There is a need to attain the conceptual knowledge and learning of all the financial claims that are made. This might look a very complex procedure that you are yet to make. This is why there is a need to learn the real and exemplary ideal thing. What the brands face is a valid point that is needed and getting a hold of. It is a little complex to calculate the equity values that were created on the beta market values.

15.4 A IBM’S Liabilities

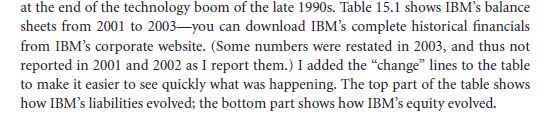

After a short look at the table number 15.1, you can come up to the value summations that are made. A total of IBM liability is understood and gotten a hold. There may be other firms that are selected and made the important factors that are used and gotten the valid nature of. Many of the other firms are made to know and understand the value property. There may be varied and diverse interest rates that are depicted. The involvement that you get from the third parties and making a noteworthy reference will get you close too.

You can calculate the M&A values. This makes the calling of the underrated interest rates a very great help in the adding up of the profits.

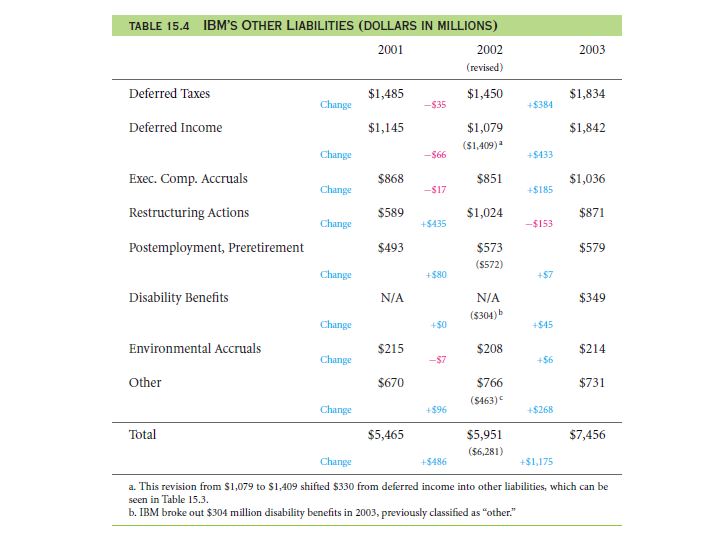

Long-Term Debt

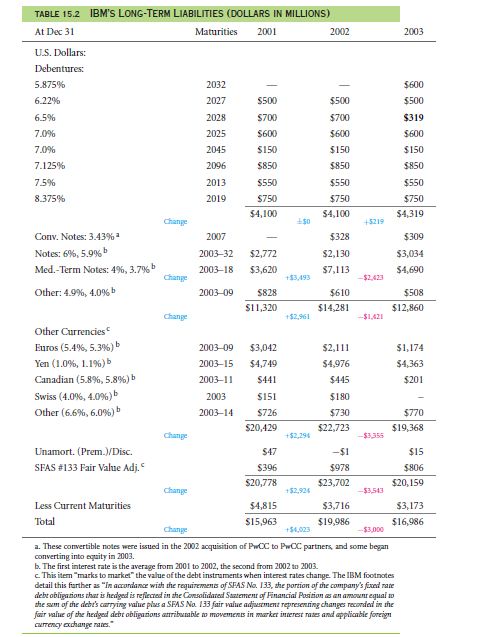

In the table marked as 15.2, you can see how the IBM has a pretty long term debt ratio. This is so as there were many people who are influenced by the very address. This is not so for the smaller business firms though.

Hybrid financing: this must be taken into consideration that IBM holds a convertible method too.

There are many financial tools that are used for the long terms, this is so for the use of calculating. The factor that proves to be a very essentially important one is that of the long term one. The changes that are forwarded in the case of such expansion, there are smaller but mediocre sized program ventures.

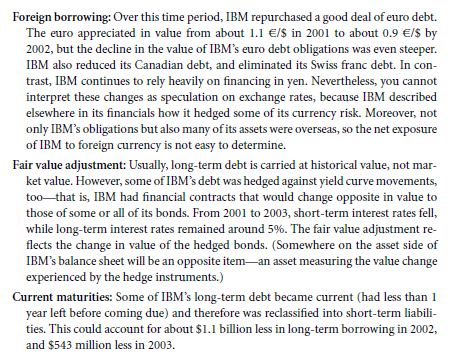

Current Liabilities

As the table here i.e., 15.3 suggests, there is a pattern of change that you can note and follow in case of the liability issues. There are many opportunities to make a clear meaning. Before the term is to happen, there can be a certain truth. This is merely the calculative part.

Whatever finance that was to be held upon, is the maximising factor and all the liabilities are to remain completely secluded and the debt term works marvellously.

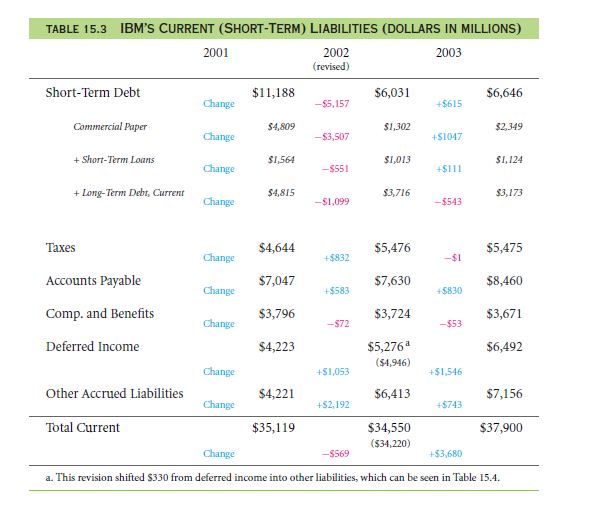

Other Liabilities

The factors that are depicted in 15.4 table makes a global impact and along with that of the very opportunity to understand and work on liabilities. The changes that are faced are there of the differed value. All liabilities are important. However, the value that the IBM makes out of the liabilities is a great sum of 65 billion dollars, and peaking high to 7 billion dollars.

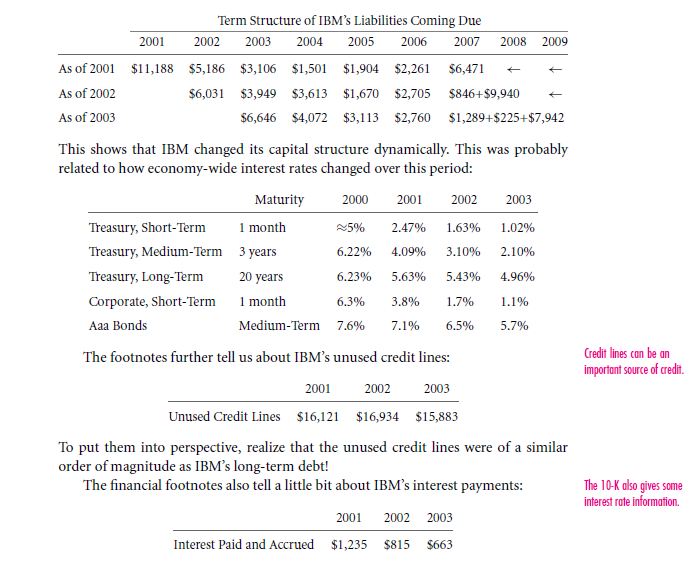

Other Observations and Discussion

As you can get by the heading, the very purpose is to understand the value of the IBM and to get acquainted with such. Most of the financial captivity that is gets or wins an upper hand. There can be various word commutations. There is a great complex process on hand.

IBM is a globally renowned brand and the liabilities that it fetches are worth applauding for. There is a better value that you get to use. Not diverting from the initial topic, there is a great value that is to cover. There is a grave measurement that you need to take and there is absolutely no need for the calculation procedure.

The value of the computed values can get a really good fashion.

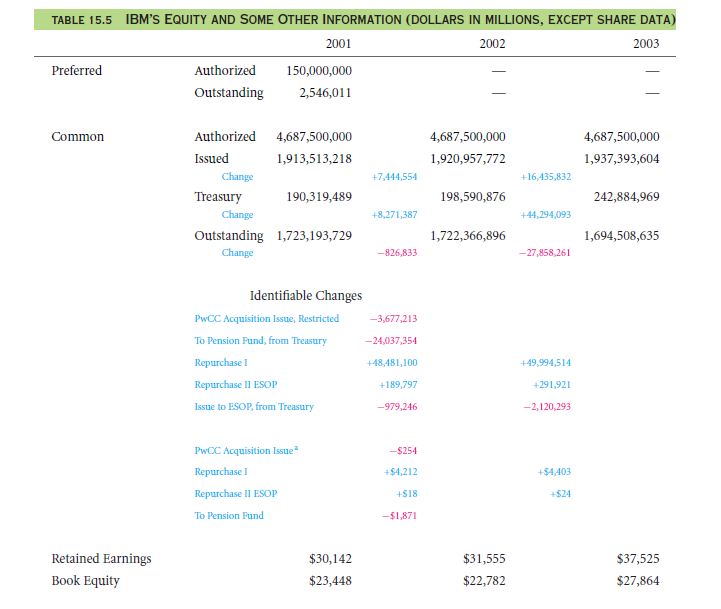

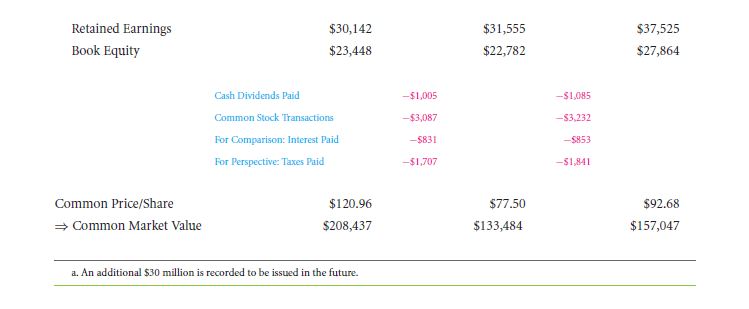

15.4 B IBM’S Equity

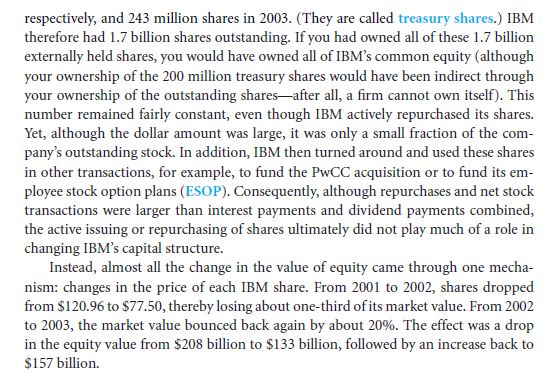

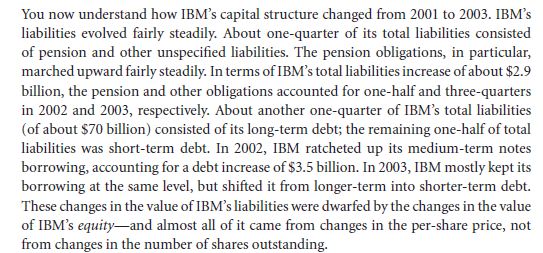

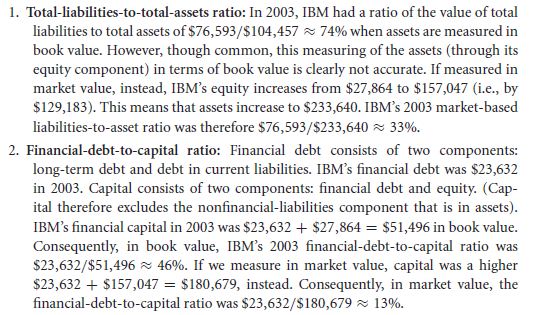

15.4 C Observations on the Evolution of IBM’s Capital Structure

There is a good suggestion that maintains the capital changes that are used as the determining factors which make the certain strategy.

The statistics that is summarized and displayed makes up for the successful statistical rates. This will be given in the section 22.1.

Summary

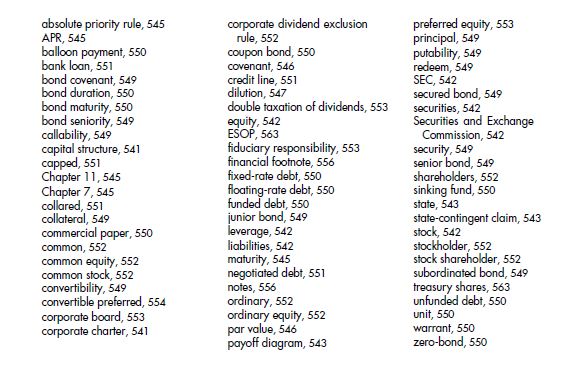

Key terms

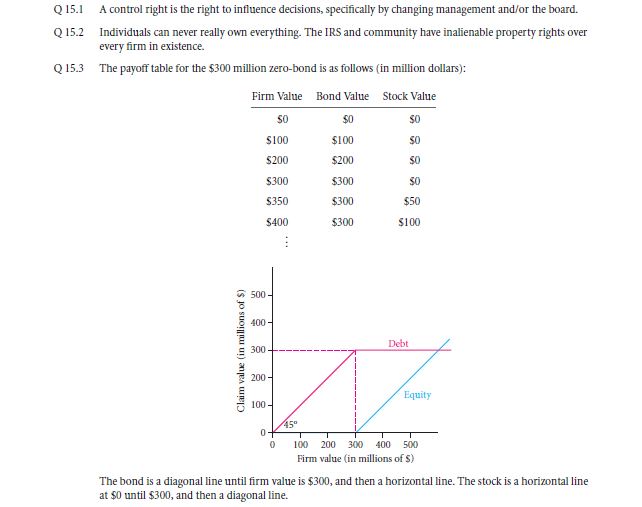

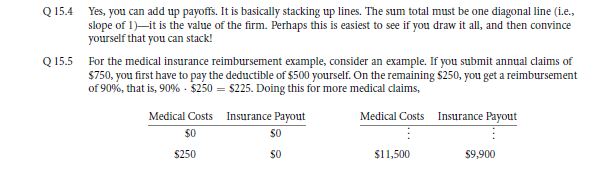

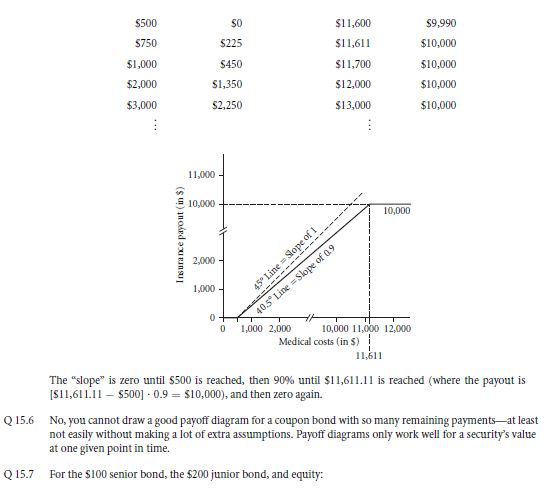

Solve now! Solutions

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

Links of Next Financial Accounting Topics:-

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management