Under most cases of loans in today’s world, the borrower may not pay back the promised amount and as a result most of the loans are not free from risks. Well, the question that not pops up is how can an individual compute the appropriate expected rated in the event that the bonds concerned are risky?

6.2 A Risk – neutral investors demand higher promised rates

Before an individual proceeds with this section of the chapter, it is important for him or her to place himself or herself in the shoes of a banker. Firstly, you must assume that a Treasury note of 1 – year offers an annual return rate of 10%. The immediate problem that the banker ought to face is that he or she is contemplating by then. He or she has already made a commitment and hence deciding on the interest he or she must charge.

The banker ought to earn the same amount from both. In the event that you are certain that the person to whom you have made the commitment will pay the promised amount, you can just charge that person 10%. The earnings from both ought to be the same. In this case, both ought to pay $1,100,000.

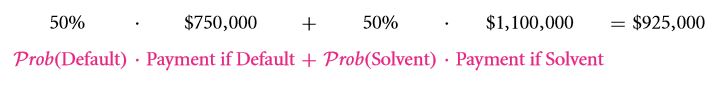

Considering the real world situation, only few borrowers exist in this world who ought to pay back the loan just as promised. An individual who pays back the base amount along with the promised interest is referred to as the solvent. If there is a 50% possibility that the borrower will default, i.e. fail to keep it up with the promised rates. This is often referred to as bankruptcy. Considering this case, the individuals may just have $750,000 + 10% interest.

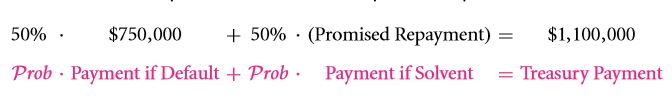

Considering the above example, the expected return ought to be $925,000 and not $1,100,000. The expected rate of return ought to be equal to $925,000/ $1,000,000 – 1 which is equivalent to – 7.5 %. This is nowhere close to the expected rate which is + 10%. As a banker one would demand much higher interest rates in the event that the borrower is a risky one. The banker ought to be expecting $1,100,000. Investing $1,000,000 into treasury notes of the government can turn out to be a lot more profitable.

If an individual calculates the desired repayment amount using the above formula, he or she ought to figure out that he or she ought to demand $1,450,000. This in turn gives the promised interest rate which is equivalent to $ 1,450,000 / $ 1,000,000 – 1 which is equal to 45%. This 45% can be further divided. 35% is the default premium and the remaining 10% can be considered to be the time premium that is paid by the treasury.

The default premium is found to be equivalent to the difference between expected and promised rate. Very few individuals are able to directly observe the expected rates. Most financial documents as well as newspapers provide the promised rate only. This is often referred to as the stated or quoted interest rate as well.

Another thing about finance in a risk – neutral world is that there is no extra compensation. The only thing that is somewhat responsible for filling the gap between the promised and the expected return is the default premium. The published yield of maturity is the promised rate. The promised payments helps in calculating the published yield. The expected payment don’t play any role in this case.

It is recommended for individuals to use the expected IRR or YTM. Most borrowers have access to the promised rate only, the expected rate remains with the banker however. Individuals must not depend on IRRs for making financial budgeting decisions. The default risk and default premium are also called credit risk and credit premium at Wall Street.

Anecdote

A Short History of Bankruptcy

“Uniform laws on the subject of bankruptcies” – that’s what the power to enact states in the Article I which is based on the powers of legislative branch. The framers of the United States Constitution included this while keeping in mind the English bankruptcy system. The early English law treated any sort of defaulting debtors extremely harshly. In addition to this, it also followed a pro – creditor orientation. In 1800, the first bankruptcy law of the United States was passed. This law was somewhat similar to the English law. This the US laws originated from the English laws before 1800.

Between the statute of Merchants in 1285 and the Dicken’s time in the middle of the 19th century the order of the day against debt was imprisonment. As far as the lack of solicitude for debtors is concerned, it wasn’t unique to the English Law. As far as the annals of history, the behavior towards the debtors used to be extremely harsh. “Body execution” was allowed by the Writs of Capias (The Common Law). “Body Execution” referred to the act of seizing the body of the debtor until the debt was cleared.

The common punishments that were inflicted on debtors are listed below:

- Consortium of a spouse ought to be abandoned.

- Seizure of property.

The lenders in Rome were even given the authority to crave the body of the debtor. However, the extent of implementation is still a debatable topic.

Direct Source: Charles Jordan Tabb, 1995, “The History of the Bankruptcy Laws in the United States.” (If you go through the original article, you ought to come across numerous historical tidbits that definitely ought to get you excited.)

6.2 B A more elaborate example with probability ranges

If the banker is asked to pay the interest rate that is risk – free, you ought to earn less. The line of separation between the promised rates and the expected rates is extremely important. Hence, it is recommended to consider another example. Imagine a situation where in I ask my friend (you for instance) to lend me some money and you are certain that I will clear the debt. Let this probability be equal to 98%.

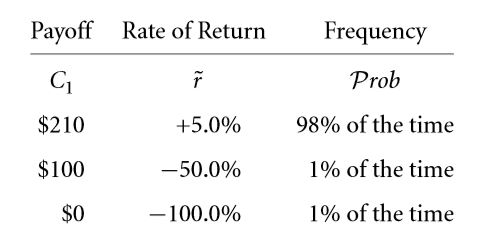

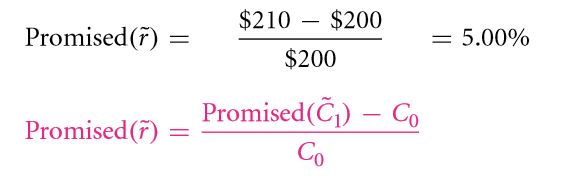

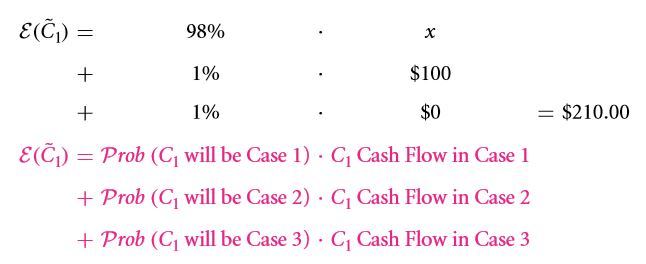

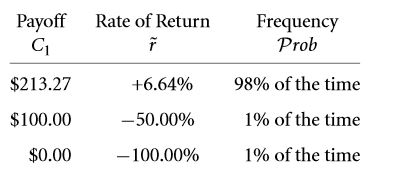

The probability of me repaying half of the borrowed amount is 1% and another 1 % probability is of the situation where I don’t repay a penny. If I want to borrow $200. This investment ought to get you $210 in the event that you invest one government bond. The rate of interest is approximately 5 %. The question here is what interest rest should you charge if you lend me the same? The table showing the outcome of lending me the money at 5 % interest is given below:

The play off is given below for the above table:

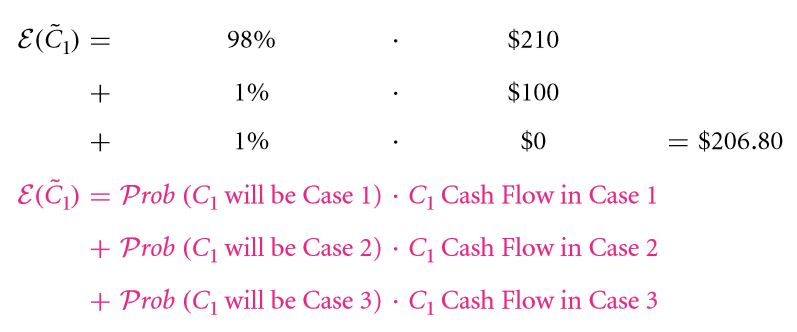

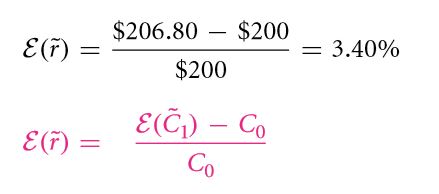

In this case, the return that you ought to expect is $206.80. This is comparatively lesser than $210 that the government bonds have to offer. Looking at it from a different perspective, if I promise you an interest rate of 5 %,

Then the actually rate of return would be:

This rate of return is definitely less than that offered from government bonds.

Under such a circumstance, you must figure out what interest rate I must promise so as to ensure that your return is same as that from a government bond. The probability – weighted mean payoff is the expected loan payoff. Ordinarily, if you are lending me the money, you would expect that same return as you would receive from Uncle Sam. If you invest $ 200, you would expect $210 instead of $206.80.You now need to solve for x:

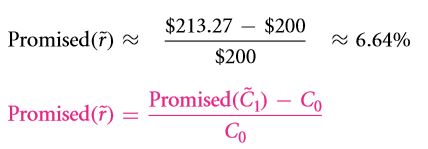

This refers to the fact that you ought to receive an interest rate of 5 % if I promise 213.27 (x). The promised interest rate in this case is:

This in turn promises:

The expected interest rate is thus

Exercise

Q 6.9 Assume the following criteria’s:

- 95% Probability of getting the repayment on $200 in 1 years of $210.

- 1 % probability of receiving $100.

- 4 % probability of not receiving anything.

Following the above criteria’s recalculate the given example.

- To guarantee an expected interest rate of 5%, what interest rate should be promised?

- Find the expected interest rate if the promised interest rate is 5%.

6.2 C Deconstructing quoted rates of return— time and default premiums

If you consider a risk neutral perfect world, the default premium is equal to the difference between the expected and the promised interest rates. For the example given above, 1.63 % is the default premium which is the difference between 5 % expected interest and 6.63 % quoted interest. If everything goes perfectly in a risk neutral world, the lender receives 6.63 %.

Note:Individuals in the field of finance must make sure that they don’t confuse themselves between the low expected rate and the promised rate. Treasuries are perhaps the only 100% safe bonds. Excluding these bonds, the promised return rate is always higher than the expected return rate. The expected rate of return is seldom provided by financial authorities. Under most circumstances, only the quoted rates are provided.

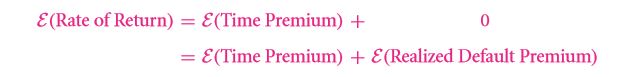

If you consider the average expected default premium, it is zero. As a result, the return rate that is expected is nothing but the summation of the expected default premium and the time premium.

For individuals who are willing to work out the above expression, the default premium that is realized and expected can be calculated in the following manner:

The difference = (6.63 – 5) % = 1.63 % [almost 98 % circumstances]

- 50 % – 5 % = – 55 % [this occurs in about a percent of all the circumstances]

- 100 % – 5 % = – 105 % [ this occurs in about a percent of the remaining instances]

In the first case only the time premium is lost where as in the second case, both your money and the time premium is lost.

If an individual considers a real world scenario, there are various other premiums in addition to the 1.63 % default premium and the time premium of about 5 %.

There are various premiums that are limited to the imperfect market such as the liquidity premium. These premiums are nothing but a compensation for the difficulty that one ought to face at the time of finding the buyers in the near future. There have been discussed in details under the scope of Chapter 10.

Another common type of premium limited to the real world scenarios is that of risk premium. This premium gives individuals higher return rates provided they are willing to take a little more risk. This has been discussed under the scope of Chapter 9.

Though these premiums are quite important in the real world, if you compare them with the default as well as the time premium, you ought to figure out that they are a lot less.

Exercise

Q 6.10 Discuss whether the expected default premium is negative or positive.

6.2 D Credit ratings and default rates

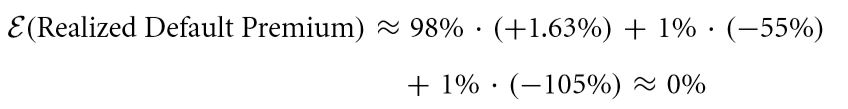

In recent years, a concept known as credit rating has emerged. This concept was brought up to aid the lenders in judging the default probability. There are various data vendors who offer credit ratings to the lenders. If you consider the credit ratings of a particular corporation, you have two options.

You may either approach Standard & Poor’s (S&P) or Moody’s or Duff or Phelps or Fitch. In the event that you wish to figure out the credit rating of an individual, you may seek the aid of Dun & Brad Street or Experian. If the event that you aren’t aware of how a credit rating looks like, it is strongly recommended for you to get your credit history rated.

An idea among most individuals is that the rating agencies today provide them with all the default probabilities of a corporation or individual but that’s certainly not the case. All they provide is an overall rating that ought to help lenders assess their clients better.

The thing about these agencies is that they ought to provide you with probability of default at the expense of an extremely nominal fee. There are a number of factors on which this fee depends. Some of the factors are:

- The desired details and criteria’s.

- Issuer’s identity description.

- Investigations

- Various aspects of the bond.

If you compare bonds that will pay off in 30 years and 1 year respectively, the 1st is a lot more prone to default than the second. Consider the table 6.1, it shows the categories of Moody’s agency. They provide the overall rating and now it is up to the lender how he or she will calculate the correct compensation rate of default risk. The grades at the bottom are known as junk grades or speculative grades where as the top rated grades are referred to as investment grades.

Empirical Evidence on Default

Before we move into the topic any further, it is important for us to have a good idea about high quality borrowers and low quality borrowers.

- High Quality Borrowers: The borrowers who has a history of very few defaulting bonds falls under this category. If you consider the probability of default, it would turn out to be less than 3 % if you consider a decade. On a per annum basis, it would be about 0.3 %. They carry their old credit ratings for a while after an issue.

- Low Quality Borrowers: The percentage of corporate bonds that default every year is about 3.5 % to 5.5 %. However, the default rate was time dependent. Things get even worse during recessions where the rate rises to about 10 % per annum. During booms, it is only about 1.5 %.

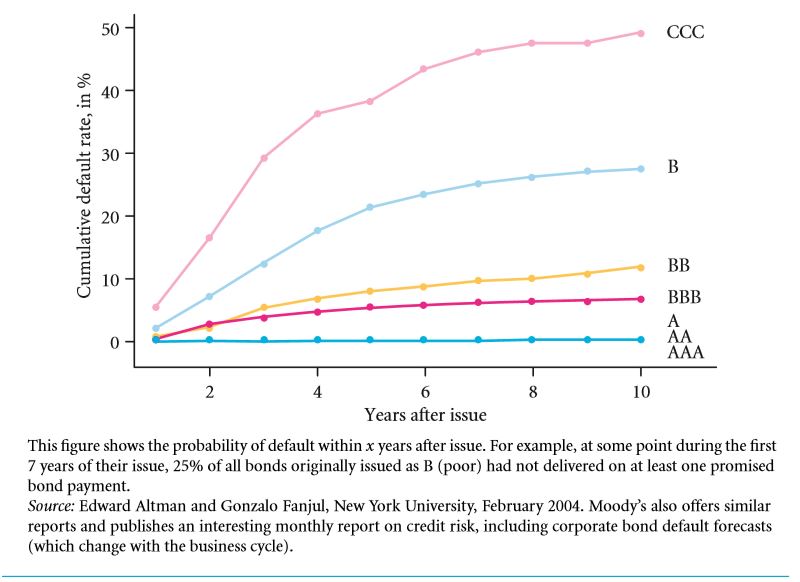

The corporate bond statistics between the years 1971 and 2003 was collected by Ed Altam, an individual from New York University. He defined default as a bond missing at least one payment. Figure 6.2 gives you a brief sketch of the credit rating:

FIGURE 6.2: Cumulative Probability of Default by Original Rating

In case an individual is willing to calculate the expected loss he or she needs both the default probability and the amount received if a default has been encountered. Speculative bonds return low amounts when a default was encountered. Their value varies from about 30 to 40 cents.

Though not a part of the figure, it can be calculated that the AA or AAA bond price might as well turn out to be about 75 cents on each dollar. This however is in case of a default. If you consider a dollar, a bond would price about 50 cents on it. For speculative bonds, the value may drop to about 25 cents during recessions.

Bond Contract Option Features

Before going into the quoted returns of the real world, it is important for you to know that the quoted returns of the real world may contain certain premiums of the contract as well. The quoted return rates of a particular bonds may vary based on certain additional features that come along with the contract. Another aspect regarding these bonds in that they may vary based of factors other than credit risk as well.

For instance, there are various corporate bonds that offer an additional feature of early repayment. Mortgage loans fall under this category. It has been noted that a borrower tends to pay off a particular loan by taking another loan when the interest rates of the future fall.

However, if the rates rise in future, the borrower needs to pay the promised amount only. Let us take into account a small example. Assume that I need $90,909 and you are lending me the amount at a rate of 10 % today. I promise to pay you $100,000 the following year. Suppose one of the following situations come up as soon as the loan is issued:

- There may be a rise in the interest rate. Let’s assume that the rate becomes 15 %. In this case I need to pay back $100,000 only y on receiving $90,909. However, had I received the money after the increase in rate, I would have got $100,000 / 1.15 = $86,957 for a promised amount of $ 100,000.

- On the other hand, there may be a situation where the interest rate falls. Let us assume that the interest rate becomes 5 %. Then the best option that I have in front of me is to repay the $90,909 and then apply for another loan at a lower interest rate.

Considering the above criteria’s, the scenario isn’t going to be a smooth one as far as the lender is concerned. Hence, the lender must compensated appropriately so as to allow the prepay option. This can also be considered to be a prepay penalty. Most of the mortgage loans come with an option for prepayment. The interest rates are comparatively higher in case of loans that allow prepayment.

On the other hand, loans without a prepayment option come with a comparatively lower interest rate. An insolvent bond is a bit biased towards the lender where as a solvent bond is biased towards the borrower, i.e. the lender would receive less returns in the 1st case in comparison with the 2nd case. These can be considered to be a default premium option as well. Hence, the amount paid may increase or decrease.

Exercise

Q 6.11 Discuss the rate of default of low grade borrowers on the basis of historical evidence.

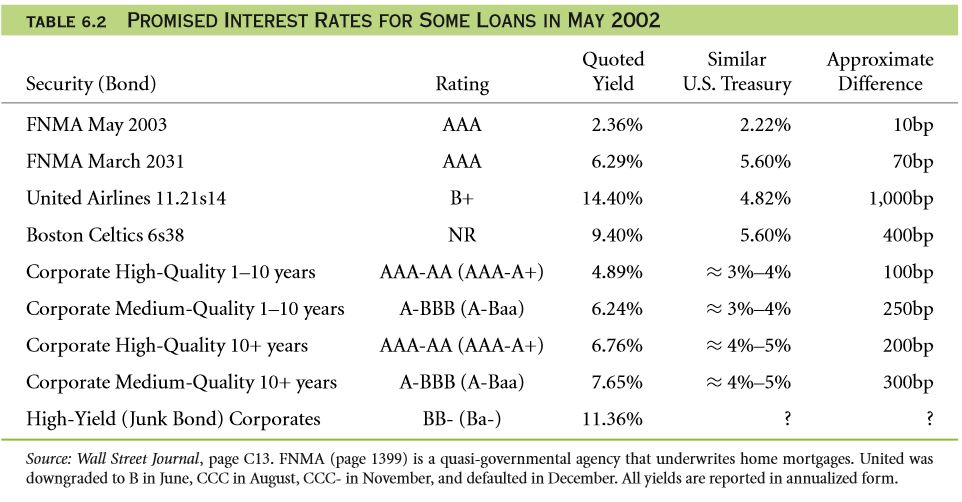

6.2 E Differences in quoted bond returns in 2002

A question that pops up in the mind of most individuals is how the bond yields that were promised can be used to obtain the credit ratings of the real world? In order to support our theory, i.e. the promised rates of a particular bond is directly proportional to default risk, we would like to take your attention to table 6.2 which lists down the issuers of May 2002 along with their various borrowing rates. The higher the credit rating of a particular bond, the easier it shall be for the bond to find a low interest lender, i.e. a lender who offers a comparatively lower interest rate.

Another frequently asked question is how does the lender come out even? Well, this is made possible by the treasury’s majority of spreads relative to the other forms of lenders. Have you ever wondered as to whether the creditors as well as lenders who deal with a high interest rate get the same rate of return in the long run? By same rate of return I am referring to the average return received. Well, this is possible only under the circumstance where in the entire market is risk neutral starting from the borrower to the lender.

As mentioned earlier in this chapter, the lenders get a greater rate of return in the event that the go for the option with a higher risk.

As far as the statistics are concerned, such a situation doesn’t exist. However, it is without a doubt very close to reality. Let us consider the table 6.2. In the table there are 100 basis point difference.

By point difference, I am referring to the difference between the high and the medium quality bonds that are issued for a long term. Out of these, almost 80 % are due to credit risk, 10 % are due to the mismatch that may be encountered between the interest rate that is quoted and the corporate world’s maturity. The remaining 10 % points are considered to be an extra compensation. This is usually taken by the creditors of low corporations.

6.2 F Credit default swaps

As of now, the aspects of loans and bonds that has been described in details above is nothing but a conceptual curiosity. A thing about the various financial sectors around you is that it is constantly innovating adapted to the change in demand. The lenders who lend firms the desired amount of money would usually demand a single payment of the interest that ought to contain all the premiums.

Another term that you must get familiar to is Credit swaps or CDS, also referred to as credit default swaps. These are certain tradeable components of the premium. These components aren’t tradeable all along but become tradeable once certain conditions are fulfilled.

Now, let us take a CDS case into account. Suppose HCA Inc. issues a bond of $ 15 million, i.e. a huge pension fund. HCA may ask from a hedge fund a credit swap of $10 million. The hedge funds bets on the fact that HCA isn’t going to get bankrupt. This CDS contract was worth $ 130,000 as per the Wall Street Journal passed in June, 2006. The value of this contract might as well rise to something about $ 400,000 the following month. This rise is often caused due to some potential deal that may be sold out which in turn may increase the risks involved in future.

The best example of such a credit swap would be a contract of some sort of insurance. In this insurance hedge fund also referred to as the swap seller is the provider of the insurance. In the event that HCA faces any sort of bankruptcy, the swap sellers ought to pay HCA $1 10 million as the pension fund.

Considering this scenario, carrying out the transaction was an extremely lucky break for HCA. However, things weren’t that lucky as far as the credit swap is concerned. In the event that any sort of credit event is encountered such as bankruptcy or any sort of failed payment, the individual who buys the credit swap ought to pay the seller in exchange for the event a premium.

However, the credit event must occur within a certain time limit such as a year. The increase in the $30,000 to $ 400,000 can be considered as the default premium. In this case, the credit swapper might as well take over the entire premium for the credit. The best part about this idea of credit swap is that it allows individuals to allow various premium amounts in a single bond.

If you consider the example discussed above, the HCA’s time premium was opted for by the pension fund. This in turn divested the pension fund of various components such as the credit risk. The CDS might as well guarantee the sale of the bond at a price that is predetermined. This pre – determined formula is usually determined by a formula.

The hedge fund without a doubt must have decided to go with the fact that HCA under no circumstance is going to be bankrupt and it was able to do so without much of an investment in HCA’s bonds. This market is often referred to as OTC which stands for over – the – counter. This means that the transactions can be negotiated only in person, i.e. 1: 1, involving the two parties. If you go by the statistics, only $ 180,000 billion outstanding credit swaps were recorded in 1997.

However, 9 years later, in 2006 $ 17 trillion outstanding credit swaps were recorded. Another major event in the field of finance is IKB, the German bank collapsing in 2007. Professionals believe that the major reason behind its collapse is the fact that it held a large number of financial securities and most of these were associated with various US mortgages. As of now, the current status of individuals holding majority of the credit swaps is a mystery.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk

Links of Next Financial Accounting Topics:-