us understand consumer behavior with the help of the following examples:

- The weather is bad and there is a big snowstorm. You have to remove the snow from the entrance of your house. What you do is you go to a hardware store. You expect an increase in price of a snow shovel at that particular time because naturally the demand of shovel has increased due to the snowstorm. But when you ask the price, you get to know that the price has been doubled so you decided not to buy the shovel.

- You visit an expensive restaurant and simply out of whim, you gave a 15% tip to the waiter.

- You chose to buy a particular book online rather than buying it from your local bookstore because you were getting a discount when you are buying online. What you failed to see here is the delivery charges charged to you when the online site delivered that book to you.

- You are getting a flight ticket from Kolkata to Hyderabad in ₹ 2500 in an online site, which is almost the same value as that of a train ticket for the same route. What you are ignoring here is the additional charges and taxes which you have to pay to the online ticket booking company.

- You have gone to a departmental store. Pickles is not on your shopping list. But you see that pickles have a 30% discount on them. You end up buying that jar of pickles even though you had no intention of buying it.

These are some examples of consumer behavior. Every customer behaves differently based on their psychology and natural behavior.Businessmen try to draw a pattern based on their behavior and make strategies to increase the sale of their products. But, unfortunately, this pattern of consumer behavior cannot be attributed to a single model of economics. In order to understand consumer behavior, we need to understand human psychology. Consumer behavior to some extent also depends on the society where they live, the kind of people they interact with and this also defines their choice and preference over some goods.

Consumer behavior is divided into the following three categories:

- Judging a product based on reference

- Judging a product on the basis of fairness

- Rule of thumb

Let us study these categories in detail.

Reference Points and the Preferences of Consumers

Reference point plays an important role in economic decision-making. Definitely, the first and foremost thing which consumers take into account is whether they are getting value. Brand value matters a lot to people. In spite of all these things, people ultimately depend on reference while buying a particular product. This reference can be in the form of praise or disapproval of a product from their family or friends. The reference can also be their past experience associated with the product. Research has found that most of decisions are based on that moment, when the purchase or the investment is taking place. Reference point can also be a place. For example,the rent of an apartment in Pittsburgh with two-bedroom is around $650 and the rent of an apartment with same feature in San Francisco is $2,125. Now, a person residing in San Francisco comes to live in Pittsburgh, will feel that the apartment is dirt cheap, so he won’t think twice or will bargain buying before taking that apartment on rent. On the other hand, a person residing in Pittsburgh and going to stay in San Francisco will find the rent is extremely high.

Reference point can also depend on demand and availability of a good. Say, vegetables are very cheap in one year, but due to drought conditions in the next year, production was limited. As the demand grew and availability was less, so, the price of the vegetables soared very high.

Our past experience with a product , price expectation, situation, place, recommendation of friends- these are the context on which we decide whether we want to buy a thing or not. Reference point affects decisions of consumers. Following are some instances of the reference points where they have affected consumer behavior.

Endowment Effect

Individuals give value to something more if they own it as compared to when they don’t. This is endowment effect. If a person is asked to sell a product which he already has, he will prefer to sell it at a higher price than his purchasing price. If you ask another person to buy that product from the former, he will be willing to pay less than the market price of the product. This shows that the value of a product increases for a person when he is in possession of it. Theoretically the price should be same but this doesn’t practically.

An experiment was performed on the students in a classroom. The students were divided into two groups- one group was given a cup each, the market value of which was $5. The other group was not given anything. Now, questions were asked from students of both these groups. The first group, where students possessed the cup, was told about the price of the cup and was asked at what amount would they like to resell the cup. The students in2nd group were also informed about the price of the cup and were asked the amount of money which they would like to take in lieu of that cup. The choice given to the two groups is same but they have different reference points. The reference point of the 1st group was the possession of that cup. The average answer of the first group was $7, and the average answer of the second group was $3.5.

Though the students in the first group had got the cup free of cost and any price which they would have suggested for selling the cup would have been a profit, yet they valued the cup more as they were in possession with it. The second underestimated the value of the cup as they did not own it. This difference in prices estimated by both the groups shows that it was considered as a loss to give up the mug, for those who had the cup than the profit obtained from the money taken in lieu of the cup for the second group. This was an example of endowment effect where possession of the cup made it more worthy than its actual price.

Loss Aversion

If people are given two options- one is gaining a profit over a product or avoiding a loss over that same product, they will choose the later. Loss aversion becomes more important than gaining a profit. This natural economic tendency of people is called loss aversion. It depends on perception. Let us again go back to the previous example. Students owning the cup knew, the market price of the product was $5 and so did not want to sell it for an amount which is below $5. The reason being, if they would do so, according to them, a perceived loss would have been created by them. They ignored the fact that they were given the cup for free, and naming any price would still have been a profit, but, it didn’t matter to them.

Let us consider some example. A man buys a stock for $50. The value of the stock is going down with every passing day. Instead of selling the stock at a loss and investing that amount in another stock where the value of the stock is increasing, he prefers not to sell it. This is because he wants to avoid loss. The original price of the stock here is like a reference point. the man doesn’t want to sell it at a loss, even though the price is going down and there is nothing to gain. As mentioned earlier, loss aversion is more important to people than receiving a profit. There are a lot of examples where endowment effects arise, but the effect disappears when consumers become experienced. Experienced people generally do not face problems of loss aversion or endowment effect.

Framing

Framing is another form of reference point. It is defined as the tendency of people to depend on the context of making choice while they are taking an economic decision. The brand names, the appearance, the packaging, the taglines used, etc. are the ways in which framing works. These factors contribute a lot to how a person makes a choice. Companies make promise to people which are not true most of the times. Skin cream companies make a promise that their products will give instant fairness or will keep the skin young forever but how many of these are true? But individuals are dazed by these packing and end up buying the product.

Example 2.Selling a house

People sometimes get a new job location or sometimes have to relocate for other reasons. Or sometimes, they want to move in a new apartment. In this situation, they have to resell their house. Now, the big step is towards finding the right price in which they can sell their house. They get an idea about it by comparing the market prices of houses similar to theirs or by consulting real estate agents.

Despite knowing the probable price at which they can sell their house, people still a price that is above the realistic price at which the house can be sold. Because of these absurd prices, no one will be interested in buying the house and so the house will stay on the market for many months before the owner will unwillingly lower down the price. During that time when the house is not getting sold, a lot of money will be spent on maintaining the house like paying the bills, taxes etc. These are additional expenditure. It is the endowment effect here. People view their special to be special and so charge a value which is much more than the expected price. As a result of this impracticality, not only the house cannot be used, but people also have to bear additional expenditure on the maintenance of the house, which is totally useless.

Fairness

Another form of reference point is fairness. Sometimes, we simply do a thing just because we feel it is right. There is no prior thought of gain or loss associated with it. Fairness does not take into consideration the material benefits.

Examples are giving charity, sparing time for people. The previous example of tipping the waiter can also be considered under fairness, because the customer was happy with the services provided to him and so he tipped the waiter. The previous example of not buying the shovel because the price was doubled and so they were cheated can also be included in fairness.

Let us understand fairness by taking ourprevious example of the shovel store. This has been explained with the help of a graph in figure 4. Curve D1 represents the situation when the weather was normal. The price was $20 for a shovel and let Q1 be the number of shovels sold in a particular month. Now, since people know that a snowstorm might be approaching soon, so, the number of shovels being sold will rise and people may have been ready to pay high price for it, had the situation been risen. This is shown by the curve D1’s upper part. The curve D2 is the time of hitting of the snowstorm. Now, the shopkeeper has increased the price of each shovel by $20. The price of a shovel is now $40. If the price has remained at $20, Q2 quantities would have been sold. But, this new demand curve will not go as far up as the old one. People do understand that because of the unfair weather, they might have to pay more than $20 for a shovel. But that increase should not have exceeded $5, or at the most $10. That is why the graph does not increase above $30.

This is an example of fairness. If weather was normal, people would have paid $30 – $40 willingly for a shovel.But they are aware of the fact that market price of the shovel is $20, and so an increase of $20 make people angry. They feel they are being cheated and so the sale drops.

Fig 4: Demand for Snow Shovels

Another instance of fairness can be seen in ultimatum game.Let us first know what the ultimatum game is. You are offered the chance of getting a share from a stranger from 100 one dollar bills. You get to decide your share. The rule is you have to convince the stranger to accept the challenge. If he agrees, you both get your share. If the stranger doesn’t agree, you both get nothing. Now, the question that arises is how will you decide the share? You can’t keep a bigger share for yourself because then the stranger will definitely say no and you both get nothing. If you give an equal or even a greater share to the stranger, then you are at a loss since you were given the opportunity of deciding the share and you could not earn any profit out of it. The basic theory comes to our rescue here.

You should give a proposal that you receive $99 and the share of the other person should be $1.The stranger should be happy to accept it because even $1 is better than nothing. If he says no, he will lose even that $1.This proposition of 99-1 is beneficial for both of you.

Yet most people hesitate while making this offer. They feel that giving a share of just $1 is unfair to the stranger and the stranger might turn the offer down. The stranger would have surely agreed had the share been 50-50.So, fairness comes into effect not only in this examples but in almost all of daily life situations.

Fairness concerns are incorporated in consumer behavior’s basic model. They are also used in practical life. In the previous example, if all the tenants searching for rented apartments in San Francisco feel that the high rents of apartment are biased, and revolt against it by agreeing collectively that they will not pay such high rents, the rents are bound to come down. In the same way, if majority of workers feel that their wages are unfair, and quit their jobs, the labor wage will increase due to reduction in supply of labor.

Rules Of Thumb and Partialities in Decision Making

Little or no experience can prove to be a hindrance while taking economic decisions. In cases, where people have no prior experience, people resort to rule of thumb while making decisions. The rule of thumb is not consider a correct and efficient rule when it comes to decision making.

Anchoring and the law of small numbers are the types of methods people take while taking decision on the basis of rule of thumb.

Anchoring

While making economic decisions, the mental rules of decision making depend on the context of the decision and the information that is we can access. While offering a charity, you are given the options of $20, $50, $100, $250, and so on to make your decision easy. These suggestions are for helping you to decide your ultimate donation. This is called anchoring. Anchoring can be defined as the impact which the information provided to you has on your final decision. Anchoring sometimes can create a bias in choices because the information provided to us can be molded in some ways.

A prominent example of anchoring can be found in price tags ending 95 or 99.

Marketers take advantages of the fact buyers are more concerned with the 1st digit. Thus to a consumer, a commodity bought in $19.95 seems very cheap in comparison to a commodity whose price is $20.01. Such strategies are implied by marketers to increase sale of their products.

Rules of Thumb

We sometimes ignore unimportant information while making economic decisions. A study has revealed that while doing online shopping, consumers don’t pay much attention to the shipping cost. They feel that not adding the shipping cost to the product will make them feel that they got the product at a much lower than the local shop’s price and hence act on the “rule of thumb”. Though the rule of thumb saves time and efforts but results in biases. Thus, they should be used carefully. Consumers during decision making use rules of thumb, however,at times, those very rules of thumb can be harmful for our decision.

The Law of Small Numbers

People are drawn to that law of small numbers. Though they don’t have enough information about an event, they overstate the probability of occurrence of that event.Say, a gambler has set a bet on black when he saw that red has come up thrice in a row. The probability was in the favor of red and he ignored that. Investors are often caught up in small-numbers partiality, and invest in stock markets. They assume that if, over the previous years, a stock is earning high returns, it will have the same fate for the following few years as well; i.e. they will definitely get high returns for their stocks in future.In this mentioned instance, the investors observed the stocks’ market value for a short time period to come to this conclusion. In fact, individuals, even after studying the returns from stock market for quite some years, many a times, fail to make an accurate estimation of the investments’ expected returns.

Individuals face a problem when probabilities are unidentified and not known. Sometimes, people form subjective probability assessments about some events. Most of the time, our estimated probability is not close to true probabilities. When calculating the probability of an event, the context in which the evaluation is made, can play a decisive role. It has been observed that when a probability of an event is very small, that probability is ignored while making decision.

Summing Up

Let us sum up what we studied. The traditional consumer theory helps us to understand the characteristics of consumer demand and thus we can predict the effect of demand of changes in prices or in incomes. This theory explains some of the consumer decisions. But there were some shortcomings of the consumer theory which is explained by the theory of behavioral economics.The economic models are not a perfect reflection of real-life situations. What model can be used to an extent will depend exclusively on the situation and the nature of the case which we are studying.

SUMMARY

- Consumers and managers make decisions which take into account the uncertainty about the future. This uncertainty is given the term risk, which is applicable when all the possible outcomes and the probability of those outcomes is known.

- The expected value of an outcome is given by the measure of the central tendency of the values of risky outcomes. Variability is measured with the help of standard deviation of outcomes. The standard deviation of outcomes is calculated is the following way: all the deviations from the expected value of all possible outcomes are squared, then the probability weighted average is taken out and the square root of this term gives the standard deviation of outcomes.

- Expected utility is an average of the utilities associated with each outcome, where the associated probabilities act as weights. Consumers maximize the expected utility when facing uncertain choices.

- The maximum amount of money which a person would pay to avoid risks is called risk premium. A person who loves to take risk would prefer an investment that is risky with a provided expected return.

- Risk can be reduced to some extent by increasing diversification, providing insurance and circulating information.

- The law of large numbers allows insurance companies to provide insurance for those assets where the premiums paid is equal to the expected value of the losses being covered. Such insurance are said to be actuarially fair.

- Consumer theory is depicted with budget line and indifference curves.The budget line shows the price of risks, and the indifference curves show how risks affect consumers.

- The study of behavioral economics takes into account reference points, loss aversion, endowment effects,anchoring, fairness policy and laws of probability.

Questions for Review

- How do you define a risk averse person? On what criteria people are divided into risk averse or risk lovers?

- Why is variance used for measuring variability, instead of range?

- George has $5000 with him. He wants to invest that amount in a mutual fund. The expected return on mutual fund A is 15 percent and it is 10 percent on mutual fund B. In which fund should George invest?

- What is meant by maximizing expected utility? Give an example of a scenario where a customer might not maximize expected utility?

- Why do people prefer to pay for full insurance against uncertain situations even though the premium paid exceeds all the losses being covered?

- Why do the insurance companies portray themselves as risk neutral in spite of their managers being risk-averse?

- People want to obtain more information to reduce uncertainty. When is it worthy of doing it?

- How can an investor avoid risk by diversifying his portfolio?

- Why do some investors put a large share of their portfolios in risky assets but some others invest in risk-free assets?

- What is meant by endowment effect? Explain with the help of an example.

- Jennifer is shopping and she finds a shirt which is so hard to resist buy. The price of the shirt is $50 and her budget is less than that. After some days, she finds the shirt on sale and buys it for $25. When a friend offers her $50 for that shirt, she refuses to sell it to that friend. Explain Jennifer’s behavior.

Exercises

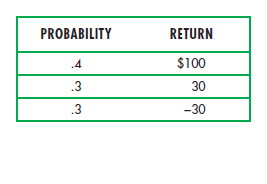

1. Suppose a person buys a lottery with the following three outcomes:

- The probability of receiving $125 is .2

- The probability of receiving $100 is .3

- The probability of receiving $50 is .5A. What is the expected value of the lottery?

B. Explain the variance of the outcomes?

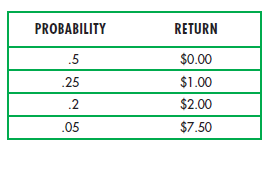

C. What would be paid by a risk-neutral person to play lottery?2. Consider a new computer company has been opened and its profitability depends on two these factors: (1) Ifthe U.S. Congress passes a tariff,there will be an increase in the cost of Japanese computers; (2) the rate of growth of U.S. economy. Which are the four mutually exclusive states of the world which will be affected?3. Richard is confused about investing in a lottery ticket. The cost of one ticket is $1, and the probability of winning is:

A. What is the expected value and variance of Richard winning a lottery?

B. Richard is a risk-averse person. What are his chances of buying the ticket?

C. If Richard gets 1000 lottery tickets, what are the factors on which his selling all the ticket for the smallest amount will depend?

D. What will be the steps taken by the state do you think about the lottery, keeping in mind the price of the lottery tickets and the probability of winning them?4. An investor wants to invest in a business, the business prospects of which has the following probability and returns:

What is the expected value and the variance of this investment?

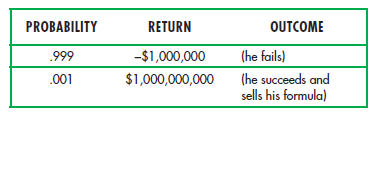

- You are an insurance advisor to a client named Sam. His company

Is developing a low-fat, low-cholesterol product which can substitute mayonnaise for a sandwich-condiment industry. This sandwich industry will pay a huge amount to the first invent or to patent such a substitute for mayonnaise. Sam’s product seems like a very risky proposition to you. You have already calculated his possible returns table which is given by:

A. What is the expected return and variance of Sam’s project?

B. If Sam is risk neutral, what is the maximum amount which Sam will pay for insurance?

C. You find out that another company will introduce their own mayonnaise substitute the following month. Sam is not in the light about this and has turned down your final offer of $1000 for the insurance. Sam tells you that his company is only six months away from introducing its mayonnaise substitute. But you already know about the other company which will launch their product next month. Would you raise or lower your policy premium? What will be Sam’s reaction?

6. Natasha’s utility function is given by

u(I) = where I represents annual income of Natasha in dollars(in thousands):

A. Is Natasha risk loving, risk neutral, or risk averse? Give reasons for your answer.

B. Natasha’s current earning is $40,000 (I=40), which is fixed. She is offered a new job. In that new job, the probability of earning $44.000 is 0.6 and the probability of earning $33,000 is 0.4.

Should she continue her old job or take the new job?

C. Will Natasha agree to buy insurance to protect herself against the variable income associated with the new job? If yes then how much would she be willing to pay for that insurance?

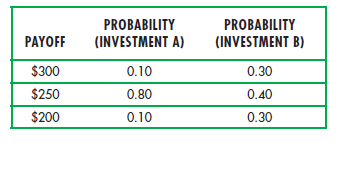

7. The following two investments have three payoffs, which are same but the probability associated with each payoff is different:

A. Find the expected return and the standard deviation of each of the investment.

B. A person has a utility function U = 5I, where I stands for the payoff. Which investment will that person choose?

C. A person named B has the utility function U = 5 . Which investment will B choose?

D. C has the utility function U=5 . Which investment will she choose?

8. You own a family farm whose estimation is $250,000. You are given two choices- sitting this season out and investing last year’s earnings of $200,000 in a risk-free fund paying 5.0 percent, or planting summer corn. Planting cost is around $200,000. The time period for the crops to harvest is six months. The revenue after harvest will depend on the weather- if there is rain, the crop will earn $500,000 and if there is a drought, $50,000 can be earned. There is a 3rd choice-investing $250,000 on drought-resistant seeds that will yield $500,000 in revenues at harvest if there is rain; and $350,000 if there is a drought. Considering you are a risk averse person, and your family wealth preference (W) is given by U(W) = 1W. The probability of a drought is 0.30, while the probability of rain is 0.70. Which of the three options would you choose?

9. A man is a risk lover when his income is low but risk averse when his income is high, he becomes risk-averse. Draw a utility function over income u (I) that describes this situation. How does a utility function reasonably describe a person’s preferences?

10. A city manager wants to hire people to monitor the parking meters.

He has the following information:

- The cost of hiring each meter monitor is $10,000 per year.

- The probability of a driver getting a ticket each time for illegal parking is 0.25 when one monitoring man is hired.

- The probability of getting a ticket is 0.5 when two monitors are hired; with three monitors the probability is 0.75; and with four, it’s equal to 1.

- With two monitors are hired, the fine for overtime parking is $20.A. Assume all drivers are risk neutral. What parking fine would you levy, and how many meter monitors would you hire (1, 2, 3, or 4) to combat the problem of illegal parking at the minimum cost?

B. Assume all drivers are highly risk averse. What will be your answer to (a) now?11. A risk-averse person invests 50 percent of his portfolio in stocks and the remaining 50 percent in risk-free Treasury bills. How will the following events affect the budget line and the proportion of stocks in his portfolio?A. The standard deviation of the return on the stock increases, but the expected return remains constant.

B. The expected return on the stock increases, but this time the standard deviation of the stock remains constant.

C. There is an increase on the return of risk-free Treasury bills.12. Suppose there are two categories of e-book consumers: 100 standard consumers who buys Q quantities of books, where Q =20 – P and

100 consumers who make decisions based on rule of thumb. These rule of thumb consumers buy 10 e-books only if the price is less than $10; the equation being Q=10 if P ≤10 and Q =0 if P 10.) Draw the demand curve for this situation. What was the role of rule of thumb in this question?

Links of Previous Main Topic:-

- Introduction Markets and Prices Preliminaries

- The Basics of Supply And Demand

- Consumer Behavior

- Appendix to Chapter 4 Demand Theory a Mathematical Treatment

- Uncertainty and Consumer Behavior

Links of Next Microeconomics Topics:-

- Production

- The Cost of Production

- Production and Cost Theory A Mathematical Treatment

- Cost in the Long Run

- The Cost of Production Production with Two Outputs

- Profit Maximization and Competitive Supply

- The Analysis of Competitive Markets

- Market Power Monopoly and Monopsony

- Monopolistic Competition and Oligopoly

- Game Theory and Competitive Strategy