Summary:-

- In order to understand financial statements, four main concepts are required: income statement, equity statement, balance sheet and most importantly the cash flow statement.

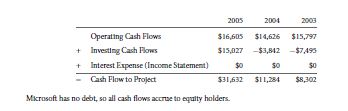

- NPV calculations and many other calculations can be accomplished with the help of financial statements.

- Net income is not used in NPV analysis

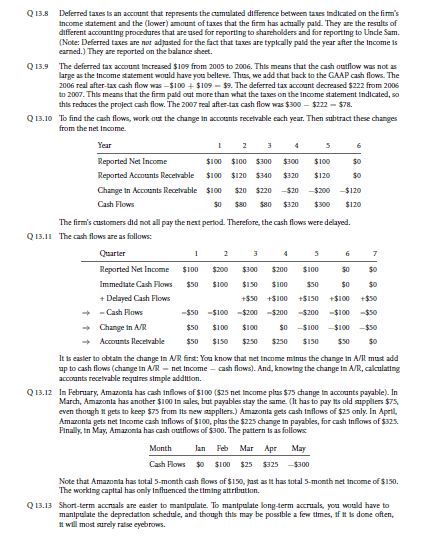

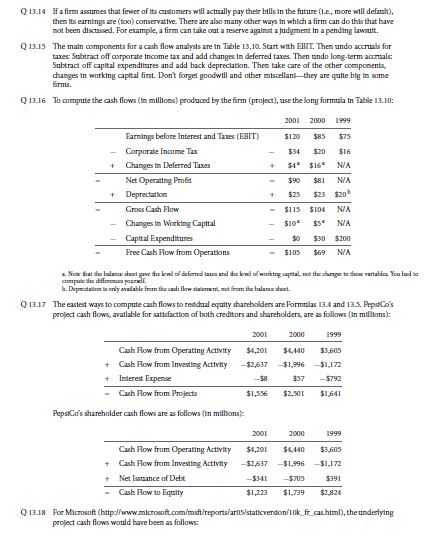

- To get the actual cash flows, you need to undo the accruals with the help of reverse engineering.

- The most important long term accrual that affects calculations is depreciation.

- The difference in the GAAP and IRS schedule is reflected in the form of deferred taxes.

- The most important short term accrual is known as change in working capital.

- Cash flow statements, if available, can help handle most difficulties in accrual calculations.

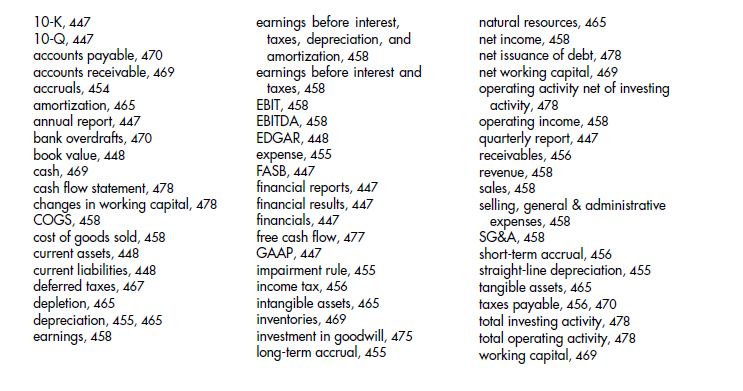

KEY TERMS

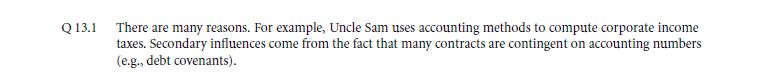

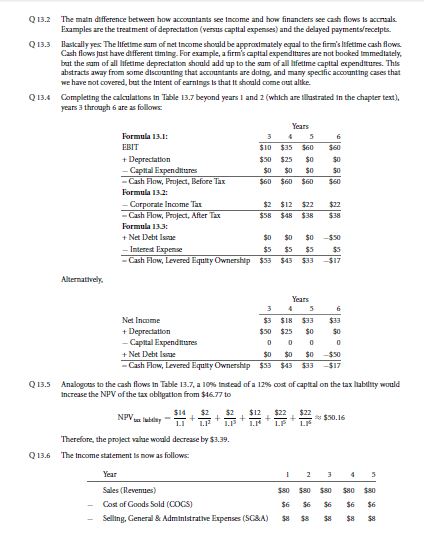

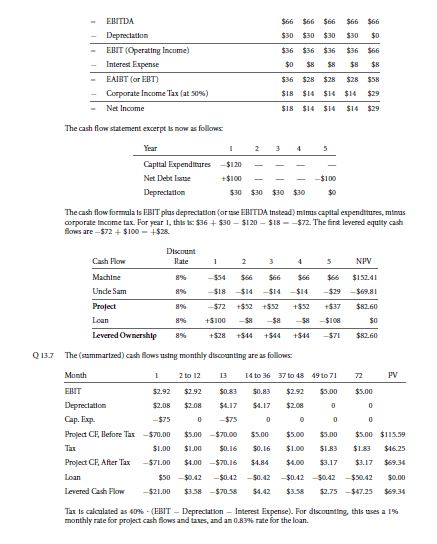

SOLVE NOW! SOLUTIONS

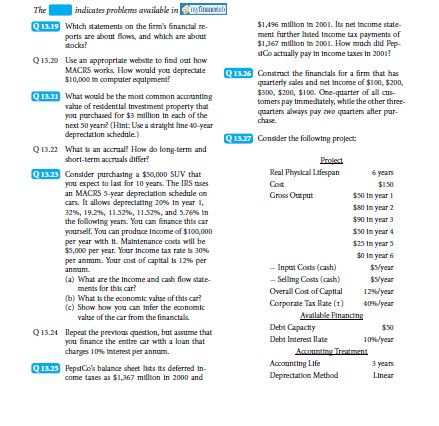

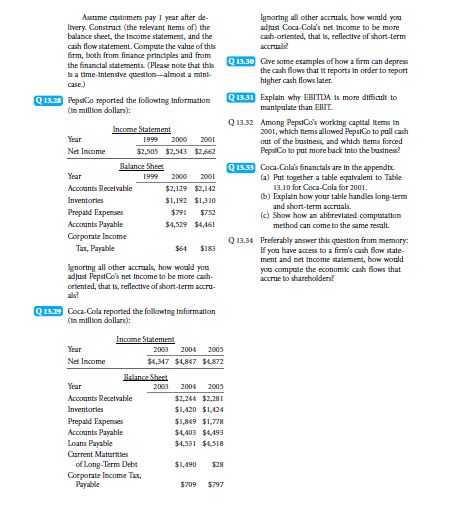

PROBLEMS

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- From financial statements to economic cash flows

- Financial statements

- A bottom up example long term accruals depreciation

- Bottom up example deferred taxes

- Bottom up example short term accruals and working capital

- Earnings management

Links of Next Financial Accounting Topics:-