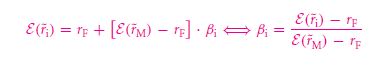

Obtaining the most reasonable aptitude is getting hold of the input rates that form the perfect CAPM formula being, E (˜ri) = rF + [E(˜rM) −rF] * βi.

9.4 A The equity premium

With the input rate that makes it absolutely difficult to make an estimation of an equity premium value. The measurement that you give for the extra added and rate of return is the one that is offered on only the risk evicting projects. However, the worse part remains to be that the premium offered on the equity market is a difficult one to make an estimation of. The ones that you choose is the most influencing estimation leveled up on the cost of capital. The main theory that governs the CAPM model makes up for the expectant rate of return. The real life tragedy remains to be a perfect one. With a great accomplishing equity premium you can get the number of ways they end up working with others. So I am left with two strong options that are – presentation of different methodologies and the one where here is only one particular variable. As the previous option appears a more promising one, you can get a true discovery of the boss getting a solution of the many cost of capitals that are presented.

A couple of attributes that must be mentioned,

Historical averages number one: The foremost thing to figure out is the total equity premium that you need to intake in the past extortion. Anyone can rely on the average premium of equities that are all of the historical condition. It reduces the risk factor that is build.

On the year 2007 it was reported by Morning star and was mostly the average arithmetic equation that was holding a premium value. The equity premium was 12.3 − 3.8% = 8.5% on a yearly rate. This will be for the year 1926. For the year 1970, what you should get is 12.4 −6.0% = 6.4%. this too falls under the per annum strata. The total buying and getting a hold of the geometric equivalent averages have been 6.5% & 4.9% consecutively.

Though, if you calculate with the average value that was set on the year 1869 the arithmetic rate of the equity or project premium will be contributed to the drops that are of 6%. When you get to start on the years that are consecutive, which should be the right opted one? As per the United States, the period that the long-term perspective would alter and the most converted and twisted one to the fallen. As a recent theory paper suggests all that you need to do is make the right decisions with knowledge. In the duration of more than a hundred years, the premium percentage will be set as 4%.

Should anyone go to understand the average sample they must understand this that it is awfully unreliable. On the understanding that the calls on the investment that people make most people understand the very chance of future project investment.

Let us look at an example, whatever happens in the 20 to the time of 30 years at the least. Ehen this process takes place, the statistical process that is met, it cannot be the one among the above. When you make a return value of the approximation, all that you get is a brief encounter of the process in hand. There hence, can be many uncertainty involved among the chances that you take. Is the estimate reliable then? The most strong headed decision that you make a stand on is mostly based on the relevancy of the given project. The time period equity that was based on the year 1880 is it mostly relevant on today’s time? Is not the comparison completely baseless?

Historical averages number two: this appears to be one of the most accountable estimation that anyone makes. As the historical relevance is found in the price making, there is an equity premium that is completely opposite to the guidance that most pupils get on today’s market. Understanding the risk that is suffered, anyone can make an appointing validation on the expected return rates. The most high rates of return can be a accounted in the future value due to demolition of many laws that existed on the historical times. The lower the rates of return, the more is the competition inflicted on the market. The result is mostly a competition among the investors. Just imagine, the investor crowd will be busy arguing as to who is better for your project investment!

The most vicious extreme vision that you get in case of the argument is that there is a low level of equity premiums that work flawless. There are many historical evidences that give a solution of transcend. The proponents that you get in the run up trade will let you get a hold on the laws that are used.

SIDE NOTE:

Bubble is a kind of runaway market place, with the rationality that has a taste of temporary being. Bubbles in the stock market are a discussion that has been going on for quite some time now. The conclusion is yet not reached. The question that you were so concerned with about the bubble related to the technology earned stocks, made a surfacing of the 1998 to the year 2000. This is referred to as the dot-com, internet and sometimes even as tech bubble. No certain explanation is found about the convincing thoughts of the fundamental ways where you get to have a certain explanation for the NASDAQ index. There is no upliftment for the time period of 2280 in the month of March 1999 and to 5000 on the time period of March 2000. This is why the case is dropped back on the tragedy 1640 on the April 2001.

Current predictive ratios: The main motive to drive the stock market’s rate of return is that there is an active historical dividend yield. as per the dividend share among the stock market analysts. The high dividend rate is a dead on follow up quality for the stock market traders. The higher the dividend yield, the more the stocks are produced. As per the dividend rate, it is a must input that the equity premium remains intact. There are many substitutes to the methods of such calculations. Giving that there are many ways to calculate the year’s premium value, the total estimated costs forms to be that which took place in the year 2008.

With the world view to be the best this incident was very unfortunate. The present dividend yield was so less that there was a direct impact on the equity premium. The effect is preceded as there is a low value of the equity premium rate. The most viciously good example will be that of the year 1990 when the stock market had showcased the best performance.

Philosophical prediction: this is one of the most accountable methodologies that are used. It focuses mainly on the total rate of return that you make out of the bonds and the stocks. With an equity premium that is as low as that of 3% will be calculated for the time period of 25 years. The equity proportion that an investor suggests is very important to follow by. As for the bond, you can invest about twice the price value. in a market that is perfect, a simple thing that you need to know, is that there is a nothing that comes for free. The reward that you earn is by taking risks. Hence, the premium percentage that you get for the equity is about 6 to 8%. This naturally seems like a very high risk to take on the available stock market. Equity premium that is working is mostly dead set on the percentage of 1 to 3 percentages.

Consensus survey: observing this method, you will be able to note that the investors or the experts that work on the projects work with reasonable etiquettes. All the reasons that are provided correlate together to form the best of the present stock market condition. In the late 2000 all people could make a return on the existing stock at hand. There were surveys taken by big names to support this cause. The return rate was set to be that of 15% and there was a high equity premium value. A total 5 to 6 percent of the equity percentage was developed by the stock market value. The total value that is dropped in the year will be accounted for. As for the part of understanding, there is a good stock market drop value. The 15 to 30 percent was the maximum in that year.

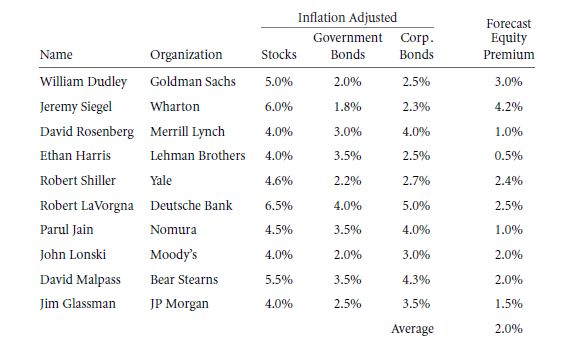

So what must you choose? As for the equity premium estimation, no one knows the right value. The wall street journal made an inflation rate that is for ecasted for the year 2050 as to be:

This rate chart will not make a very big difference if the numbers are a little adjusted. This is due to the equity premium value difference with the inflation value. It cancels each other out simply. What matters is actually the much that you end up quoting – the equity or project premium that are safe in comparison to the no risk property. The total value for the CAPM is all about the spirits and the no risk nature of the assets in hand. This table will give a clear value of the aspects that you have in your hands. There are long term variants that are used in the medium and the higher rates make the calculation an extremely easy procedure to follow through.

ANECDOTE

Was the 20th Century Really the “American Century?”

Rate of return compound rate for the duration 1920 to 1995 in the great nation of United States accounted as 8% on a yearly fashion. The inflation rate was adjusted up to 6%. In Romania, the situation was very different though. If any investor had to invest there, they would have to make the investment at a rate of annual capital of around 27% each year. This amount of appreciation that was handled on by the German invasion and the Soviet Union did suffer a lot though. This course went through over a time period between 1937 and 1941.

Many European countries (eastern) had been the victim of such great oppressive times. Countries cannot just simply have the experience that is easy to wipe over the investment work done. These countries had all had a taste of the political injustice that was created. The investments had all been highly stellar in the long run. Let us assume an example that Argentina went through with. The stock market was a disaster and wiped out the entire interested investor crowd from the year 1947 to that of 1965. Peru had tried to make this delirium work on the years 1941 and 1957. They and tried a total of three times. The result had been very poor with the stock market crashing along with the economy. On the third attempt made by Peru, it proved to be lucky for them. As the saying goes third times the charm, Peru also succeeded in making the investment body with a massive rate of 63% rate of return.

The Indian stock market which started on the year 1940 had offered all fellow investors to fetch a rate of return that was real and of 1% on a yearly basis. Pakistan had started their stock market on the year 1960 and got to the rate of return which is 0.1% on a yearly fashion.

All the European countries had a prolonged stock market evaluation with no political trouble at the present date. Compared to many other countries of course. For an example I would like to display that the Switzerland and Denmark have earned the nominal rates which make about a total of 5% on a yearly fashion. This is in the years stretching from 1920 – 1995 whereas, United States had earned a total of 8% on a yearly fashion.

The stock market in the USA showcased the value of an amazing performance. This is the ratio for the twenties. What will be therefore Chinese century then? Will the steel prices of the Chinese company reflect this value then?

Looking at another aspect, the project that you are serving to, serves as the befitting counterparts that are required in a project. With a long term association the equity premium value is shortlisted as the ones which make up for a great return rate. This bond that you make up is of a premium value. The return rates that a person gets are of much higher value and the rates of return turn out to be of a geometric aspect. Rather than being arithmetic in the heighten proportion, the rates of return will be a much more beneficial if the progression rate is geometrical.

However, the arithmetic rates are good in the later outcome. Proving to be better than the arithmetic returns the rate of the equity suggested value, then there will be a good explanation. If there is a 0% arithmetic average then the suggested one will be similar to the two year loss that will be induced with a 4% rate of return.

The one authorization that is needed is hence the best way to induce in the collaborating medium. I cannot cut down the problem for you at all. While picking up on the number, anyone can decide on to whether or not to invest in it. There have been many possible sites where you can actively indulge yourself. With the equity premium rate ranging from 2% to that of a 4%, anyone can easily decide on the project that needs to be undertaken. The main thing remains that the investor body must always take a likely impression of the investing range of rates. I myself do not have any natural preferences. But, it is the percentage which matters. What you should keep in your mind is the duration period. An approximated duration period must be focused on to get a level headedness in the world of business.

The estimates are the real deal makers. The equity premium must not be lower than 1% and you should maintain that while working with them. The premium for equity further must be a constant factor that rules and governs the formulation. This is the rule that everyone must abide by to get a good profit percentage. So you must not invest unjustly. Take a moment to consider before making a decision. You can thus choose on the profit percentage. These will otherwise be the unavoidable mistake that takes your business investment plan down the hole.

It may be difficult to make an estimation about the premium, but there will be no way around this. Project premium is the most influential thing in the working of the bonds. Hence, you can also state that these are all part of the finance that is used. You will again need to make an investment that is to finalize the attachment of the bond. For all basic investing purposes anyone can get a ‘no escape possibility’.

To get the perfect concept about equity rates, what you must do is create the profit percent book and reveal the rates that were created as a profit. Judging by the relative rate, you can understand the viciousness of the rate that is created, what you need to know is that there is an endless process that you get to follow. The estimation that you will make is a great one. Everything that you know about the master idea makes for the equity rate to double up.

When the market is down, you do not need to worry. All that you need to worry is about the rates to be stable. On the relativeness to the equity percentage rate, all that you should care about is finding a good investor. In the theory that is for the CAPM, existential market is filled with risks. But, this risk is worth the dive.

Markets are viable for all uses and hence the worldly resolution is a direct reflection of the way that is supposed to be. As for the risks that are estimated on a daily scale, there will be a proper spread of the risk free evaluation. On dealing with the typical market value, anyone can weigh down the market risks. The popular Dow Jones 30 is a market index which is very effective as well as it is the one which consists of large stocks company, a total of 30 such that is. There is a huge simplification of the value that is estimated. The other aspect that is used is known as S and P 500. This too works in the most common and familiar similar way that is included.

9.4 B The Risk-Free Rate And Multiyear Considerations

This is the secondary imputation that you can use in the formula of CAPM. Treasuries – that is where this has been developed and taken from. Which treasury though? If the curve depicting the yield having an upward slope, these treasuries yield the value of 2% and that too in the duration of 1 year. What should e the consecutive values? These are 4% over a duration of 10 years and 5% over the duration of 30 years. So how are you supposed to use the CAPM formula? The interest rate must be more than that of the multiple duration of a year.

As per the guidance that you get from the formula of CAPM, there will be no hand on hand help. There is not a single clear conceptualization of the graph curve in the case of yield. As per the practical reasons, there is no sense in making this advert. The way to match the projects along with the treasuries is all:

- By estimating one benchmark that is required in the expected rate of return, must be used to yield the treasuries. This will always make the world seems smaller and the equity value more. This must be applied for your own individual project value and not the observed ones. This is essentially one exclusive way to make a mark on the project with IRR.

This is in fact a very good rule to start following. It picks up a risk less rate to measure the world value and the machine hence will work flawlessly. Let us focus on an example, supposing the cost worth of a machine is that of the measured value and hence the cost will be distributed through the rate of 2.5% on a yearly basis. Now, compare this to the value of a 10 year old project that consumes a rate of 4% per annum. This is easy, you would go in for the most easy one that is the sure 10 year old investment project.

This is a more reliable option for choice as you can rely and develop a trust on the older working and reasonable to trust simply. Cost of capital must be thought of simply investing on the entire portion. The money that you get is a more reasonable one. The 3 month nature is what you make of the projected value. this gives you and all the other prospective hypothetical buyers a chance to invest on something of a much higher value that is not simply of the 3 month.

- By an estimation of the multiple required expected rates of return that you make. as per the NPV value, you can estimate the cash flows that occur at various different time value. the zero bonds must be converted in a platter assisting the time value and also of the cash flow numerator. The responsive rates are all in the numerator sub part.

The most universally accepted agreement quality is the one without any suggestive risks and the rate that is included in the CAPM formula. In case the project at hand has a beta rate of 0, you will be expecting an offer rate that is almost similar to the risk less treasury value. with the option to switch on. If someone gives a major value of the curve depicting the yield rate, there will never be the one that continues.

The different risk free rates that are included in the major motive will be that of the second variations. The answer to depend on casually is more of the long duration investment that will be done. The conjecture that is presented on the stand of the rate value, there seems to be a weird answer. There will be no more than a heavy band range. The point of all this is if the investors would make an investment. The entire decision is based on whether the conjecture will be that of a risk adverting way. The rate of return is not the only decision making factor.

When an investor makes an investment, what he focuses on is the ultimate profit he will be making from the project. The long claims that he made are all nothing but the in depth research premium values. Be it long term or of the shorter term period. The money making rates that are put in the invested money at hand, gives a clear perception. With the greatest value that is analyzed in a project, it means the value that it was invested was a big one. The premium values included in the personal project evaluation will be nothing but that of wholesome effort.

Unfortunately if someone makes a mistake by investing in a value that is wrong, it does not give any certainty. If you just happen to select the wrong project you can easily back off. But, if you choose to invest in one, you get the hard end of the luck. My preference would be to use the geometric project investment value rate to incur the least loss on projects that you do not feel a 100% certain about. This will not let you go completely broke. What you might face however, is that the rate of expectant return will not turn out to be peeking a height of greatness though. Arithmetic rates are surely peeking and give a high return value. What you need to ask yourself is that whether the money that you are putting forward is worth the utter risk of uncertainty? Even the duration of the project is something that can determine the fate for you.

9.4 c Investment Projects’ Market Betas

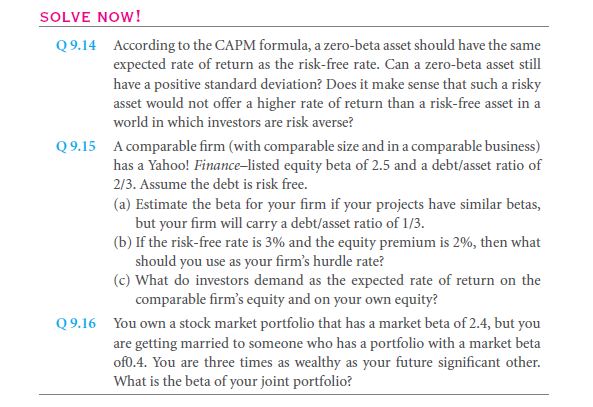

The most important thing that you need and must always estimate is the market beta of the project. This is used to measure the total rate of return on the project body. this is depicted on the inputs that are made on the previous terms and could be used in the making of the inputs. The specified projects that you choose can take a big jump on the chance of getting through with the values that are given off. Investments are all made to make a profit, so you must keep the profit making factor on your mind.

The Implications of Beta for a Project’s Risk and Reward

CAPM method that you take in a basic factor for choosing the best value.that means the worth choosing is basically done by this formula. The calculations are made with the help of graphs. Asset evaluation is made with the zero beta value. The market risk that you will fully take is basically that of the rate evaluation of the rate of return. On the assortment of the zero values that is returned on the standard evaluation value, there is ought to be the particular venture. The zero betas that you accept, you get the honest assortment that you get in the offering of the many project values. Now there are many risk rates that complicate the calculation procedure. What you need to jot down are the specific value rates.

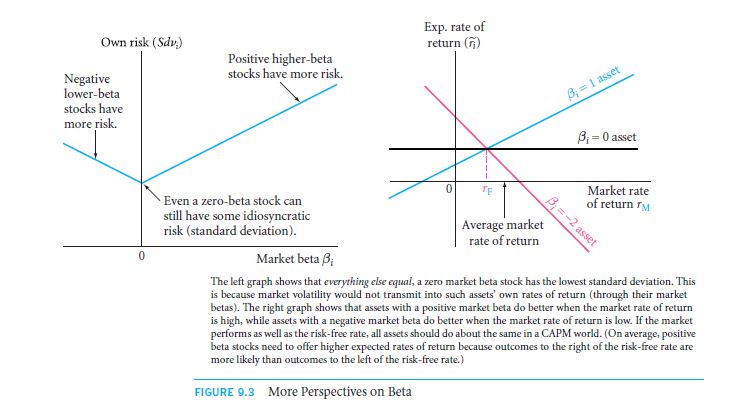

The values that are set on like a grandeur one will be just a little more comforting. The various queries that you keep on setting for the CAPM method, makes a jotting of the risk evading rate that remains constant. This risk percentage that you take is 3%. The premium equity remains to continue on with the constant rate of 5%. The market beta of the zero value will remain to be that of about 3% on an average rate. This will sum up to give you a value of 20% on the monthly basis. The contrasting factor will be that the market beta will be having a ‘– 3’ value. The expectant earning will be of 3% + (20% − 3%) * (−3) = −48%. This is so in a case if the stock market hits a hike 20%. The value will again change if the stock market makes a downfall that is 20%, it will be 3% + (−20% − 3%) * (−3) = 72%. There is a deviation that is included in this. The rate that you get a hold of is based on the risk that the firm is taking. The graph below will depict this in the figure number 9.3.

The graph that depicts the figure 9.3 brings light to the rates of return that are conditional in nature. The x axis is changed and is not a stock level of the market. This is the existential stock market policy that is used with bonds. The y axis has a rate of return that is implemented on a stock market. The assets are induced with a good amount of betas of positive value and that too when the market is doing good. The assets with a negative beta value will have a high rate of return expectation if the market doesn’t go very good. This is something that you had already known from before haven’t you?

In case the stock market shows a negative value for the risk less stocks, then the beta value will not matter at all. Graphical representation of the stocks will give off a low rate of return that is for the expectant rate and this is what matters the most. the only factor that is worthy of any mention is that the stocks levels which are low, will serve forward as a turn over for the total market foundation sand the steps.

Hence it can be concluded that a low expectant rate of return is equivalent to a high price value.

Beta Estimation

The way to find a good estimate for beta value, it has to be said that the entire thing depends solely on the project that you have in your hand. That is only whether the project is easy or simple.

Market beta values that are for publicly trading firms: finding and holding on to a market beta value is mostly easy for maintaining the equity. This is of course the case for stocks that rae traded publicly. It can be said that mostly all the websites with financial motives may publish them.

Market beta values that are from a direct regression:the market model regression estimation is pretty easy. So, you can even make the calculation and eventually make the model yourself. There will be no definite mystery. Beta value terms that you see on the financial websites have a direct estimation that is from the historical worth of the time series and is applicable on the regressive values too. The thing that we did in the section 8.3B is the exact thing form that we do in the one that you are about to learn here. The covariance that is gotten in the one that is depicted in that graph is divided by variances that the market mostly suffers. This is followed by the shrinking of the formulations.

Market beta values that make to the comparable reasons: there is only one sort of regression method that gallops the beta formations and hence the betas are individual to each other as well as are very open. Here is an example that will help you to identify the problem. Assume that there is a particular pharma company. Their products are rejected by FDA. There will be a negative huge rate of return in a month’s time. The negative rate of return will become the outline that hits the brand statistically. The market, if goes down, or up, in that months’ time, then the firm will give off a positive or a negative beta value for the market estimation. The beta estimation that would be formed will be a value that does not represent the market value in the upcoming or progressive future.

If the long run is taken into account, the announcement of this particular will appear haphazardly while the beta value will be staying on the rightly estimated rate. By the time that this entire procedure will be over to give result, you may be well dead resting cold in your coffin. To get rid of the possibility for a long duration of uncertain events, there can be a given calculation for the calculation of these beta values of not only this firm but also the other firms that are in the present market. This of course needs to be on a definite scale. You cannot just randomly choose to calculate those companies which are of a bigger size and structure. The calculations must be specific to the one that you are calculating for. Then these beta values can be compared to reach to a conclusion number.

The project has a value that does not include any rates of returns that existed through ancient times. This may be so as the division is not made or branded publically. As for the method of calculating, you are not left with any other variant alternative methods. The calculations cannot be made by direct calculation and comparisons of other investment betas of the firms that are eligible for calculations. CAPM is mostly the one that is used in the calculation but the comparison forms the difficult part.

Let us look at another example; if a newly launched soda brand is just similar to the PepsiCo brand, then the soda company at hand can adopt the functioning beta values of the PepsiCo firm. The adopted value is a much higher though, but it can be calculative to the power indices. The expected rate of return will be having a higher beta value in comparison to the beta estimate value.

Market beta values which are based on the economic intuitions: upon thinking, if the good public trading that a firm offers is the trust level and is a comparable value. When you can have the reliability of a judgment power, the rate of return is mandatory. The judgment is very reliable in the evaluation level. The stock market will be the playground to act on if the beta value converges to be negative. You can make a stained judgment if you happen to arrange for a formula of CAPM to act on along with the beta value estimation:

Formula that is represented on the right side helps massively in the translation of the intuition that you hold on to as the beta estimation befalls. The right query to make is that, if the stock market is to display the percentages of +10% or that of -10% as a risk omitted rate or the rate of return as the project that is depicting. The guess working strategy is so entirely difficult to make that the beta estimate becomes very difficult to learn.

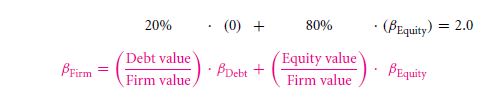

Equity and Asset Betas Revisited

You must learn to distinguish among betas that are governed by assets and the ones governed by equity. This is a very important thing. Remember these by the example given below.

Assuming that there is a rate 4% that is risk free and the property premium is 5%. The project is supposing of $100 million and has a beta for asset that is 2.0. What you do is finance or invest a total of $20 million for a risk less debt. As the definition goes, there will be a beta value 0 for the amount $20 million. The equity beta that you find as is the formula that is asset beta basically.

So solve this to find the beta to be 2.5. No one would want to get their hands dirty on the base of the hurdle. By the rate that you generally use at least. The average rate of interest that you make out of it, is,E(˜ri) = rF + _E(˜rM) −rF_ . βi= 4% + 5% * 2.5 = 16.5%. The rate that you get here is basically very high. In such a case, you must adapt the project of return to be E(˜ri) = 4% + 5% * 2= 14%.

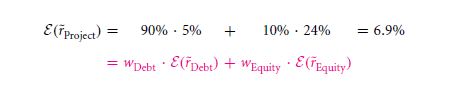

If the project remains to be private, then the hurdle rate that must be looked up is the public ones. If there happens to be a firm that is similar to the one in attribution, then the beta list must be taken as 4. The financial websites will list them as that one of the 4% + 5% * 4 = 24%.

This will not be the perfect rate of hurdle as that of the project. You can see that the rate percentages are 90% debt along with a 10% property. If the beta data is 0 then there will be no worry requirement as further. It will be a very good assuming point. The data that is used in the corporate debt will be included in the debt beta. The ones who practice the expectant rates of returns get on the assured debt taken has a list of data that is worth comparing for. This maintains the credit rate and later creates a BB bond. The debts that you incur are that of this particular BB bond and are mostly the offered percentage which is 100 lame points that are assisted in the treasury. The standing stagnant rate is 4% and hence, you might get the option to compare the cost of capital on as 5%. The rest of this procedure is so utterly easy. Hence, the rate of return that you calculate will be of,

It would make for a really great hurdle rate estimation for the project that is on hand.

Links of Previous Main Topic:-

- The capital asset pricing model

- What you already know and what you want to know

- The capital asset pricing model capm a cookbook recipe approach

- The capm cost of capital in the present value formula

Links of Next Financial Accounting Topics:-

- Empirical evidence is the capm the right model

- Application certainty equivalence

- Theory the capm basis

- Theory capm alternatives