So whet will be some of the practical and theoretical methods that are followed in the aspect of capital budgeting method? These methods are all marked and used to help on the investment decision? They all do exist which are not a bad choice. In the aspect of IRR and also that of NPV this forms up as common used budgeting rules which make a practical rule hence it is laid to as the main payback rule.

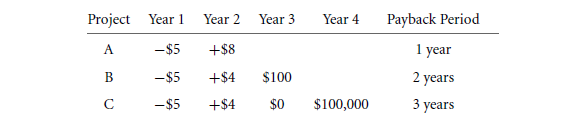

The main thing that you must know is that you must not fall for such a rule. The projects under this rule are made to be as the best one to follow through with and hence, the original investment falls on a fast loop scale. So, let’s consider on the following projects:

The project that is marked as A is mostly signified as the best one with the minimal period of playback. It will show as the worst one when the other three main projects go on to become the worst ideal. As for project B, the mostly used shorter period remains to be the most interesting one. With the project that is dissipated as C, there will be the longest of the period where there is a payback enforced and hence, they are all discounted for. The measures that are taken ask on the basic value of how elongated the entire process is to get a grip at the money. That is only the present money deal. It remains as a pretty bad idea.

The project that is marked as A is mostly signified as the best one with the minimal period of playback. It will show as the worst one when the other three main projects go on to become the worst ideal. As for project B, the mostly used shorter period remains to be the most interesting one. With the project that is dissipated as C, there will be the longest of the period where there is a payback enforced and hence, they are all discounted for. The measures that are taken ask on the basic value of how elongated the entire process is to get a grip at the money. That is only the present money deal. It remains as a pretty bad idea.

The payback amount can however be of a very interesting ideal.

- The beauty of the payback is its simplicity. This will be an easier deal for all the managers to get a grip in as they train in finance. What you need to understand is that the entire concept of the money that is paid back remains on the deal that it will be returned back to you in a duration of 5 years. That being said, the ending sums up to the NPV that is $50 million.

- The payback that you get is based on the entire capital of the cash flows. This helps to set on a trust build up with managers. As relied on the instance, the department manager will get the money that you initially invested in a project to be returned back within a duration of one to three years. If the manager is not being able to refund a great deal of the better management.

- With the limited capital, and imperfect market, the entrepreneur faces the brutality of falling under. As an entrepreneur, it becomes your duty to serve as a supreme with the limited capital that is left. The money may be short, so the condition of liquidity persists and hence attains out to be a difficult deal.

- Among the ordinary situations, the choice of benefit remains pretty clear. Either you cut on the cause, or you leave out on the money. With the time value of money that is given, the money that can be obtained within the time period of one month in hand. If the project remains to be a negative in the terms of NPV, with many years of money back duration.

With all these, you can efficiently use the money back guarantee to make a rightful decision. These decisions can however get you involved in the common risk of falling into bad projects. So it is not a very bright decision to follow up through with capital budgeting methods. As far as the idea of the rightful information is involved, projects are mainly concerned with information that is interesting on only one side. There is a possibility that there will be a comparison among the projects. However, it is not a healthy one.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Net present value chapter 4

- The internal rate of return irr

- The profitability index

Links of Next Financial Accounting Topics:-

- How do chief financial officers CFOS decide

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management