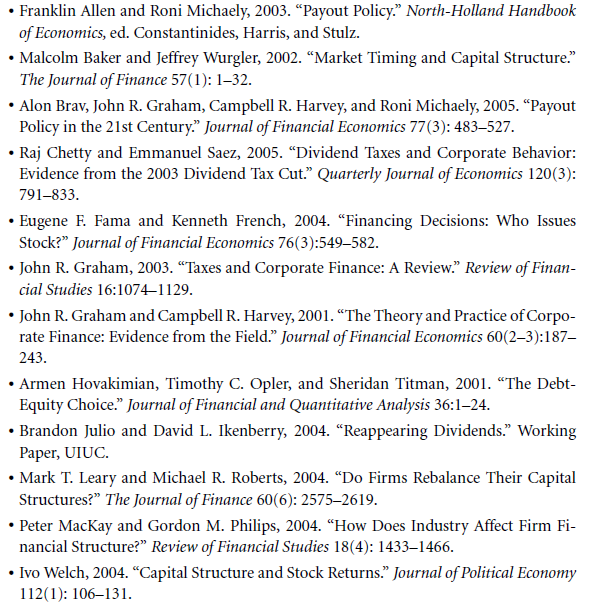

A List of Some Recent Empirical Capital Structure–Related Publications

In contrast to various other topics of this book- where knowledge holds firm grounds over many decades- factual structure of capital still essentially remains a mystery that is yet to be solved but an area which demands active fundamental research. Much of it is apparently lucid and has come into the picture only recently. The summary of this particular chapter is a subjective reading and understanding of self study after all.

In due course of time you will find many references to published papers from really old times and current time and times that are yet to come on all chapters and sub topics on the website of this book. However, it is necessary that you wrap your brain around this yourself and understand this unresolved area. So, without much pondering breaking the ground rule sit can be said that published references are not available in any part of the book while it is only available in the website (maintaining this list does not prove the greatness of structure of the capital). Below you will find a helpful index of papers that have been published over a long period of time after the over yield which is a phenomena that occurs once in a millennium. All these papers that have found a mention in the list will suggest many significantly related, primitive but also equally intriguing and most certainly more relevant papers. So have a look and you might just get closer to solving the mystery behind the genesis of the structure of capital.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

- Risk and return risk aversion in a perfect market

- Investor choice risk and reward

- The capital asset pricing model

- Market imperfections

- Capital structure patterns in the united states

- Empirical capital structure patterns

- Mechanisms versus causes

- What are the underlying rationales for capital structure changes

Links of Next Financial Accounting Topics:-