Arbitrage is an essential concept of Finance; without which the study of Finance is incomplete. Arbitrage explains the true meaning of an efficient market or a perfect market. Three questions always remain unanswered without the ideology of arbitrage:

- How can an efficient market help in predicting stock performance?

- What is the secret to success of investors?

- How can efficient market help in valuation of big corporate events?

11.1 MARKET EFFICIENCY

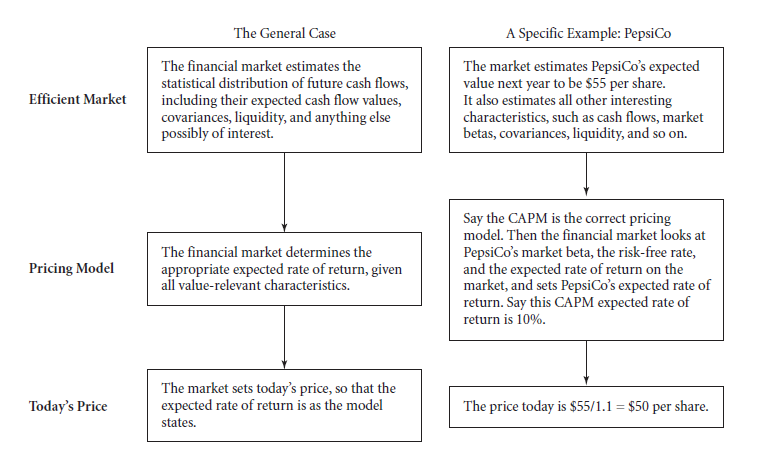

It refers to the usage of all available information in setting the value. A perfect market can initiate a steep competition among all the involved investors. In such scenarios; the prices playing a significant role in the very market; reflects all the available information. This is called market efficiency. It is not similar to mean-variance efficiency concept.

Though, in an efficient market; you cannot use the collected information to predict the future returns. Thus the set price can only be efficient, if it is predicted correctly using the available information.

For instance: Suppose verifying the given characteristics of PepsiCo, the expected rate of return is considered to be 10%. The market then relates the best estimate price for next year to today’s price. So, if it is expected that the price of PepsiCo stock will be $55 next year, the price to be set today should be $50. In this case, the price setting will be considered inefficient if it is $49 or $51.

On the other way around; you should not be able to locate the information which can confirm you the rate of return. The stock price for PepsiCo will be mispriced, if it is predicted by authorities that the price will rise or will stay the same. So, overlooking the information before setting price; is not considered as market efficiency.

The concept of efficient market gives rise to two questions:

- What is the model?

We certainly did assume the rate of return of PepsiCo is 10%. But from where did we get the value? So, indeed there have to be some model; which considers the factors of risk, liquidity and many more to perform an accurate valuation. CAPM is a good model, but without an efficiently proved model, market efficiency is just a hypothetical concept.

- What is the information set?

If the market is not perfect and different investors have various information; what is the needed information set? A company’s CEO obviously knows much more than public and has more inside information. But, it may not be efficient with respect to insider.

Why can be market efficiency so difficult to prove?

Let us consider that the expected rate of return be 20% instead of the predicted 10%. This can happen if; expected payoff changes from $55 to $60 or today’s price set is $45.83. So, two conclusions from this instance are:

- CAPM is not the correct model. May be the market followed some other flow where the expected rate of return was set to 20%.

- The stock market is inefficient.

So, either you have to accept it is your fault, assuming that the market is perfect, but you may somehow lacked some information. Or you have to accept that the market was not efficient. So, for the former case, the search for all information may continue forever-till you find the perfect pricing model.

11.1A SHORT-TERM VERSUS LONG-TERM MARKET EFFICIENCY

As, no one knows the correct model of pricing, it is difficult to disprove market efficiency for long period viz. one year or more than one year. Though CAPM is a reasonable model, but often it’s predicted value are incorrect.

So, for long horizons, market efficiency is a conceptual practice that requires regular testing. Hence, the ideology has become more faith related matter than scientific logic. And so, financial analysts draw two types of conclusions for long run market;

- CAPM is a wrong model, but the market is efficient.

- Market is inefficient.

Long run:

No perfect pricing model can give bets like; ‘+$1 million with 99% probability’ or ‘-$1 with 1% probability’. Even for companies like PepsiCo, it is unreasonable for expected return on stocks to be 100%. So, it is out of line for the model to predict such returns.

This is what makes it hard to distinguish between a flawless model and an efficient market. So, devoid of proper set of information, it is indeed hard to determine, whether the expected rate of return for PepsiCo stocks will be 10% or 12% a year.

Short run:

On the other hand, when it comes on daily basis, the same concept of market efficiency can prove itself useful. This is because, over a single day, the expected rate of return like 10%, 20%, 0% per annum does not affect the investors. Even for high end returns like 20%, the expected rate of return for daily basis remains above 5 points.

So, often it is seen that, for day to day basis, you expect the return to be a little higher than 0%. But, with a history of stock return work; one can easily predict the chances in market. Hence, they do not blame on the pricing model, rather they say the market is not perfect.

Two concepts:

- For short-period, market efficiency is a strongly built concept as; the expected rate of return should be tiny. And if it is not, probably the market is to be blamed.

For long intervals; it is hard to relate today’s price to future values. Hence, when they cannot pin down the estimate accurately, the model is blamed.

Links of Previous Main Topic:-

- Market imperfections

- The capital asset pricing model

- Investor choice risk and reward

- Risk and return risk aversion in a perfect market

- Uncertainty default and risk

- Working with time varying rates of return

- A first encounter with capital budgeting rules

- Stock and bond valuation annuities and perpetuities

- The time value of money and net present value

- Introduction of corporate finance

Links of Next Financial Accounting Topics:-