Payout cash is important part for imperfect capital market. Now, whether that paying out is suitable in creating value or it is just destroying value. So, anyone can understand after going through the analogue of capital structure section. Now, it is a straight question that what you will do with the cash of investors for your company.

There are two sides or two ways for you. First one is passing of negative NPV projects for paying out cash will create the value. However, if you have the second option of passing of Positive NPV projects as you want to pay out cash, then it will destroy the company value.

Determination of payout policy is very important and for that determination of capital structure has a prominent role.

Anyone can understand it properly if he takes review of following points –

- Personal Taxes – Some proper decision is significant and what has explained here can destroy value. It means of paying to dividends or in case of repurchase of shares, the tax liability of investors will be bigger than reinvesting of money.

- Corporate taxes – Here payouts for equity are able to create value because by repurchasing of shares on debts, the probability for payouts in future will be beneficial as they are tax advantaged.

- Signaling and agencies – At the moment of repurchasing shares and paying to dividends in cash as temptation for cash to make Negative NPV projects, the one can create value. It is important to know about the different projects related to it. Empire buildings, managerial perks and pet projects come under this category.

- Financial distress – Distress financially indicates that the problem of cash or suitable amount in the company is unavailable and the probability of paying a huge amount is not possible at a time. Now, the resultant would be destroying value and ultimately bankruptcy.

Now, it is necessary to know about payout cash in different forms. What would be the right one for you between repurchases of shares and dividends. There is a huge difference; though both ways are associated with cash pay out. Before getting proper knowledge it is important to understand about personal income tax as these terms are related with this kind of income tax.

Investors Clienteles and Personal income tax differences

Which is the best way for paying out cash? Why this is a proper way and more valuable? There are two ways to pay out either dividends or buyback of shares. Repurchase is considered as a better way than others like dividends.

Statutory income tax in personal level were eliminated the faults of dividends, but still the smarter way to pay out is repurchasing rather than dividends payout. There are some differences between, dividends and capital gains in personal income tax.

There are two types of investors in repurchasing section of shares as participating investors and non participating investors. Those who are non-participating, face no consequences in tax. However, in case of participating investors, they have to face only potential taxes for capital gains.

However, the prime requirement or repurchasing is still there and it is taxation of dividends take place year after year, but taxation of capital gains take place only when an investor feel it or realizes it.

Clienteles – Retail clienteles feel free to repurchases of shares and improve their way of getting paid other than tax of capital gain. You can understand it just by knowing that some retail investors purchase stocks at a higher price, however there are many investors who have purchased at a lower price.

Now, at the moment when a company repurchases the shares, then investors having low accumulated gains of capital take part do not get much consequence of capital gains. In this way those participants who are having higher accumulated gains for capital avoid realization and then they suffer no consequences of tax.

Accumulating taxation – In case a firm had to offer 20% capital gains in a year and $ 100 investment would make an earning of $ 100 x 1.2 x 1.2 = $144 in 2 years. Now, if tax rate applied were 50%, and then you kept $22? Now, in case of the dividend payments with 20%, the investors would have 10% receivable after interest of tax. Now, what would be the net gain per year, it would be $ 100 * 1.1 *1.1 -$100 = $21. So, the difference between the dividend and repurchase payout is $1 or you can say $22 – $21 = $1.

It is understood here that there is bit difference between dividend and repurchase. The reason is a very small part of dividend gets included in repurchasing of shares after each year. In real cases, the tax is not as much as 50%, but very small, so in case of purchasing also, the actual difference is very less.

Capital Loss offsets – It may happen that there is loss in capital gain. But, getting perfect balance becomes important and thus offsets are done. Repurchases of shares or re-investments of any capital gains are important to maintain the balance. However, offset dividend payments are genuinely not possible with capital loss. Moreover, each investor realizes a force of dividends.

Now, it is good to have some gains for retail investors through some unrealized capital gains, but this “out of the tax penalty” is perfect only for repurchasing, but if you consider it for out of the tax penalty for dividends, then it will not be profitable for you. In this market, clientele potential for different types of investors are available like investors with zero-tax or tax-exempt.

It means low-earn inventors like pension funds are able to take bit earn from dividend taxes. These investors successfully hold bonds to taxes of shelter interest as well as stocks to dividend taxes of shelter interest. Now, it is also important for you to understand that effectiveness takes place when cum-dividend or ex-dividend dates are nearby.

Do you know that in what condition arbitrage of dividend tax is perfect? Those who are low tax investors, they are in short supply.

If you go through the IRS rule for this, then arbitrage for one day tax is illegal. It directly indicates that arbitrage for dividend tax is not accurate as it is somehow illegal. The clienteles reduced dividends for penalty related to repurchases of shares.

Low investors only needs to know about their pension funds in this case as why tax perspective gets paid from pay dividends of firms. If you go through the pure tax-perspective, then it will be clear that share repurchases take over or dominate dividends. It is prominent here to know that share repurchases avoid most of the personal income taxes.

IRS can do one thing legally and it is declaration of repurchase share just at the equivalent rate of dividends. However, in case of “Publicly traded corporation” this became weak. IRS rules are not suitable always for public firms.

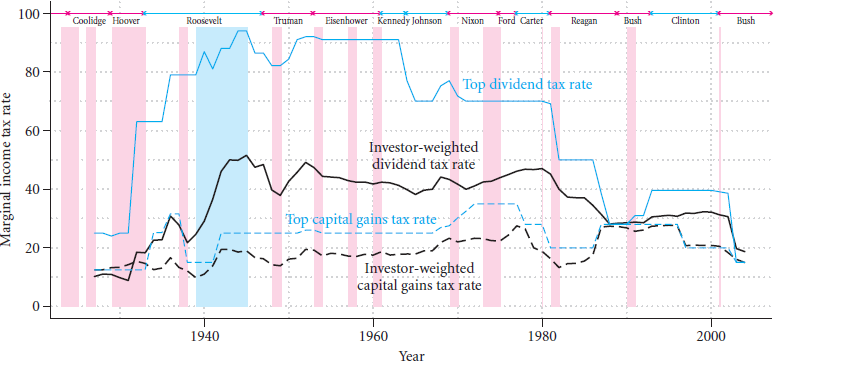

For historical equity, tax perspective for repurchase is somehow better than dividends. Now, go through the following picture to understand the tax rate capital gains and dividends.

Till 2003, the dividend tax rate was just equal to normal rate of income tax. 35% as in 2002, but it became accurate in the year 2008 which was capital gain of 15%. However, 35% was applicable for dividends of foreign corporation as well as those dividends which were non-qualifying.

Reagan Tax reform 1986 Act started working effectively, but before than it was really worst condition because there was the tax rate 50%. What is the reason of that companies paying-out-cash in dividends these days? All companies started following education those days, because it became very important to follow some proper way to understand the paying out factors. Corporations paid out mostly through repurchasing of shares as compared to dividends pay out.

The impact of paying out through repurchases effect the corporation strategy for paying out, and more and more started shifting to pay through share repurchases rather than paying through dividends. This took place in 1980. The prime motto was returning payment to the shareholders.

In the year 2003, when Bush focus on tax cut of dividend in a logical way, then many companies follow paying out in dividends, most accurately done by Microsoft Corporation. What Microsoft declared? Special dividend of $32 billion, repurchases of shares $ 30 billion and along with that an exact increment in share value as dividends in all normal shares. It became 32 cent in place of 16 cents.

This increased the market value for Microsoft by 20% where capitalization of $ 300 billion. It was bit successful, but at the moment company declared about quarterly earning and this decision had the ability of felling back the shares at the same time.

Nontax Differences

There are some important points of difference between repurchases of shares and dividends. And these are as follows-

- Dividend smoothing –

John Lintner got that corporations unwilling to reduce dividends, as an alternative of that increasing this slowly on proper time was a good choice. So, corporations followed paying smoothly for a long run payment effectively. This step of smoothing of dividend is known as Dividend smoothing.

It became strong and favored by students as well as management. Still this is followed, but a number of corporations change their way and it is not much strong these days. The impact of this decreased since mid 90s. All firms did not follow, even 1% cut dividends. Though the expert said that a corporation could easily adjust their way of dividends to pay in their own way, but it did not work effectively.

The different situations as well as some interest pattern rate made it more accurate. Stickiness dividends behavior makes the complete way of pay out more interesting. Shareholders always want dividends to keep continuing.

Managers thus oblige and tend to cash via repurchasing of shares. They apply payment through dividends only in case of permanent solution. Now, there is a reason behind that. In case of increasing dividends on one time optimistic way of earning, then in the near future this dividend might have to cut.

So, it indicates that increase in dividend value is somehow a proper notice for the managers to focus on more share repurchase to maintain a proper balance. Cutting of the dividends makes the financial market disappointment.

- Executive stock option –

This comes at the second position among many reasons. An executive stock option is an exact option for executives and here price of stock depends on the price of each share. Managers with different options choose buyback to dividend payment. The reason is after purchasing a share the price drops and it becomes a bad for the manager.

- Executive ownership –

Executives are not allowed to tender shares in their repurchases offers of shares. So, what they do in this case? They just take more shares after dividend payment through repurchase.

- Investors’ preferences –

Here, you can easily get about the choice of investors. Those who are retail investors at a small level, they will always select dividends rather than repurchasing of shares. Do you know the mystery? Those retailers who need cash always want dividends. It is important to know that selling a fraction of stock gives physical cash.

It is also very prominent to know that a person does not have to pay personal income tax in case they sell small amount of stocks. However, it is also true that if you really want cash by selling shares, then you should end up by selling more shares, but in that case paying of personal income tax will take place. “Investment Substance” reduction is another factor that each investor does not think much.

If you look at the past, then penalty of tax dividends today is somehow lower than those days. It means the preferences effects of each investor are irrational as well as real, but not universal.

- Exclusion clauses of fund charter –

Dividend paying stocks are important for a lot of companies and shareholders. Stocks holdings are excluded for a few companies as they did not have initiates their payments through dividends.

Questions:

- When equity shares are considered can you both take into account equity share repurchase and dividend payout details?

- How are dividend payments and share repurchasing different from each other?

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Equity payouts

Links of Next Financial Accounting Topics:-

- Empirical evidence

- Survey evidence

- Summary in equity payouts

- For value financial structure and corporate strategy analysis

- Capital structure dynamics firm scale

- Capital structure patterns in the united states

- Investment banking and mergers and acquisitions

- Corporate governance

- International finance

- Options and risk management