This add-on section ripens the quid pro quo flanked by risk and yield. This topic is not the focal issue of corporate finance, but it is the central topic to the lessons of investments. Thus, where we are targeting and where we are heading is vital to be taken care of.

- Extensive expansion of assignments lessens the rate of risks.

- Thus, we know that diversification is the favourite of many.

- We know that resources that show covariance in negative terms from the left over section of the portfolio are essentially picked from the stand point of diversification.

- The degree of toxicity is given by the value of the parameter termed as beta of a venture. This is for a certain range of investments.

- The unanswered issue is what amount of each resource need to be ventured upon?

Is it wise to buy 25% of A along with 75% of B or else 50% of each? How shall the weight upon each investment be determined? What then is your optimum asset portfolio? These are examples of questions that one may come across.

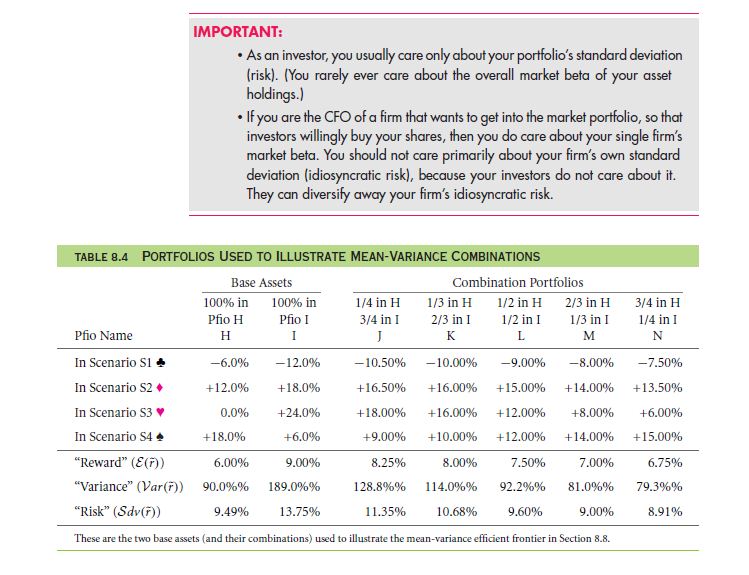

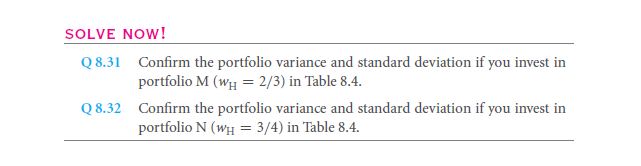

Now, let H in addition to I be two fresh base resources. If we intend to consider these assets as being portfolios on its own, such that they include many other varied stocks. How shall we come up with a best possible sequence of these assets I.e. H and I? The table below shows the various combinations so obtained. Portfolio K invests wH be value 1/3 in H also, wI be of value 2/3 in I, these would bring upon the following results:

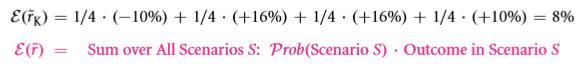

The probable rate of return for the portfolio shown here is stated below.

This is calculated considering all possible future cases.

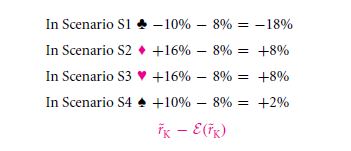

So as to calculate variance of K, we shall opt for the step wise process depicted in section 1B. We begin by finding the mean.

The other value that you will get is,

Links of Previous Main Topic:-

- Investor choice risk and reward

- Portfolios diversification and investor preferences

- How to measure risk contribution

- Expected rates of return and market betas for weighted portfolios and firms

- Spreadsheet calculations for risk and reward

Links of Previous Main Topic:-