In most of the industrial firms, it is the double entry system of bookkeeping that is followed. In this case, the basic principle happens to be equating both debit and credit sides and balancing the ledger. In case of correct accounting, a situation has to arise that include totaling debit balances to that of credit balances.

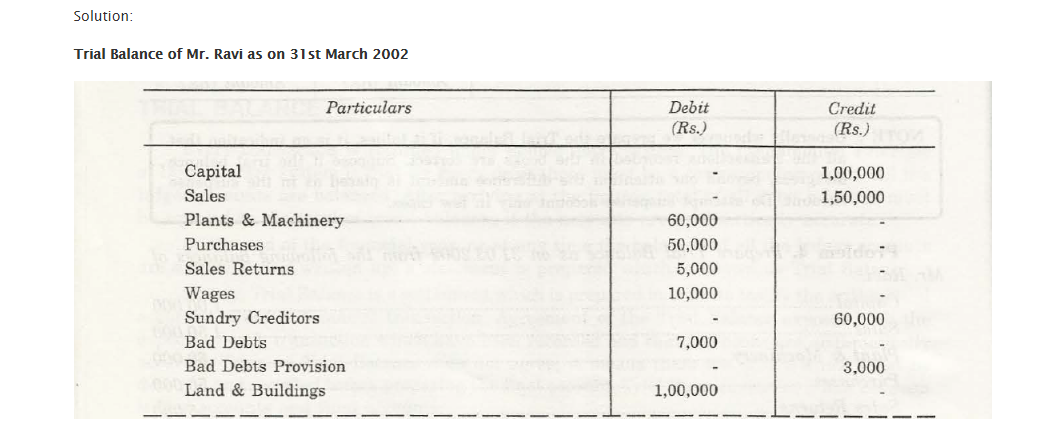

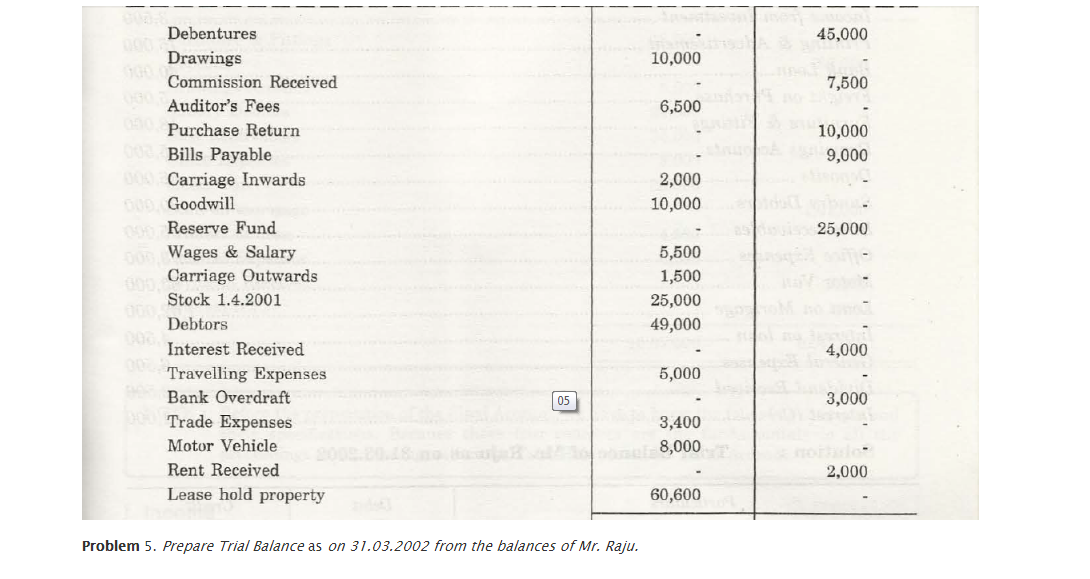

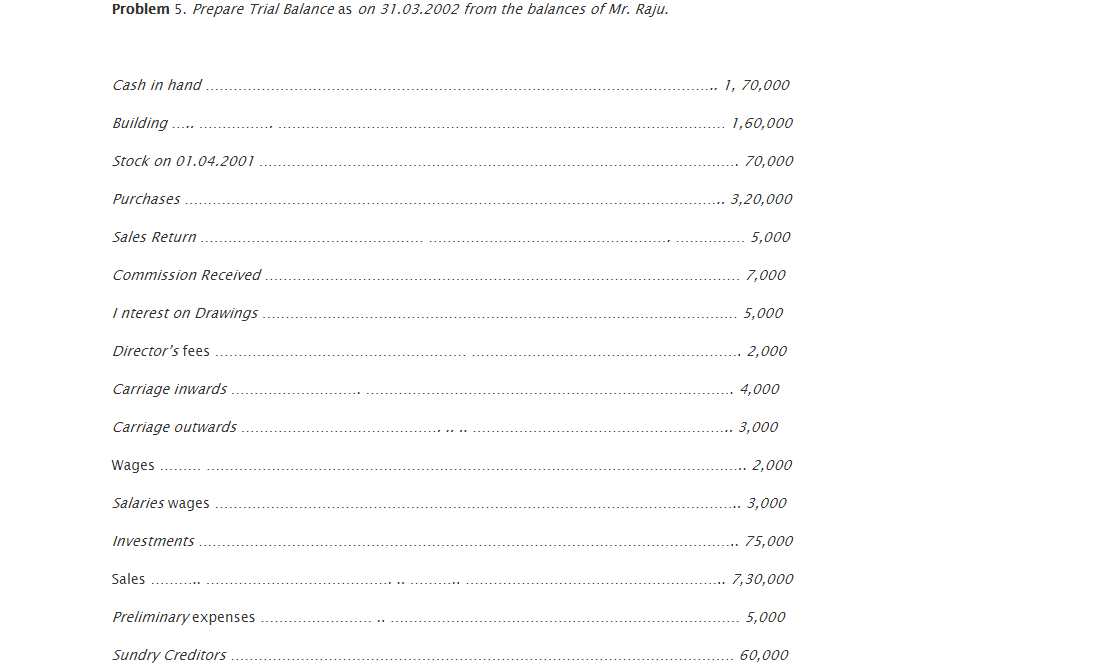

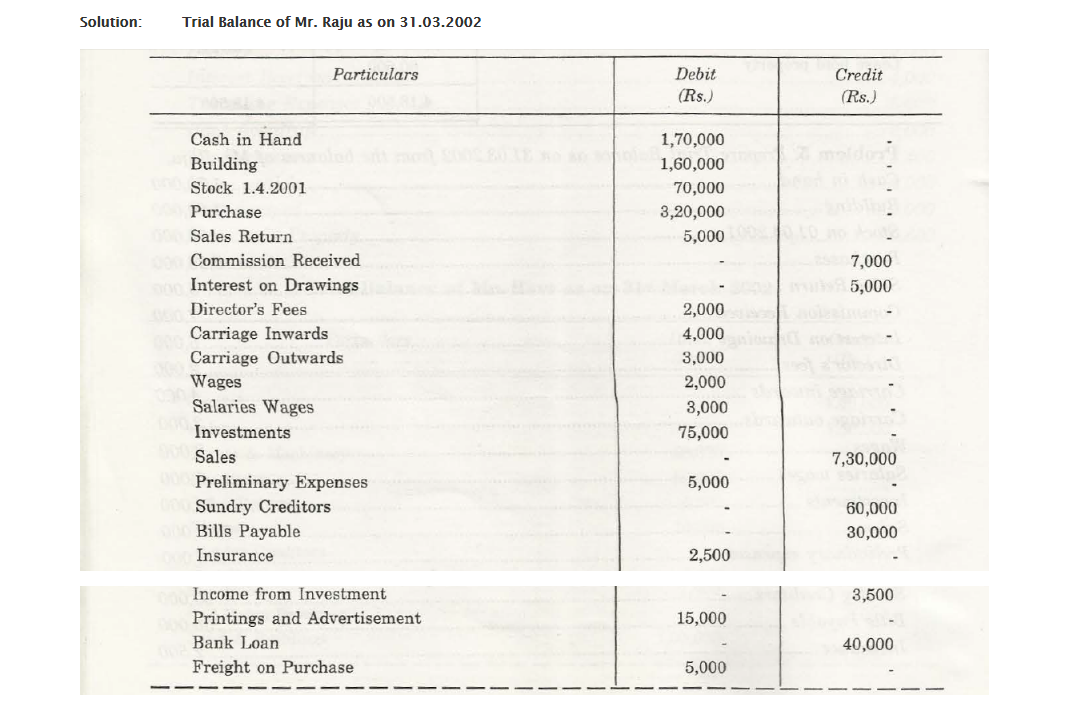

However, after a certain period of time, that is annual in most cases, a summation of these accounts needs to be done. This is known as Trial Balance. So, as per general terms, a Trial Balance is that settlement which is detailed and notified to prove arithmetical accuracy of financial transactions.

Thus, creating a balanced Trial Balance is very important to determine accuracy of a particular industrial organization.

Aims of creating a proper Trial Balance:

A very important factor that needs to be noted is that this document is a link between ledger and final accounts. Hence, it can be used for confirming arithmetical accuracy of total financial transaction that is carried out in a financial institution.

Since its primary reason is to match up two sides of an account, hence chances of clarifying problems and creating an error-free account is there. Some of its other aims are:

- This canbe used for verifyingmathematics of any transaction. So, in case of big establishments, this is just the perfect option for matching accounts.

- Since, this balance agrees only when both debit and credit sides match, hence, there is no need to constantly verify ledger accounts.

- This Trial Balance is the ideal way to prepare Balance Sheet, Profit and Loss and Trading Accounts.

Thus, with a specifically detailed Trial Balance a host of issues associated with financial transactions can be solved.

How to prepare Trial Balance?

For a student, it is important that he or she understands Trial Balance and then know ways to prepare it in an ideal manner.

There are two methods of preparing a proper Trial Balance:

- Balances Method:

In this method, a complete track is prepared by accumulating balances from various ledgers. This system proceeds by transferring Debit and Credit side of ledger balance to Debit and Credit side of trialbalance. While accounting, nil balance account is not taken into consideration.

- Total Method:

In this case, ledgers are not balanced; rather both Debit and Credit totals are shown in their respective columns.

In this regard it is also to be noted that:

Credit side is equal to either Liability or Income account balances

Debit side is equal to either Asset or Expenses account balances.

Format:

In this case, in the First column, serial number is placed. This is followed by Particulars in the Second Column. Finally, in the Third and Fourth columns, both Debit and Credit balances are placed.

Thus, on the whole, this is a very important aspect that is to be noted.

Links of Previous Main Topic:-

- Preparation of final accounts

- Recording of business transaction basis of accounting

- Single entry system of bookkeeping

- Double entry system of bookkeeping

- Classification of accounts

- Rules of double entry or accounting rules

- Accounting cycle

- Journal

- Ledger

Links of Next Financial Accounting Topics:-