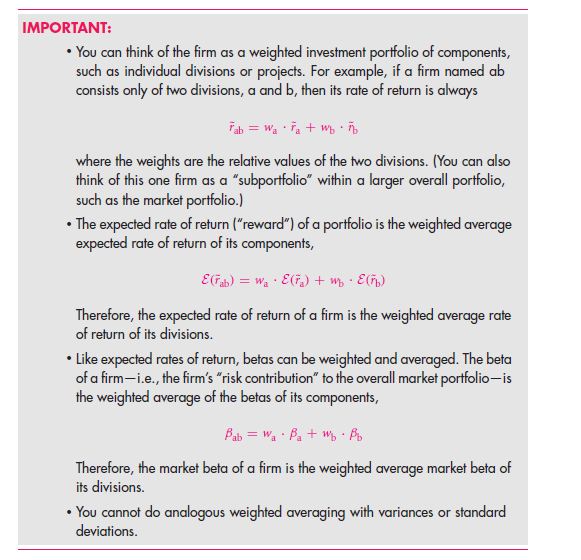

Now, we trace back our route to the administrative point of view of resolving out the risk and subsequent return of our corporate assignments. Numerous minor assignments are piled up together. Hence, it is very general for administrators to take into consideration many projects which are encapsulated as one range of investments. As for instance; we can assume our firm as a assortment of disunions that are grouped as a unit.

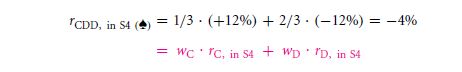

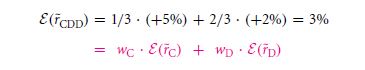

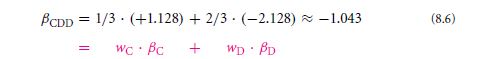

If the sub section C and D is of worth $1 million and $2 million respectively, then it can be said that the firm has C and D together, and the worth is tagged as $3 million. In other words it can be stated as C owns one third of the value of the frim, on the other had D owns two third of the value of the firm. Such portfolios are termed as Value weighted portfolio. It is so called because the weightiness that they are given is a consequence of the market worth of that component.

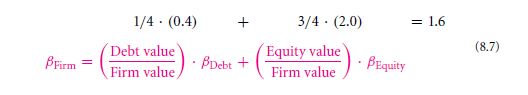

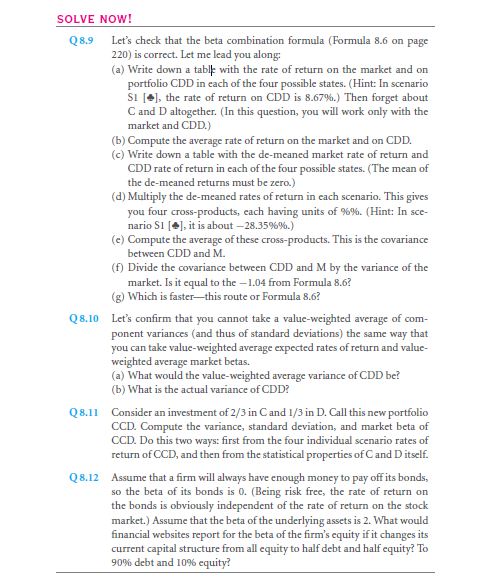

Verifying this section you will land up with the formula 8.3, but only modified as,

What the firm can comprehend the divisions and is definitely a consistent change that you get to alter. The market beta value may not be so much as that of a $300 million of the equity value.

The total of the asset beta value will make a comparative equity beta value that is of 2. This is what most financial websites claim to be of.

Links of Previous Main Topic:-

- Investor choice risk and reward

- Portfolios diversification and investor preferences

- How to measure risk contribution

Links of Next Financial Accounting Topics:-