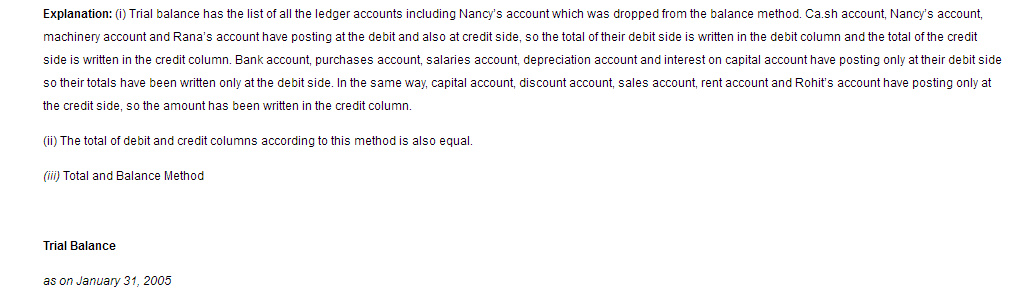

As per the conjoined explanation of both credit and debit column, it should be made sure that in all the methods the trial balance should tally.The entire procedure of preparing trial balance is based on 3 methods. Those methodologies in balance preparation are as follows:

- Total method

- Balance method

- Balance and Total method

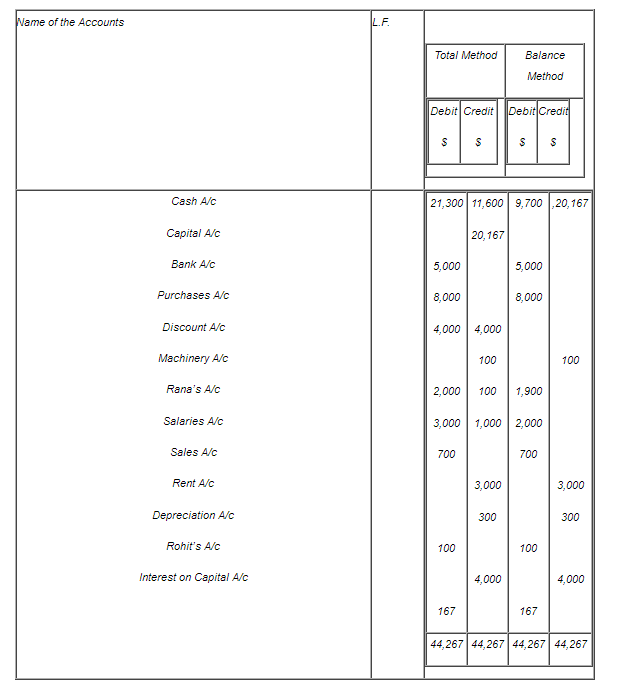

- Total method

You are already aware that in every account credited and debited amount is written separately in trial balance. Total of debit section is written in debit column, and that of credit section is written in credit column. As per this method, the credited and debited amount in totality should be same on both the sides. And if the recorded amount does not tally with each other, then it signifies the presence of errors. It is necessary that all such mistakes are identified and then corrected.

- Balance method

In accounts, it is a known fact that there are 2 sections in ledger accounts. They are credit side and debit side. It is with the help of balance of ledger accounts; trial balance is prepared. Monetary information in ledger balanced is used and balanced at the close of a certain financial period.

In an account, if credit section shows an excess than debit section, then that account will show credit balance. Information of this is recorded in the trial balance at credit column. Similarly, when debit section showcases excess than credit section, that balance record (debit balance) is written in the debit column.

All in all, the main idea of utilizing balance method is to tally the amount information of both the credit and debit side (same amount data).

- Balance and Total method

In trial balance, this method showcases both the methodologies that are stated above, i.e., balance method and total method. In this case, the division of accounts column is done via both these methods. It is true that different methods will give different results in accounting balance. But the idea of utilizing both these methods is to make sure that credit and debit amount in totality are same on both the sides.

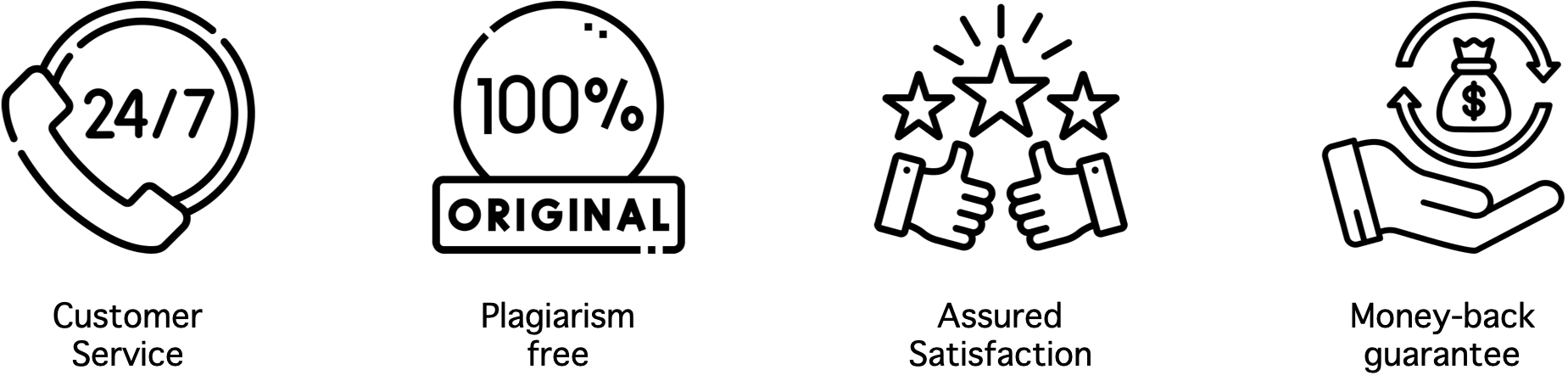

Journal Entries

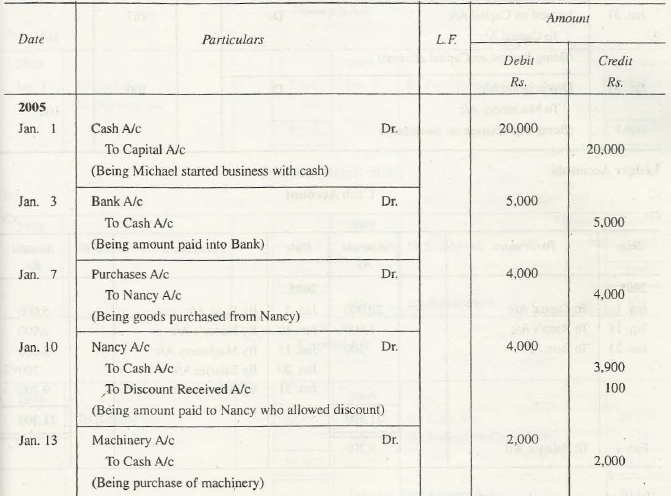

Ledger Accounts

Cash Account

Dr. Cr.

Bank A/c

Dr. Cr.

Purchases A/c

Dr. Cr.

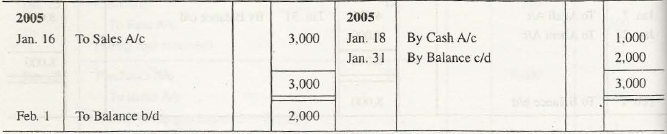

Nancy’s A/c

Dr. Cr.

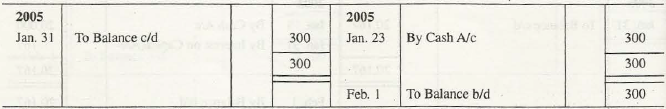

Discount Received A/c

Dr. Cr.

Capital A/c

Dr. Cr.

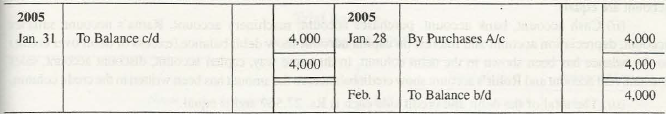

Rana’s A/c

Dr. Cr.

Salaries A/c

Dr. Cr.

Sales A/c

Dr. Cr.

Rent A/c

Dr. Cr.

Rohit’s A/c

Dr. Cr.

Interest on Capital A/c

Dr. Cr.

Depreciation A/c

Dr. Cr.

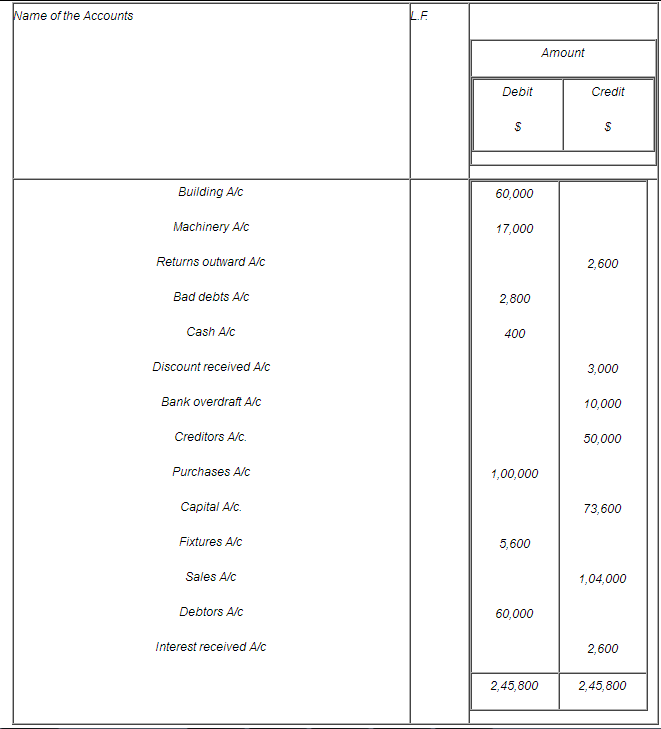

Redrafted Trial BalaA/ce

As on 31-dec-2006

Links of Previous Main Topic:-

- Book keeping

- Meaning of gaap

- Origin of transaction

- The concept of debit and credit

- Subsidiary books or sub division of journal

- Balancing of ledger accounts

- Meaning of trial balance

- Special features of trial balance

- Limitations of trial balance

Link of Next Accounting Topics:-

- List of important accounts and balances

- Balance sheet in final accounts without adjustments

- Adjustments additional information in preparation of final accounts

- Meaning of bank reconciliation statements

- Bills of exchange concept of bills of exchange

- Errors affecting or disclosed by trial balance introducing the concept

- Meaning of depreciation