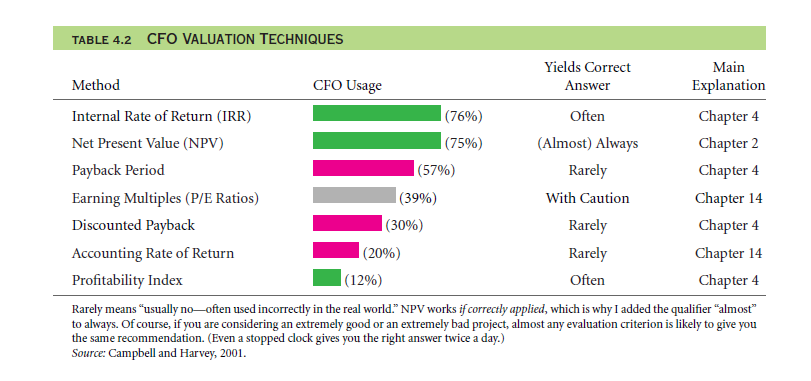

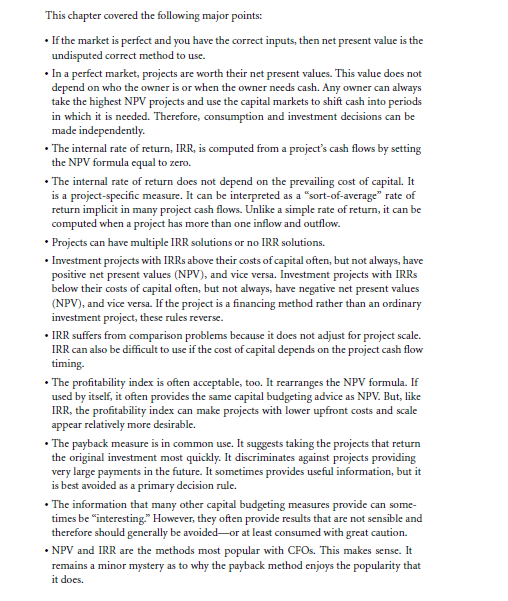

We know that mangers do the capital budgeting. What do they do in order to do so? As listed out on a survey, in the year 2001, Graham & Harvey took a survey of 392 managers who are chief financial officers. These people were asked as to what sort of techniques they were using while deciding on the projects they had to choose. Look at table 4.2 to see the result of this survey. The main most prominent features that are displayed are of payback of the period and net present value.

The most common sight that you will notice is that with the capital budgeting and there rules. There will further be many intricate details that come along with NPV.

The two methods that are explained here are so of multiple earnings and the rate of return that is being accounted. In the chapter numbered 13 &14, you will get to learn about these in a broad detail. The multiple earnings method, compares the project in hand to the other firms and their earning values. In case, a particular project earns more than that of alternate project availability, then there will be many approaches given to select from. This however is a not very prominent idea and it reflects the firm value.

Other responsive ones were not allowed by Graham & Harvey as the third measurement was for a project selection. This was done to increase the earnings. All that managers care about is the earning that a project makes. In the short run that is. All they care about is the retirement sum. Hence, they many eventually pass off better projects that have a better look for the long term.

Rules are mostly based on the accounting dealings and really not on the economic strata. I would however, recommend in the using of these. Though I have absolutely no idea about the sort of projects that you want to settle down with. A measurement of the project in hand may eventually turn out to be more of cynical. The rate of return will be 190% on a yearly scale.

The capital budgeting method is going to provide you with a powerful language that will be important to learn and use to rationalize that of the professional manners that are used in the project. These may also be used to learn that of the reasons that are used in the funding. Most of the influential managers use their positions to land on with good projects. As a supposed, these are not at all objective methods. Neither are these methods quantitative at all.

Summary

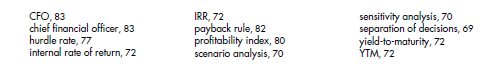

Key terms

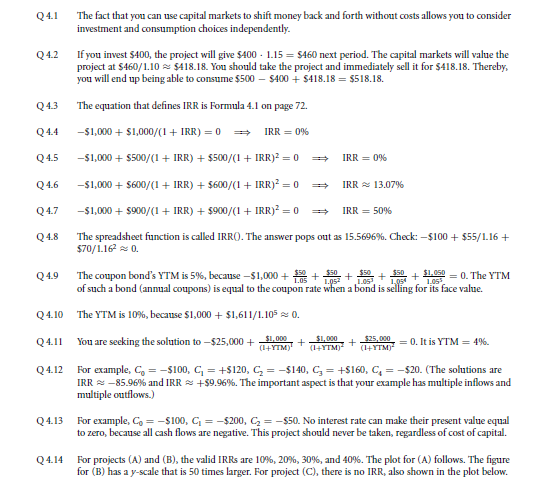

Solve now! Solutions

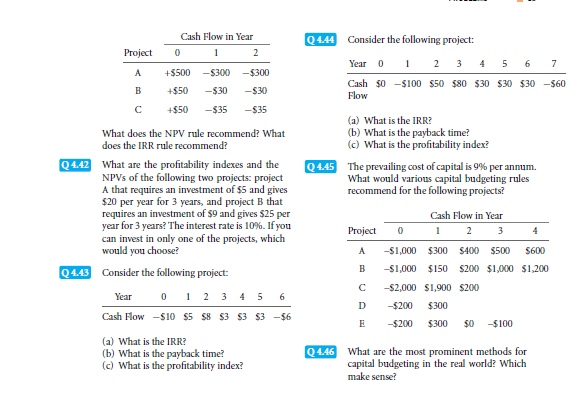

Problems

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

Links of Next Financial Accounting Topics:-

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Perfect and efficient markets and classical and behavioral finance

- Capital budgeting applications and pitfalls

- From financial statements to economic cash flows

- Valuation comparables financial ratios

- Corporate claims

- Capital structure and capital budgeting in a perfect market

- The weighted cost of capital and adjusted present value in an imperfect market with taxes

- What matters

- Equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management