Describing Risk:

Risk is an uncertain future event. To explain risk quantitatively, we need to understand the probability of risk. The uncertainty of risk cannot be described or assumed. The live example of it can be observed everywhere. There is a risk of accident while crossing the road, but to survive in this world, we need to go outside. Risk also prevails in share market or the stock market. It’s not that every person will gain $1000 by investing $100 in the share market. A company which is at the highest position today can be on the lowest one tomorrow because of this investment risk which prevails in the share market.

Probability:

Probability is termed as the expectation of risk which may occur in future due to an uncertain event. Suppose, for example; you are thinking to invest in the share market. For that, you need to analyze all the data regarding it. After analyzing all the data, suppose you want to spend $1000 in steel company’s new project. With an expectation of earning $5000, the possibility of earning $5000 may be 20% as the company may also incur a loss in their new project.

The probability of one generic interpretation depends on the frequency with the help of which future events tend to occur. Let us take an instance. In the past; the same company inaugurated a project identical to the new one. So, 70% of the result obtained will be based on that experience. That may be called as the objective of the new project.

There may be two kinds of probability, one is subjective, and other is the objective probability. Objective measures of probability cannot be deduced if there is no similar experience to measure probability. The forecasting or perception of the future event that a result that can occur may be based on an individual’s personal experience is known as subjective probability. It’s not necessary for each time that it will be according to the rate of occurrence with which an event has already taken place in the past. In the case of determination of subjective probability, various people may dispense or attach various probabilities to different consequences and in that way make different options.

Suppose, for example, a search for natural gas took place in a certain area where there had never been any researches before. In that case, the one who is an expert in the oil business or who have a better idea of it can give a subjective probability which is higher than the others. This is like a chance that increases the possibility of the project to succeed. It may be because of variation in information supplied to different individuals which cause to vary subjective probabilities among individuals.

Comparison and description are two quantifications that help to choose among risky choices. Possible outcomes can be determined with the help of variability, and other measures describe expected value.

Expected Value

Those values which are predicted or which is a perception of the uncertain situation with every possible end results can be called as expected value. The probability of all these individual end results is utilized in the form of weights. In the case of central tendency, the expectation regarding the payoff that we require to measure is on an average basis. Thus, it can be said that the expected value measures central tendency.

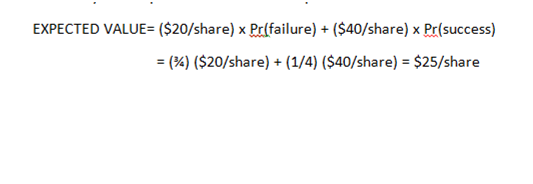

Suppose, for example; a person decided to invest in a company that explores offshore oil. If the exploration effort is successful, the company’s stock will increase from $30 to $40/share. However, this on per share bas is may also get reduced to $20 if the exploration effort will be unsuccessful. So, the chance of the project to be unsuccessful will be more i.e. ¾ than it to be successful i.e. ¼ only. The expected value that we express in this case are:

Now, suppose, the possible end results are n, then its anticipated value comes to stand as:

Variability

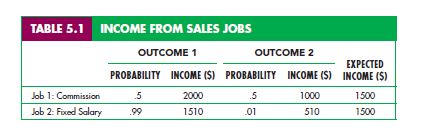

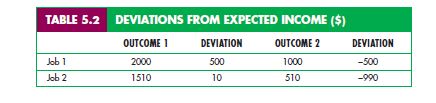

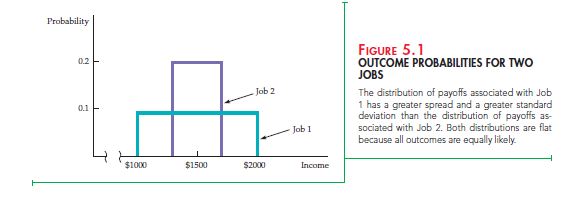

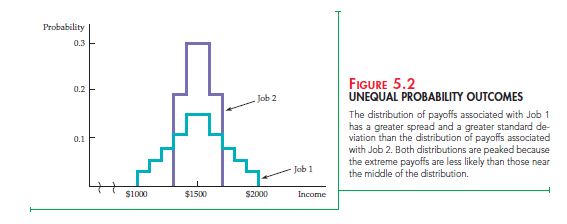

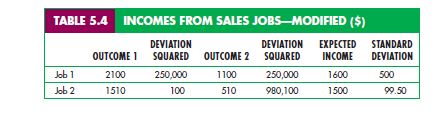

Variability is defined as the degree to which reasonable consequences or likelihood differs in a doubtful situation. We will use an example to check or to see the importance of variability. Suppose for that we took an example of two part- time sales job in the summer season whose expected income amount is $2000. This amount is same for both jobs.

In the case of the initial job, the amount of income depends on the amount of sale, so it is a commission based job. In this occupation, $2500 can be easily earned with the help of effective sales effort. And the one who is less successful will earn a minimum of$1500. So, there are two equally likely payoffs for this job in which the next occupation is salaried. The probability for you of earning $1550 is 0.99%. However, 0.1% probability is also present for that company to go out of business. On such grounds, you earning can only stand $550as severance pay.

Decision Making

To avoid risk, a person can like that job which has a lower amount of risk. Suppose, for example; you are allowed to choose between two jobs that are related in our example. We are sure that to avoid risk, second job will be your likely preference.

Now consider the fact that we have added $100 in both of the jobs. Our idea is to increase the anticipated payoff from $2000 to $2100, which job will make you prefer?

5.2 Preference toward Risk

A job example used by us to demonstrate how people evaluate the uncertainty of risk, but the principle is applicable to other choices as well. The main point in this section regarding concentration is made on two basic things. One is the consumer choices, and the other one is the utility they acquire from selecting among unsafe substitutes. To make things simple, we will be considering the utility of purchaser with his income. Or we can consider consumer’s ability to buy things from that money. Or for a more suitable explanation, we can call it consumption power of the consumer. Therefore, the payoffs are measured not by the dollars that a customer earns but the utility.

A lady’s inclinations toward risk is described and shown with the help of a certain graph. As per that, the OE curve represents the utility function on the vertical axis. This representation states the utility level that can be accomplished by her. This curve depicts each level of income. The measurement is in thousands of dollars which is showcased on the plane (horizontal axis).

As per the graph, the level of utility and income simultaneously increases. The increase in the level of utility is from 10 to 16 and then to 18. This increase in income is from $10000 to $20000 to $30000. But it should be noted that the marginal utility decreases with increases in income. When the hike in income is from 0 to $10000, it starts falling from 10. The next reduction is from 6 when the hike in income is from $10000 to $20000. For the last section, which is 2,the hike in income is from $ 20000 to $ 30000.

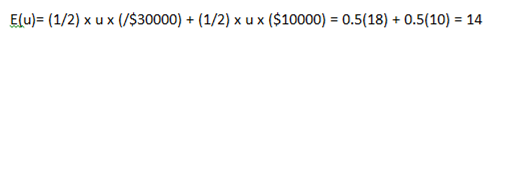

Let us assume that this customer is thinking to choose a risky or dangerous sales job with a salary of $15000 which can either double his salary or reduce his salary to $10000 only. The probability count in each case is considered to be 5. The associated income in the utility level for $10000 is 10. This level is marked at point A. And at point E, associated income in the utility level for 30000 is 18. This specific risky job on comparison with the present $15000 job has a utility level of 13.5. This level is shown at point B.

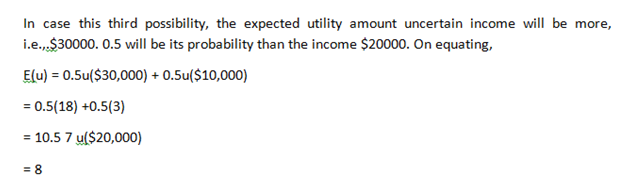

By calculating the probable value of income outcome, she can evaluate her current job. With the help of the expected utility, which is denoted by E(u), she can get the value. This can be done by the help of value measure which we can calculate regarding utility. The expected utility is the sum of utilities linked with all the possible end results. It is weighted by the prospect that there will be a definite end result. In this scenario, the assumed utility is,

This current riskful job has more utility, i.e., 14 than that of original which is only 13.5. Hence the risky new job is preferred to the original job.

The previous job had an assured$15000 as an income without any risk and with 13.5 as utility level. While this latest job is full of risk but profitable as there is a salary of $20000 with a utility of 14. If a woman seeks for higher expected utility, they will choose the risky and new job.

Various Preferences toward Risk

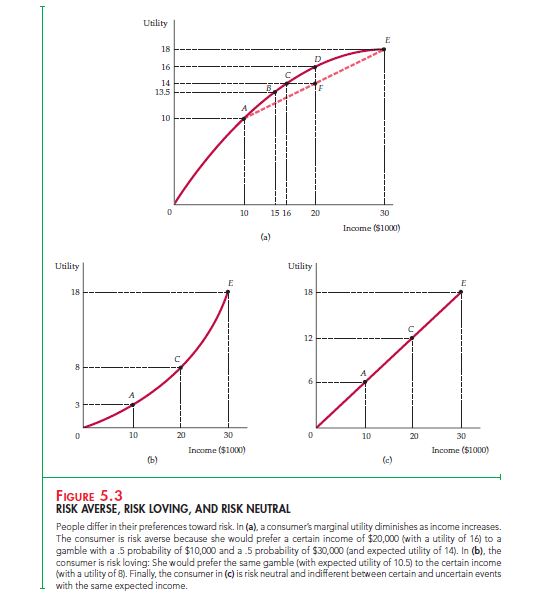

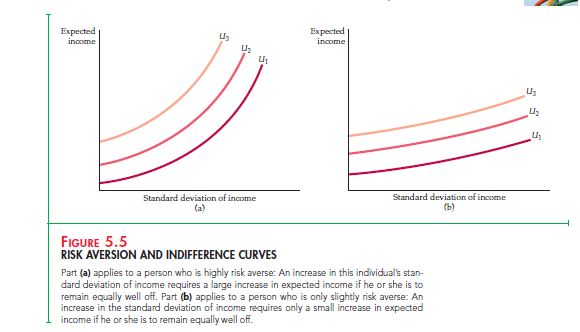

There are different kinds of people in this world, and each has their preferences or opinion toward risk factors. Some prefer to take risk; some are neutral towards the impact of risk. Whereas there are some people, who don’t want to take the risk at all. An individual who is not keen on taking risk is happy with a certain amount as income to that of a higher amount with possible risk. Such kind of individuals has a depreciating marginal utility. Most of the people try to belittle their risk. They have an antagonistic viewpoint toward risk. A live example of it can be seen everywhere. There are many people who ignore or are reluctant in taking life insurance, medical insurance but are searching for a job with a stable wage.

Let us assume a frictional graph which is applicable to a woman who does not prefer taking risk. Let us take into account that she can have either have a job that would help her yield $30,000 as income or a certain salary of $20,000. The probability in the first case is 0.5.In the 2nd case, the probability for an assumed income of $10,000 is 0.5. According to this, likely salary will also be $20,000).

Now, from the above scenario, the uncertain salary’s expected utility comes to stand 14. At point A in the graph, 10 is the average utility and 18 at point E is the utility. This in entirety is depicted by point F.

The next step that we can take is the comparison between the utility produced by risk free method to the expected utility regarding riskful job. The earned amount ($20 K) is without any risk factor.16 is taken as its last utility level which is depicted by point D. This level is higher than the expected utility level 14. The level in the latter case is related to that risky job.

Losses are more important than gain for a risk-avoiding or risk evading person (concerning utility change). The income on augmenting from $20000 to $30000, there is a utility hike of two units. On the other hand, when there is a reduction in earnings from $20000 to $ 10000, there is a six unit utility loss.

Risk – neutral person remains unconcerned regarding the value between an uncertain income and a certain income. This criterion remains constant even if both cases have similar expected value. Marginal utility for a risk-neutral person remains constant. In Figure, utility associated with job generating $30,000 or $10,000 as a specific income has 12 as probability value in both cases. This is the utility for $20,000 when taken as income.

A risk-loving person prefers more to unpredictable income than a predictable one. Even though the expected future value of uncertain income will be less than the certain income, this is the chosen preference. Those people can be said to a risk-loving person who cares for their family more than their life. Only they invest in life insurance and other related activities.

Risk Premium

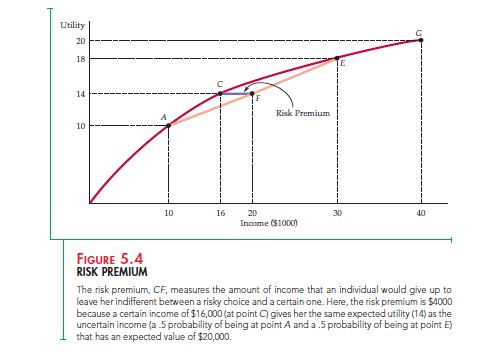

Risk premium can be expressed as the monetary amount which a risk evading individual will pay to stay away from risk. It is because of risky substitutions on which the magnitude of risk premium is entirely dependent. These risky stand-ins are that an individual has to face.

In order to control the risk premium, the explanation of utility function is described with the help of an income extension to $40,000. If you go back, there was an example where a lady was approaching to a dangerous occupation that had the expected utility of 14. In that case, the assumed income was of $20,000. Its end result is graphically demonstrated with the help of straight bisections from point F. That can be achieved by outlining a plane to the Y axis.

5.3 Reducing Risk

With growth amounting to state lotteries, we can say that many people are risk loving and investing in risky alternatives. Nowadays, most of the people do not gather in casinos. However, there are some people with abundant of money, spent their money in the casino to reduce risk. Many people try to belittle their risk by taking insurance. Here 3 methods are explained with whose help consumer and business can commonly reduce risk. Those 3 are:

- Insurance

- Diversification

Attaining more information about payoffs and choices

Diversification

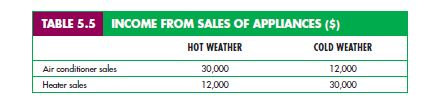

Diversification refers to allocation or investment of money in different companies or sectors where the possibility of risk or the amount of risk is low. Large corporations invest their money in small amounts and in several different sectors to reduce the amount of risk. If the money is spent only in one place, it may be possible to lose all the money which is very risky.

Suppose, for example; you want to gain something by investing $10000. It may be possible to invest all $10000 at a time in a company, the investment can be separately made with $5000 each in two different companies to diversify risk. In this case, if the amount invested in the first company will not gain anything, with the help of a second alternative you can earn more than $5000. So, by diversifying the resources into many segments, you can reduce risk. It is a way in which you can diversify your risk along with the money.

In simpler version, the person can earn $5000 or more by diversifying the risk with a probability of 0.5.

The Stock Market

The Importance of diversification can be observed in the share market where individual stock prices can increase or decrease by a large amount on any given day. However, there are certain stocks which experiences hike in their costing while others experience a decline in price. An individual or person takes more amount of risk by investing all his money in one stock only. The risk amount of can be minimized by diversifying those monies in 10 to 20 different shares.

Similarly, an individual can also diversify risk by investing in mutual funds: It is an organization which pools money from different individual or investor to invest in the different stock. There are many mutual funds which are available for both bonds and stocks. These funds are prevalent ones because they condense or minimize risk through broadening their aspects. Another reason is their lower fees in comparison to the assembling cost an individual’s portfolio of shares.

Subjecting to the share market, it is not possible to diversify each and every risk. Prices of some stocks fallen while of some increases. To some extent, share prices are taken as correlated variables which are positive in nature. They have an inclination and tendency to move in similar direction by the change in economic situations. Let us take an instance. Suppose there is a beginning of a severe recession period. This period is likely to diminish the profits of various firms and industries. It may also be the case that this period may go along by a sharp tip as per the overall market. There are chances of you to face some riskful situation even when you have a diversified portfolio of shares. So, here it can be seen that the stock market depends on the economic condition of the market.

Insurance

Insurance is the way to reduce risk. Many risk evading people take much insurance to reduce their financial risk. They will buy the insurance even if they have to suffer an expected loss which is equal to the cost of insurance.

Here the question arises why they will buy that insurance whose cost is equal to the expected loss. The answer to this question is implied in our analysis of risk aversion. Purchasing insurance assures an individual to have the same amount of income without having a risk of incurring a loss. It can be said that the certain earning is the income gained from risky condition as the expected loss is equal to the cost of insurance. For a risk evading individual or consumer, the assurance of having same salary irrespective of outcomes or uncertainty is more valuable than to lose some amount in the greed of having more money.

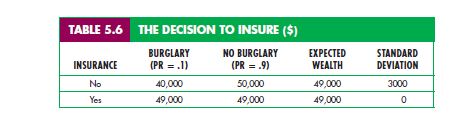

To elucidate this point, we can assume that there is a 10% chance for a homeowner that his house can be looted. It can be also assumes that $10,000 can be the loss amount. Now we will consider that the homeowner has property worth $50,000. We will also assume that his wealth is divided into 2 categories. One does not has insurance costing and the other category has insurance of $1000.

It should be noted that the expected wealth will remain same in both circumstances. The variability, nevertheless, is quite diverse. The standard wealth deviation without any insurance is $3000. And, 0 with insurance. In conditions when no forced entry takes place, the homeowner without any insurance gets a profit $1000. But in case of loot, the homeowner without any insurance suffers $9000 as loss. Here the important point to remember is that for a person who evades risks, the count of losses are relatively more (regarding utility changes) than profits. Hence it can be said that by purchasing insurance or getting insured, a risk evading person will gain more utility.

The Law Of Large Numbers

Insurance companies exclusively sell their insurance in large amount. They are the firms which reduce risk by selling much insurance. The capability to evade risk by functioning on a huge scale is relied on the law regarding large numbers. This states that this event may be unpredictable and random, and the average end result of quite a number of events which are w nearly same can be easily foretold. While selling insurance, a person or insurer never assure for hundred percent that the person who took an insurance will meet an accident or will die because of some unexpected reason. But still, everyone wants to insure their life because of the uncertainty of death which has experienced by others. No one can predict accurately. But all these steps are taken only to minimize the amount of risk.

Actuarial Fairness

Many insurance companies by functioning on a large scale can be assured of their adequately large event number. Apart from those, payment in totality will be paid in equal amount. That amount is again similar to the total money paid out amount. Let us go back to the same burglary example. A man has inkling that there is a 10% chance of his place to be looted. If this probability turns to reality, then a minimum of $10,000 will be his loss amount. Before the risk stands in front of him, he makes a rough calculation of his assumed loss.

The equation for this is,

$1000 x ($10,000 x 0.10)

The involved risk in this case is considerable due to its large loss probability, which is 10%.

Let’s suppose that 150 individuals who have taken burglary insurance and are also situated in similar place. The insurance is taken from one and the same company. The insurance company may ask for a premium of $1000 from all those people as all of them suffers a loss of $10000 with a probability of 10-percent. An insurance fund from this premium of $1000 produces $100000. From this amount losses can be easily remunerated. It is only on the law regarding large numbers, the insurance company depends upon. It is because of the capacity of the company to hold estimated loss amount of those e 150 people, which will not be more than $1000 each. Hence company can relax even if a loss occurs.

When the amount of money which is paid as premium for the insurance is similar to the assumed payout, it can be stated that the insurance is just. Nevertheless the insurance companies charge more amount as premium than the expected loss as they need to cover administrative cost along with some profit. Competition among insurance company can bring the premium amount close to the actuarially fair value. However, in few instances, government regulates insurance companies for charging excessively higher amount of insurance premium to protect the consumers.

In the recent years, the insurance companies came with a view that the catastrophic adversities like earthquake are unpredictable and hence cannot be seen as the diversifiable risk. Indeed, from experience of disaster, these companies are not sure about the determination of actuarially equitable insurance rates. In case when private companies show their unwillingness to sell insurance regarding earthquake in California, the state itself had entered into insurance business to fill gaps.

The Value of Information

Availability of information helps the predictor to predict the risk accurately. None can estimate or predict accurately with a limited amount of information. A better prediction helps to reduce risk which is possible only when sufficient information is available. Individuals will recompense for valuable information as the information is the valuable commodity. The difference between assumed value when the provided info is incomplete and the assumed value of choice when the info is complete can be said as the value of complete information.

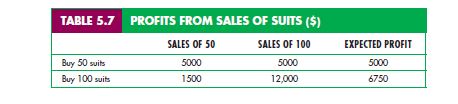

To check on the value of the information there is a specific method. Assume that you are an owner of a apparel store and managing that and must know how much tuxedos to order for a particular fashion season. If 100 suits are ordered, $180 is assumed to be the cost of per tuxedo. On the other hand, if only 50 suits are ordered, the cost will increase to $200 per suit. Suppose you already decided the selling price of these suits $300 but are not aware of the quantity you are going to sell. Those suits which won’t get sold will be returned, and for that, you will earn the only half price of suits you paid. You will be selling, without any extra information, only with an expectation that you can sell 100 tuxedos with0.5 probabilities and the probability of selling 50 suits will also be 0.5.

You will buy 100 tuxedos if you are risk neutral without any additional information. A risk- neutral person will decide to do this only with a view to earning a profit of $12000 to $15000. However, if you are a risk-averse person, you will buy 50 tuxedos only to avoid risk. On such grounds, you can appropriately predict the amount of profit as $5000.

Regardless of the future sale, the correct order placement can be done with the help of complete information. Both the outcomes are identical, and with complete information the assumed profit would be $8500. On calculating the value of info:

Complete information with expected value is $8500

100 tuxedos with less uncertainty value is $6750

Complete information with equal value is $1750

Therefore, the amount of $1750 is the amount that can be paid for the accurate prediction of sales.

Links of Previous Main Topic:-

- Introduction Markets and Prices Preliminaries

- The Basics of Supply And Demand

- Consumer Behavior

- Appendix to Chapter 4 Demand Theory a Mathematical Treatment

Links of Next Microeconomics Topics:-

- 5.4 The Demand for Risky Assets

- Uncertainty and Consumer Behavior

- Production

- The Cost of Production

- Production and Cost Theory A Mathematical Treatment

- Cost in the Long Run

- The Cost of Production Production with Two Outputs

- Profit Maximization and Competitive Supply

- The Analysis of Competitive Markets

- Market Power Monopoly and Monopsony

- Monopolistic Competition and Oligopoly

- Game Theory and Competitive Strategy