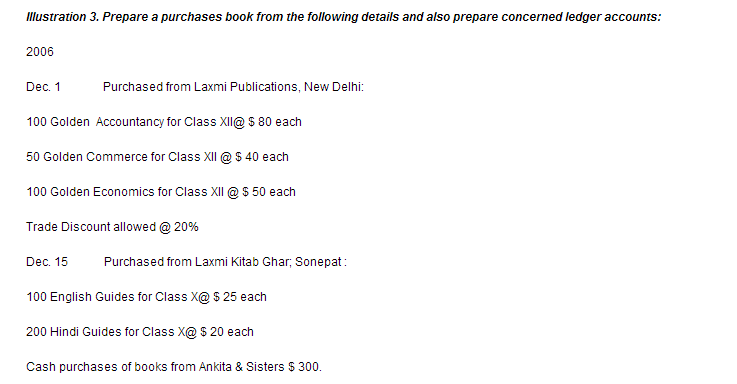

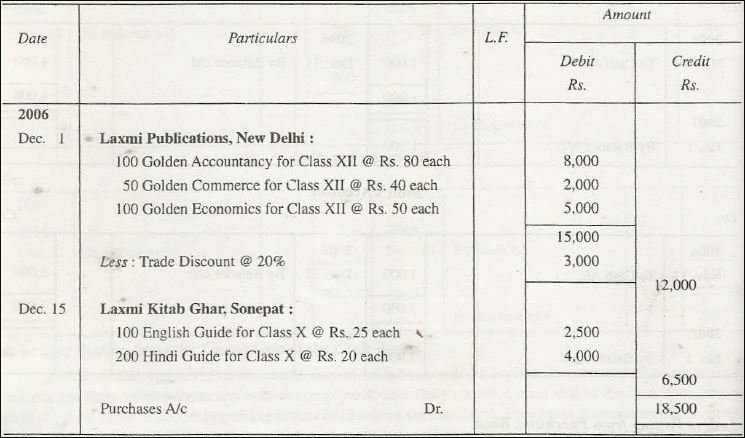

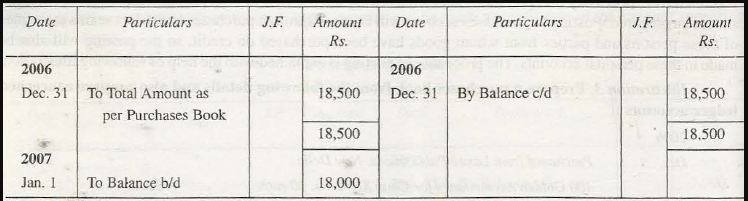

Purchase books are only responsible for recording credit purchases of goods. Cash purchases can be recorded in cash book. It becomes essential that purchases account reflect position of total purchases that are found both cash and credit which gets prepared.

Ledger positing from purchases book is necessary

Ledger posting from purchase book appears to be an important concept as it helps to cover different field of accountancy. Students though find it difficult to study it and will certainly be in need of some kind of assistance in doing it, but while pursuing accounting degree it becomes very much essential. It should follow certain guidelines:

- An entry needs to be done from day book or journal

- The updates should be highly organized and date needs to be mentioned

- Date of entries need to be same in case of day books and ledgers

- When all necessary entries are made, it is essential to post page number of a single book to another

Concept related to ledger positing

Ledger is known to be a book which contains different accounts and offers with various financial information related to particular business. This is also referred as principal book keeping. There is usage of other books which helps in preparation of final book. It is necessary to understand depth of concept which can help to manage ledger posting from purchase books.

Ledger posting from purchase books

Purchase book is also effective as it helps in subsidiary record which can be adopted for storing information of credit purchases. Cash book can be adopted only when cash purchases are done and help in credit purchase which is recorded separately. The purchase day book appears in accounting ledger which involves purchasing transactions that gets recorded.

Links of Previous Main Topic:-

- Book keeping

- Meaning of gaap

- Origin of transaction

- Balancing of ledger accounts

- Classification of ledger accounts

- Distinction between journal and ledger

- Importance or advantages of ledger accounts

- Ledger posting from cash book

- Ledger posting from journal entries

Links of Next Accounting Topics:-

- Ledger posting from sales book

- Meaning of ledger accounts

- Summary of rules of posting form subsidiary books

- Theoretical questions on ledger accounts

- Adjustments additional information in preparation of final accounts

- Meaning of bank reconciliation statements

- Bills of exchange concept of bills of exchange

- Errors affecting or disclosed by trial balance introducing the concept

- Meaning of depreciation