If trial balance is to be explained in simplified words, it is considered as a test which gives out the result with arithmetical accuracy. Even if you carefully look through the postings of subsidiary books and in journals, and both the credit column and debit columns of trial balance are found to be equal, it cannot be stated as accurate.

Despite the balancing of ledger accounts and the balances of ledger accounts to trial balance is correct, it is considered only as an assumption and not a precise outcome. This is because of few minute errors in trial balance that remains undetected and gives out the clear picture of both the credit column and debit column being equal. It also states that the trial balance is free from mistakes and error in principles.

All such errors that come under trial balance are as follows:

- Errors of principle

- Errors of omission in books of original records

- Incorrect account stated in original books

- Compensating errors

- Posting to wrong account

- Errors of principle

As per double entry system, the book of accounts is maintained. It is via this system that we come to know that every debit has its equivalent credit. If the written amount on the credit side is similar to the written amount on the debit side, in arithmetical terms that account will be deemed correct. But if an incorrect amount is written in the debit or credit side (for any reason), in those scenarios, it will be taken as errors of principles.

There may be instances when an accountant may not have a proper understanding of these errors that falls under the accounting concept. To make the concept a bit clear, let us assume that acquiring a building or property is capital expenditure. The amount that will be debited in this case will be in building account. Now, by any chance, instead of debiting the amount into the building account, the accountant accidentally debits it into purchase account. In this case, and on that account, errors of principle will be applicable.

As the amount information remains the same (only the accounts change) balances at both sides in trial balance will be same. Although that mistake will continue to remain on that account, as per double entry record the total computation will be considered as complete. Considered as a loophole, these errors of principles in such situations cannot be identified with the help of trial balance.

Taking into account of these instances, auditors and accountants should never consider trial balance to be as a precise and final proof in accounting.

- Errors of omission in books of original records

Book of accounts is mainly utilized for recording the transactions in business. But it is not mandatory that all transaction records are written in this book. There are instances when certain transaction records are omitted mistakenly.

Suppose, a client returns some of the commodities which were received as stocks. Although the commodities were received by the company but due to some reason, that information was not recorded in the book of accounts.As per this case, trial balance cannot identify this mistake as there is no record of it and as per that complete transaction already took place.So, debit and credit sections of the trial balance will show variation in amount record. This minuscule error can have an adverse effect on business.

If in one section of journal entry mistakes are found, or while posting the total transaction record to ledger accounts from subsidiary book few details get omitted, those mistakes can be identified.On the other hand, any omission will have no track record, making the recordings to be accurate.So, it is always advised to properly check the book of records for rectification and write transaction details immediately to prevent hassles.

- Incorrect account stated in original books

Incorrect name of an accountee or transaction record made in erroneous account cannot be detected in trial balance. Hence, this wrong information is used in a subsidiary book or journal, and the outcome is seen as different amount information in credit and debit sections.

Suppose, Client A purchased some commodities for $500. Now, for some reason, that amount was debited mistakenly in Client B’s account. The trial balance, in this case, will not be affected. This is because it is Client B’s account in which the posting is made (debit side) and not in Client A’s account. So, credit or debit in incorrect account remains undetected by trial balance.

- Compensating errors

In accounting, there are instances when it is considered that effects of certain mistakes can be nullified by the effect of other mistakes. It is regarded that if 2 error effects are combined with each other, then debit and credit sections of trial balance can be equalized. Even if there are mistakes present in it, still in totality it can be compensated.

- Take for instance;X purchased some commodities for $200. But his account was debited with only $20.

- Now in another case, Y paid $200, but his account reflected only $20 as credited amount.

- In the first case, as per the error, only $20 was debited instead of $200 (mistake of $180). As per this the error effect in the trial balance will show $180 less in the debit side.

- Similarly, in Y’s account, $180 is recorded lesser at the credit section of trial balance. Now, this error balance effect will be reflected in the credit column.

Now, if you combine the effects of both the errors, you can see that in both the cases, amount error is of $180. But on one side, $180 is the credited amount in credit section of trial balance, and on the other side, $180 is debited amount in debit section of trial balance. Therefore, despite having errors on both sides, transaction records will tally in trial balance.

- Posting to wrong account

There are cases when transaction postings inany of the books are mistakenly made for an incorrect account but with correct amount and at right side (credit side or debit side). Few of the books are:

- Purchase book

- Returns book

- Cash book

- Sales book

When such correct postings are done in wrong accounts, despite being a major mistake in itself, trial balance will reflect equality in both credit side and debit side.

Errors regarding credit balance in ledger accounts comprise of the followings.

- Liabilities accounts

- Revenue and income account

- Returns outward account (Purchases return)

- Interest on drawing account

- Capital account

- Funds accounts

- Sales account

- Reserve account

- Creditors account

Errors regarding debit balance in ledger accounts comprise of the followings.

Losses and expenses account (bad debts, wages, etc.)

- Returns inward account

- Debtors account

- Assets accounts

- Purchases account

- Drawings account

Trial balance preparation

To record business transactions, it is the book of accounts which is generally used. There are mainly 3 steps which in combination completes the total procedure.

- The first step is utilizing journal proper and subsidiary books and recording business transactions in those.

- The next stage is utilizing the collective information from journal proper and subsidiary books and preparing ledger accounts.

- And the final step, which takes place in the book of accounts for recording business transactions, is trial balance preparation.

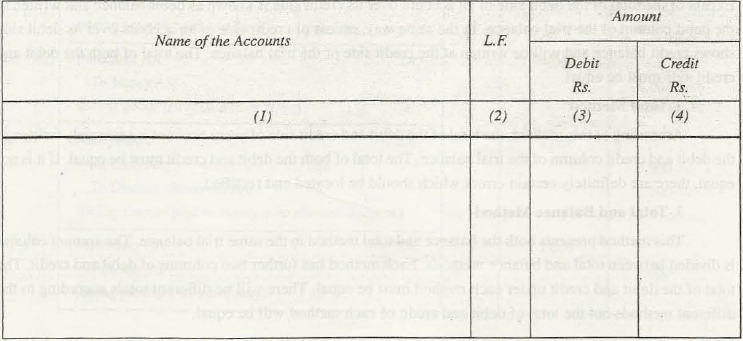

The format in which this trial balance is prepared is via these methods,

Name of account

All of the ledger accounts are listed in this column. As per this, every account should be mentioned here with proper account names in this column. Any mistake or deletion can tip the trial balance out.

Ledger folio (L.F)

This column states the precise page number of ledger accounts. Even if in a ledger there are different ledger accounts, the same page numbers will be mentioned against salary accounts.

Amount column

The amount column comprises of both credit column and debit column. In case of credit column, trial balance is prepared as per total method. And for debit column, balance method is utilized for preparing trial balance. In amount section, both balances are reflected.

Here is an image of trial balance.

Links of Previous Main Topic:-

- Book keeping

- Meaning of gaap

- Origin of transaction

- The concept of debit and credit

- Subsidiary books or sub division of journal

- Balancing of ledger accounts

- Meaning of trial balance

- Special features of trial balance

Links of Next Accounting Topics:-

- Methods of preparing trial balance

- List of important accounts and balances

- Balance sheet in final accounts without adjustments

- Adjustments additional information in preparation of final accounts

- Meaning of bank reconciliation statements

- Bills of exchange concept of bills of exchange

- Errors affecting or disclosed by trial balance introducing the concept

- Meaning of depreciation