For any business organisation, noting down its assets and liabilities, and working in regards to that is of utmost importance. It is based on these two aspects, that profits and loss incurred by a company can be determined.

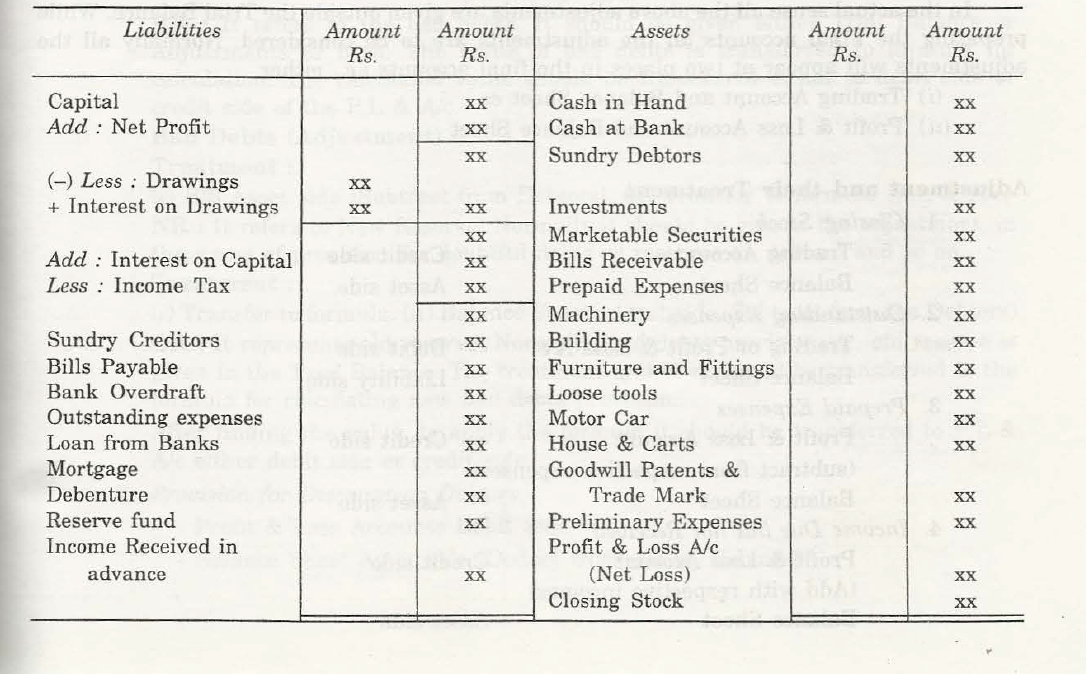

Hence, a Balance Sheet can be defined as statement that depicts the assets and liabilities as well as capital of a particular organisation at a certain point of time. It also provides details associated with balance of income and expenditure of a company over a certain time period.

When placed with a Balance Sheet, its left side depicts the Liabilities and Capital position, while right side depicts Assets and Investment position.

Links of Previous Main Topic:-

- Preparation of final accounts

- Recording of business transaction basis of accounting

- Single entry system of bookkeeping

- Double entry system of bookkeeping

- Classification of accounts

- Rules of double entry or accounting rules

- Accounting cycle

- Journal

- Ledger

- Trial balance

- Income

- Expenditure

- Assets

- Liabilities

- Final accounts

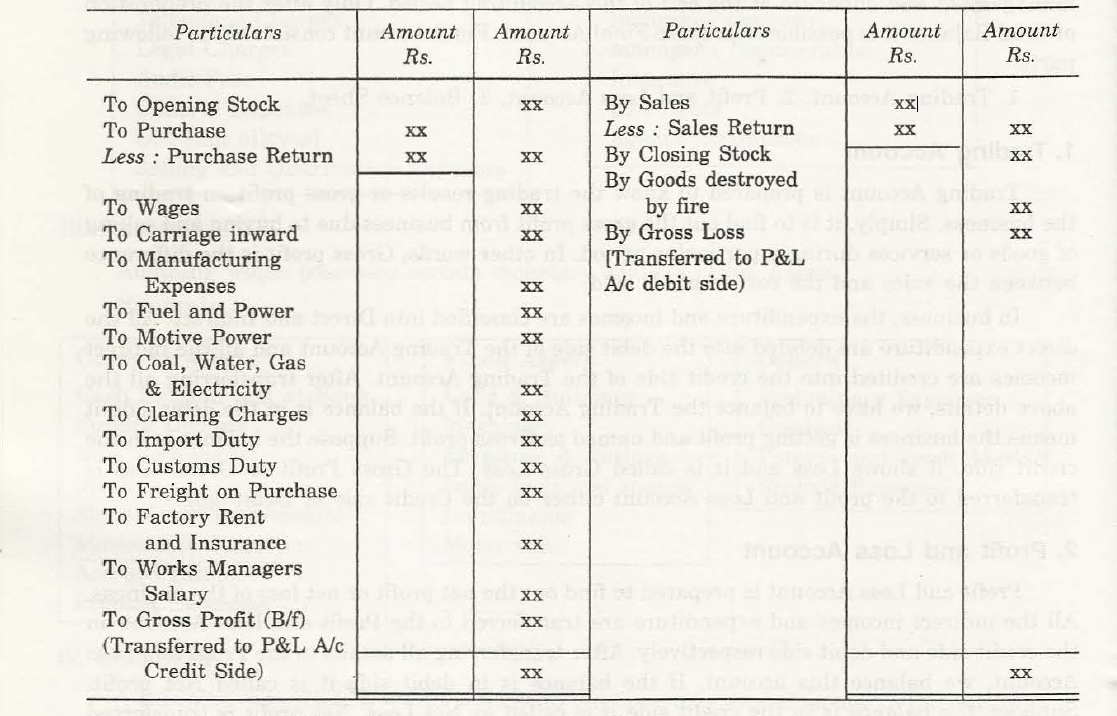

- Trading account

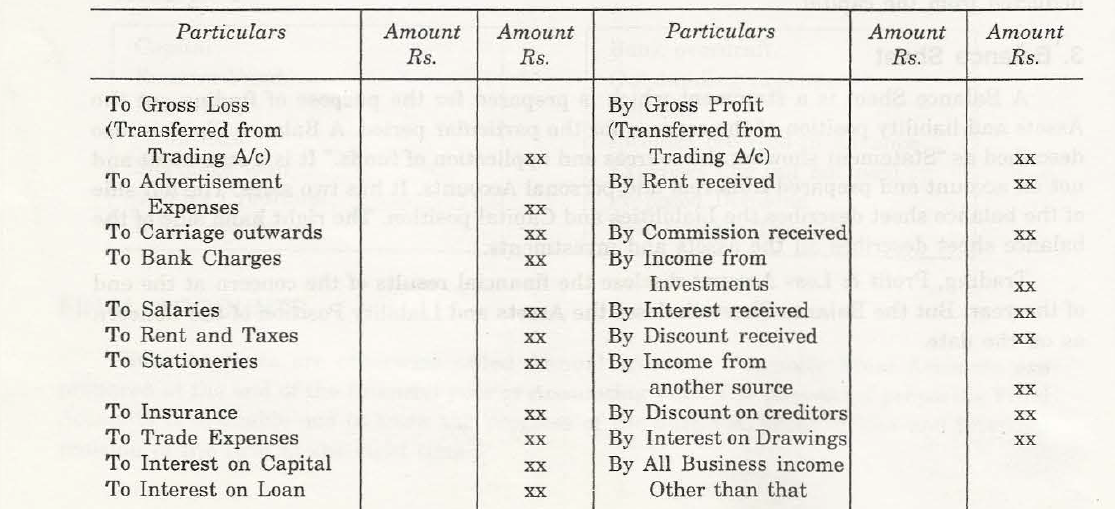

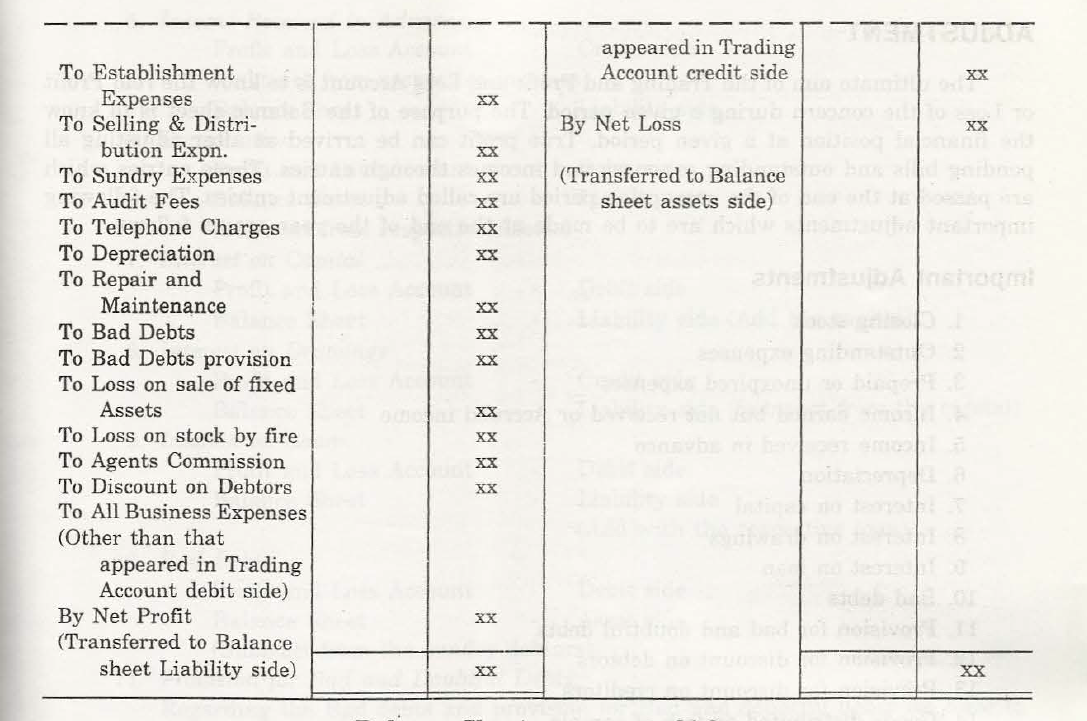

- Profit and loss account

Links of Next Finance Topics:-

- Adjustments in financial accounting

- Minimization problems

- Learning objectives the transportation problems

- Special case of traveling sales man problem

- Replacement theory learning objectives and chapter outline

- Learning objectives and chapter outline for waiting line queuing theory