The Cost of Production

In this chapter the readers will be able to check that how production technology and the prices should input, evaluates the cost of production of a given company.

7.1 Measuring Cost: Which Costs Matter?

It is necessary to know how a firm (company) reduces or minimizes its costs. For that, we must know what costs are and what are the expenses that we must include in these costs. For instance, the wages or salaries that a firm pays to its employees and workers are included in its cost. Or maybe the space that it has taken on rent for running its office is also considered to be a part of cost.

But what will be the case if the firm or the company own the office building them? That obviously means they are not having to pay any rent for the office space. Moreover, what about the expenses incurred in equipment and research & development that can’t be recovered? These are the questions that need to be answered.

Economic Cost vs. Accounting Cost

When it comes to cost, economists and financial accountants think of it differently. Financial accountants, for your information, are those who keep track of the various expenses that are incurred, keep track of assets (properties that a firm owns, like land, equipment etc.) and liabilities (expenses that a firm needs to pay, like debts or outstanding services)., and prepare yearly reports on these figures.

The cost that financial accountant has to measure is known as the Accounting Cost. This includes costs like the real expenses. This means they are only bothered with the actual monetary expenses.

Economists, on the other hand, have a more prospective view on what should be included in costs. They are concerned about even those resources that have not been fully utilized or put to use. They are bothered with allocating resources in such a manner that the expenses of the firm are lowered, which increases the overall profit of the firm. So, in essence, the cost of putting all resources to use is Economic Cost.

The economic costs help a firm to differentiate between costs which can be controlled by the firm, and those that can’t be controlled. The regular costs of investment, which include capital and other factors like cost of raw materials, along with cost of salaries and wages to the workers and employees, basically every cost related to production. But some resources that seem apparently less important, can also be put to use, and that is where the concept of opportunity cost lies.

Opportunity Cost

It is basically the cost incurred when the resources are not placed at the right pace so that it can offer the best alternative outcome. This can be explained through an example. Assume a firm have their own building, and therefore do not have to pay a charge to anybody for use of office space. Apparently, it may seem that as far as expenses related to charge for office space is concerned, cost is zero. But the economists would disagree.

The accountant will say obviously the cost is zero. But the economist will argue that had the building been given to some other firm as office space, then that money made on the rent would have been a source of income. But the office space is being used by the firm itself for its own work, and that means that the firm is potentially incurring a cost, this is actually the opportunity cost. Thus, the cost that is incurred by utilizing the building instead of making money by leasing it out is the economic cost, or opportunity cost, of doing a business.

Even money paid to employees and workers may seem as normal economic cost, but are actually opportunity cost if you think about it. The money whatsoever it is, paid to workers can be used for a better alternative, e.g., machines could have been bought, which could do the work for more people at a lower cost. But instead, hiring humans and paying them every month is the cost the firm incurs, and is opportunity cost that tends to hiring workers. Thus it can be seen that when we account for all the costs incurred by the firm, we have Economic Cost = Opportunity Cost.

Economic cost and opportunity cost may seem similar kind of thing, but the concepts and techniques of opportunity cost is useful in cases where foregone alternatives don’t reflect expenditure. For example, let us consider the case of a toy store owner, who manages her own store, and so does not hire an assistant. Now, had the owner done another job somewhere else, she would have made let’s say $60,000 annually from that job. But because she is managing her own store, that means $60,000 is the opportunity cost for managing the store herself.

Again, let’s say the owner had acquired inventory worth $1 million for her toy store, and she hopes to sell it for a substantial profit. But suddenly, another toy store owner offers her $1.5 million to acquire all her inventory. Should she sell it? For this question, the answer should be depended on the potential of her business, and also the opportunity cost. We can assume it might cost her the total amount of $1.5 million for the inventory, since this value is now the present market value of buying the inventory. So here, the opportunity cost of keeping her inventory and not selling it is $1.5 million, instead of $1 million she paid for the inventory.

You might think that the opportunity cost might be just the $500,000 difference between market value to the point of inventory cost and the cost of acquiring it, but the thing is keeping it would mean letting go of the $1.5 million that the other toy firm is offering her. The accountant will tell you what would be the cost of keeping inventory. It is around $1 million in this case, the amount she paid to get it, but the actual opportunity cost is the $1.5 million amount she is sacrificing, what she have earned by selling it to the other toy store owner.

Also, economists and accountants differ in their opinions in counting depreciation. The profitability of running any business needs counting of capital invested on buying machinery and running it. This cost not only includes actual money spent on machinery, but this cost also includes the cost due to wear and tear of the machines. Accountants may evaluate past performance using tax rules that are loosely defined for wear and tear on an asset, but that may not reflect its actual cost incurred due to the wear and tear since it varies asset by asset.

Sunk Cost

The expenditure what any firm has made already, and can’t be recovered is called the Sunk Cost. Sunk cost, unlike opportunity cost, is visible and not hidden, and therefore must be ignored while making future decisions.

Since a sunk cost can’t be recovered, it should play no role in a firm’s future decisions, and that is why it has to be ignored. For example, a firm buys a machine designed to do a specific task, and has no alternative use. Since it is not possible to put for any other purpose, the value of opportunity cost will be zero, and the cost of the machine is the sunk cost, since it can’t be recovered by putting it to other use. The decision may be right or wrong, but since it can’t be changed, it is not thought about again, and is ignored. So it is not counted in the economic cost.

Had the machine been capable of being utilized in other way, or sold to a firm, then there would be an opportunity cost for holding this.

Now let us consider there is prospective sunk cost of firm. Assume any of the firm is considering buying specialized equipment. It is an economic decision, since they have to evaluate whether buying the equipment can increase their revenues and thus justify the expenditure.

For example, suppose a company paid $500,000 a year back to buy a new building in a city they are planning to relocate to. The option gives them a right to, say buy a building at a price value of $5,000,000, which means buying it will make the total cost $5,500,000. But now they find a building worth 5,250,000 in the same city. Can you tell which one should they choose to purchase? The reply is the first building. Economic analysis says that the $500,000 for the option is sunk cost, so that is not used for any decision. Now, the question is whether to spend $5,000,000 or $5,250,000 as an additional amount. The economic cost of first building is $5,000,000, while that of the other building is $5,250,000. So unless the second building is available at $4,900,000, the company should stick with the original building.

Fixed Costs and Variable Costs

The value of entire economic cost is called the Total Cost of a firm, is divided into two parts: The Fixed Cost and Variable Cost.

- Fixed Cost does not vary with varying output levels. Thus the name. It is affected only when there’s no output, i.e., going out of business.

- Variable Cost is the cost that varies with varying output levels.

Fixed costs include cost of insurance, maintenance cost like electricity, and may be the salaries of a few employees. This doesn’t change with output. These have to paid even with less output. It is only stopped by shutting down.

Variable costs include expenses on salaries of workers, cost of raw materials etc, those that vary with varied production.

Shutting down, to eliminate fixed costs, doesn’t mean that the firm is going out of their business portfolio. Suppose a company has several factories, and now are incurring losses. So now they want to cut down on the cost in one of the factories. So they just stop production. But still they are having to pay for the guards, the electricity and other maintenance of the building, the fixed costs. So to take fixed cost to zero, they have to close down the factory, turn off machines, the electricity etc, so that they do not have to pay any of these. But they are still in business due to the working of other factories.

To identify which cost is a fixed cost, and which is a variable cost, we need to consider the timeline that is being talked about. Over a short period of time, say a few months, almost all costs are fixed. In this time, you can’t remove workers, you have to honour all contracts, neither do you cut down on raw materials, even if the production output is low.

But in case of longer timelines, a few years maybe, many costs are there which become variable costs. During this time, a firm can choose to reduce the number of employees, spend less on raw materials, or maybe even sell off some machinery.

But over a long enough timeline, like say 10-12 years, every cost becomes variable costs. In this time, you can sell of all your machinery, remove your workforce, or sell off the land of your factory etc.

Recognizing the set of variables and set of fixed costs is quite essential for a firm. Let us consider the case of Delta Air Lines. The management of the airline wanted to clarify the details of how the costs would be affected if they reduced their daily scheduled flights by 10%. Now, over a short period of time, say 6 months, with fixed schedules, it is difficult to reduce its workers. So in this time, most costs are fixed and won’t reduce with reduction in flights. But with a longer period of time, maybe a few years, Delta has enough time to reduce its workers, or maybe even sell the planes that they don’t need. Hence, the value of these types of costs will be considered as variable, and this should be reduced with a 10% reduction in flights.

Fixed vs. Sunk Cost

Sometimes people confuse fixed costs and sunk costs. Fixed costs are those a firm pays to keep themselves running, irrespective of output. These include maintenance of office space, salaries of some key workers, insurance etc. It can be avoided only when the firm is shut down, so that these expensed aren’t needed anymore.

Sunk costs are those that have been already paid, and can’t be recovered anymore. For example, the expenses of R&D for a pharma company for developing a new drug, it is then shifted to testing it on the market. Regardless of the whether the drug is successful or not, the money spent on research isn’t coming back. Thus it is a sunk cost. Also, the expenditure for chip fabrication plant for making microprocessors would also be sunk cost, since it is a specialized system, and can’t be used for any other purposes.

In case, if the firm promises to pay part of an employee’s pension after his/her retirement, that would be a fixed cost, since the firm will pay it regardless of the profit they make. It is necessary to differentiate the terms fixed and sunk cost, because sunk cost do not affect a firm’s decisions for the future, unlike fixed cost. If the fixed cost is too high in comparison to the incoming revenue, firm might consider shutting down and making zero profit, which is better than incurring losses. A high sunk cost may also prove a bad decision (like cost of research for a failed pharmaceutical drug) but it can’t be recovered by closing the firm production. Only prospective sunk cost can affect a firm’s future decision.

However, a firm may choose to not differentiate the value of fixed and sunk costs. For an instance, a semiconductor company buys a chip-fabrication plant for $600 million. Now that is again a sunk cost since it has a specialized use. But the company decides to amortize (pay in intervals) the amount – $100 million per year, and treat the $100 million as a fixed cost every year. But the firm should know about the fact that this won’t eliminate cost since it is a commitment. But amortizing capital expenditure is a good way of evaluating profitability, since it allows you to break your expenditure in pieces over time. Thus it simplifies economic analysis.

Marginal and Average Cost

Now we start the discussion on how to draw the distinction or division between firm’s marginal cost and average cost. In that case, to understand that, we use cost function, that is the relationship between the cost and the output of a firm. We take the help of a table for illustration, before we explain.

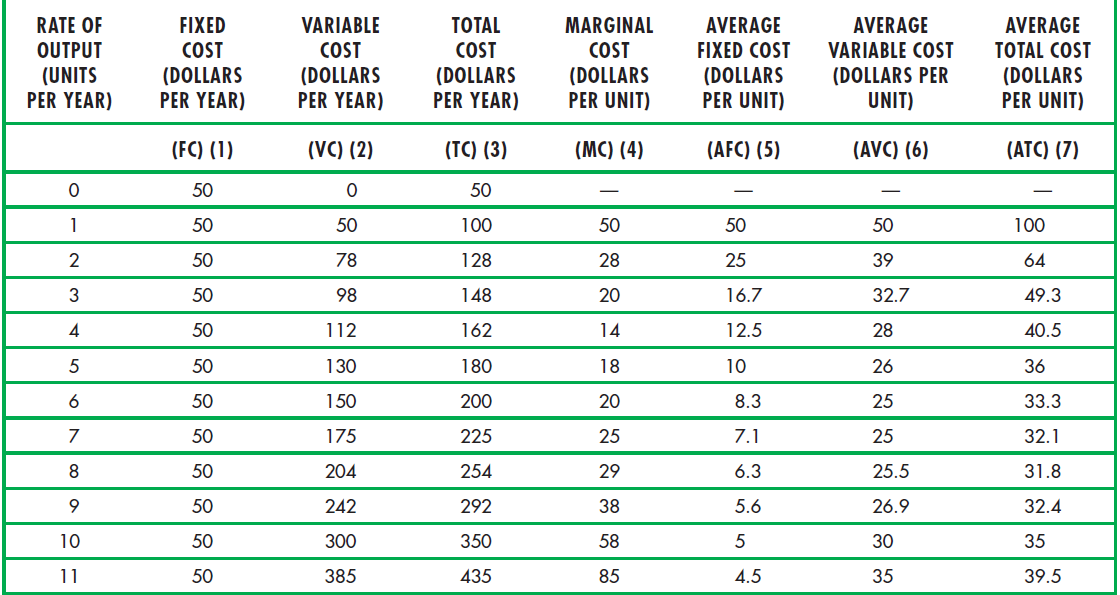

TABLE OF A FIRM’S COST

Marginal cost, also known as the incremental cost. This cost is the increase in the value of cost due to increase in output. As we know that the value of fixed cost cannot be changed, marginal cost is thus basically an increase in the value of variable cost when an extra unit is produced, or the increase in the value of total cost due to increase in one output unit.

Marginal cost gives a firm the idea of how much cost they have to incur to increase output by one unit. From the table we can see that the 2nd column is variable cost and the 3rd is total cost, and the marginal cost can be calculated from either.

Average Total Cost, also known as the average economic cost. This cost can be obtained when total cost is divided by corresponding output. So the average total cost of production of 5 units will be given by $36 (180/5) from the table.

From the table, the average fixed cost is $12.5 when output is 4 units. Now, fixed cost doesn’t change. Thus average fixed cost only decreases with increasing output.

Similarly, average variable cost is similar to the variable cost when it is divided by corresponding output. So, from the table, the output is $26 (130/5) for 5 units.

Now that all types of costs have been discussed, we have also seen how costs are over a short or a long period of time. More importantly, fixed costs over a short duration may not get fixed over a longer period of time, like employees of workers, short term contracts etc. Even fixed costs like cost of equipment and other charges of plant may not get fixed when the time period is given too long, since the firm can get a new plant or buy new machinery.

However, fixed cost may not become variable on the long run. For example, when a firm commits to contribute to an employee’s retirement plan, the payments may have to be made for a long time, until they run bankrupt.

7.2 Cost in the Short Run

The Determinants of Short-run Cost

We saw from the table earlier that variable and total costs get increased with increasing output. By how much the value of costs would be increased depend on production process, and also the level to which this production is involved for the decrease in marginal returns to its variable factors. For example, it is possible to occur diminishing marginal returns when marginal product of labor decreases. Now to produce more output, more labor must be employed.

So marginal product of labor decreases with more employment of labor because of diminishing returns, therefore, more expenditure has to be made for increasing rates of output. Consequently, variable and total costs get increased with increased rates of output. However, if marginal product of labor get decreased only slightly with more employment of labor, costs won’t increase as much with more rate of output.

The above equation with only a single variable input states that marginal cost is the price of input when it is divided by marginal product. If marginal product is low, it means a lot labor is needed for extra output, which means a very high marginal cost. Again, a marginal product means the amount of labor required is low for extra output, meaning low marginal cost. So, marginal product of labor decreases with increasing marginal cost and vice versa.

Diminishing Marginal Returns and Marginal Cost

It means marginal product of the labor decreases with increasing employment of labor. So, marginal cost increases with increasing output. The table earlier shows that as output increases from 0 to 4, marginal cost decreases, but from output 4 to 11, marginal cost increases, it shows that decrease of marginal returns exist.

Shape of Cost Curves

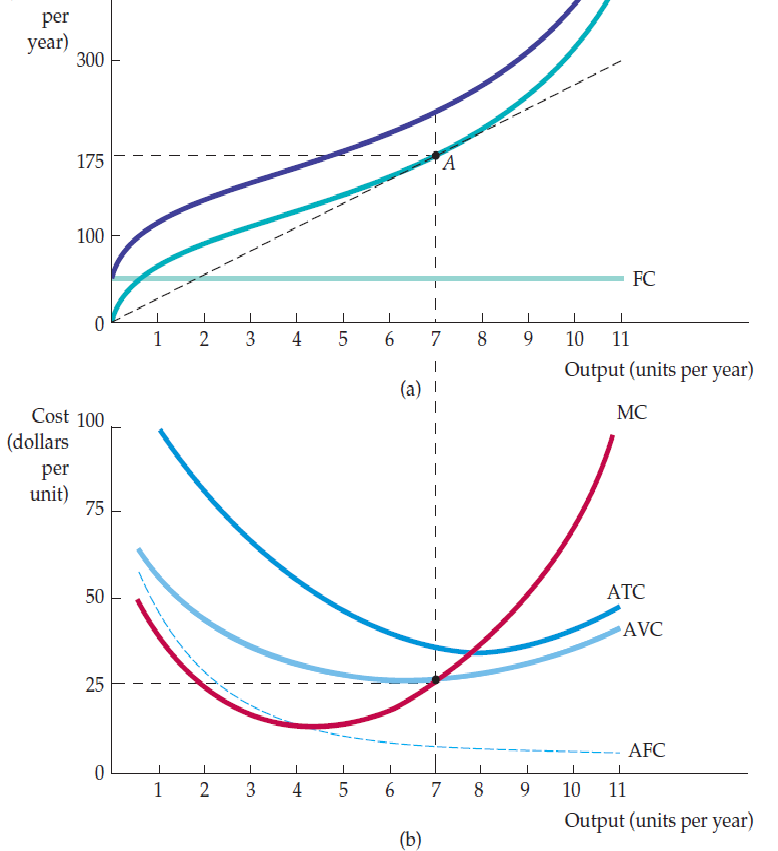

The above figure shows us how measures of cost changes with changing output. The top graph shows total cost, variable cost and fixed cost, while the lower graph shows marginal and average costs. The numbers are all taken from the first table.

In graph (a) we see fixed cost not changing, and staying at the horizontal line $50. The variable cost changes. It stays to zero for the output zero, but increases with increasing output. The total cost is determined by adding the vertical distance from variable cost curve to the plotted line of fixed cost curve. Since the fixed cost cannot be changed as it is constant at $50, vertical distance between two curves also remains constant at $50.

In graph (b), we see how the marginal cost and the value of average cost curves are related to each other. Since the average fixed cost is constant at $50, the curve keeps dropping towards zero as output gets larger. When marginal cost is below the value of average cost, its average cost curve will fall. When marginal cost is minimum, the average cost equals marginal cost. When marginal cost is considered above the value of average cost, the value of average cost curve rises.

Links of Previous Main Topic:-

- Introduction Markets and Prices Preliminaries

- The Basics of Supply And Demand

- Consumer Behavior

- Appendix to Chapter 4 Demand Theory a Mathematical Treatment

- Uncertainty and Consumer Behavior

- Production

Links of Next Microeconomics Topics:-

- Production and Cost Theory A Mathematical Treatment

- Cost in the Long Run

- The Cost of Production Production with Two Outputs

- Profit Maximization and Competitive Supply

- The Analysis of Competitive Markets

- Market Power Monopoly and Monopsony

- Monopolistic Competition and Oligopoly

- Game Theory and Competitive Strategy