It is to be noted that in business, certain prospects and machinery can surely be used on a regular basis and managing the wear and tear of that machinery is of prime importance. It so happens that at times value of those assets may increase over a certain point of time.

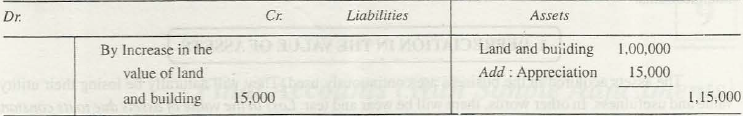

This increase in value of assets results in increase in gain in regards to those assets. This will result in further debiting of asset account since it follows the rule, ‘debit the increase.’

Presentation in Final Accounts:

- When Appreciation appears in Trial Balance, it is taken on credit side of profit and loss account.

- When Appreciation appears in adjustment side, then it has to be placed in dual points. On the one hand, it has to be depicted on profit and loss account, while on the other hand it has to be depicted on that value that is associated with concerned assets on the Balance Sheet of the paper.

However, it is to be noted that as per rules of presentation and conservatism, no firm depicts their increase in asset price on a formal note. Whereas Appreciation is taken as a casual item, Depreciation is taken as a usual entity.

Links of Previous Main Topic:-

- Book keeping

- Meaning of gaap

- Origin of transaction

- Adjustments additional information in preparation of final accounts

- Depreciation in the value of assets

Links of Next Accounting Topics:-

- Outstanding expenses

- Prepaid expenses

- Accrued or outstanding expenses

- Unearned income

- Interest on capital

- Interest on drawings

- Interest and dividend on investment

- Interest on loan

- Bad debts not in adjustment

- Provision for bad and doubtful debt adjustment

- Further bad debts adjustment

- Provision for bad and doubtful debts given in the trial balance

- Provision for discount on debtors

- Closing stock

- Summarized presentation of adjustments

- Theoretical questions final account