Ratio analysis is a tool that is used for getting a quick indication of a company’s financial condition in respect to market. As a form of Financial Statement Analysis, this is calculated in a specific manner.

How to calculate ratio analysis?

Certain details are to be placed while calculating ration analysis. These include:

Liabilities:

- Sundry creditors

- Dividends and payable bills

- Share capital

- Debentures

- Short term advances

- Accrued expenses

Assets:

- Fixed capital (Machinery, Land, Building)

- Receivable bills

- Sundry debtors

- Cash at bank

- Inventories

- Patents

- Prepaid expenses

Current Ratio = Current Assets/Current Liabilities

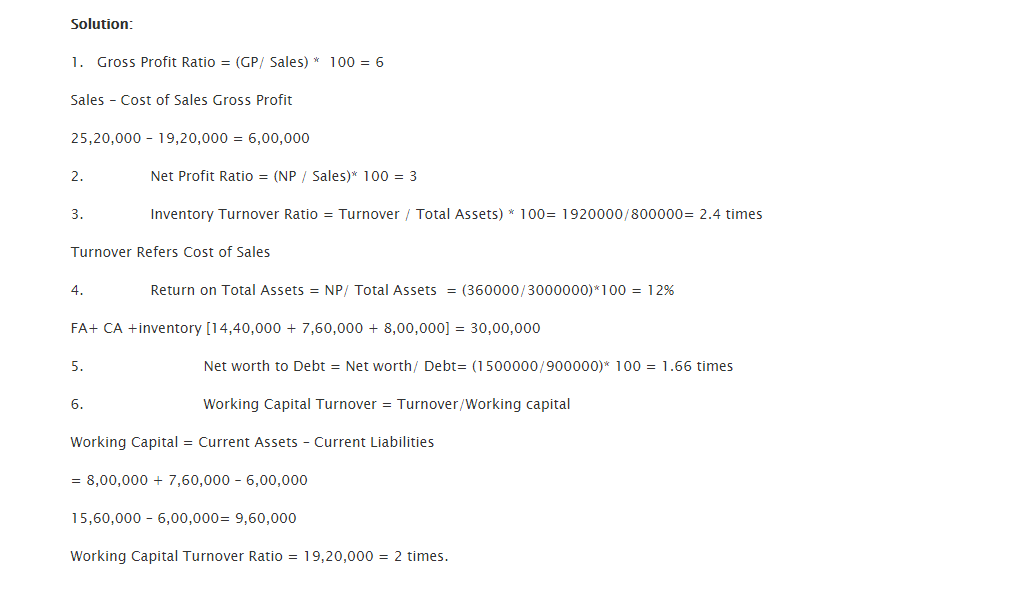

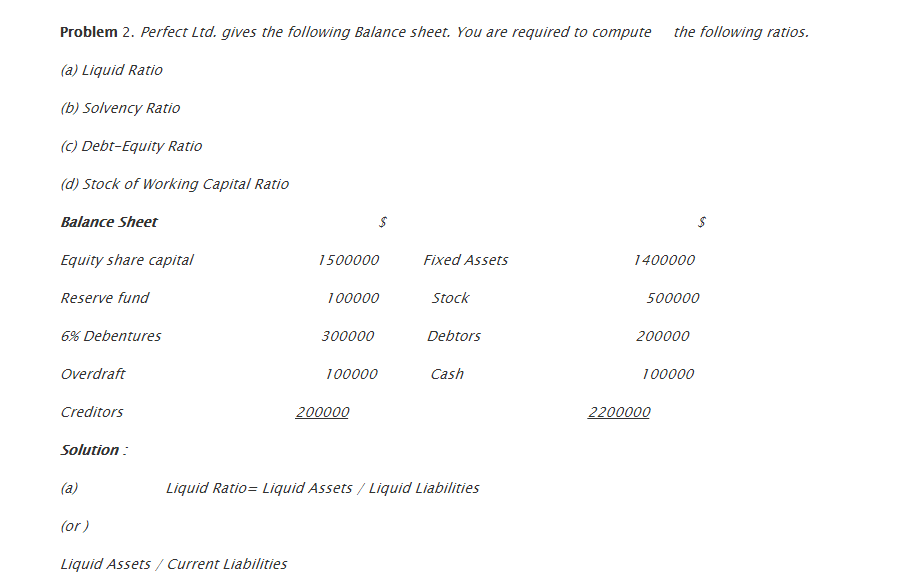

Liquid Ratio = (Current Assets – Prepaid and Stock Expenditure)/Current Liabilities

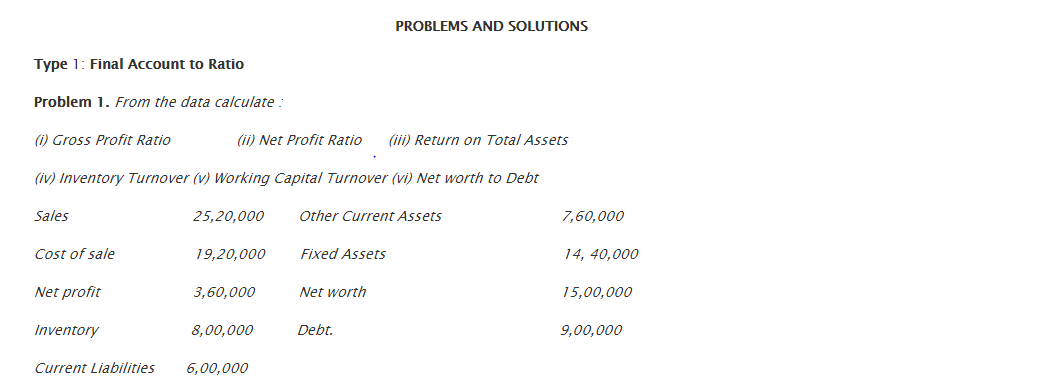

Gross Profit Ratio = (Gross Profit/Net Sales) x 100

Gross Profit = Sales – Cost of Goods Sold

Net Sales = Gross Sales – Sales Return/Return Inwards

Inventory Turnover Ratio = (Turnover/Total Assets) x 100

With help of these formulas most of the sums can be calculated.

Links of Next Finance Topics:-

- Introduction to accounting and branches of accounting

- Preparation of final accounts

- Introduction of fund flow statement

- Introduction cash flow statement

- Ratio analysis significance of ratio analysis

- Advantages of ratio analysis

- Limitation of ratio analysis

- Classification of ratios

- Liquidity short term solvency ratios

- Long term solvency ratios

- Profitability ratios

- Activity or turnover ratios

Links of Next Finance Topics:-

- Learning objectives and chapter outline in assignment model

- Minimization problems

- Learning objectives the transportation problems

- Special case of traveling sales man problem

- Replacement theory learning objectives and chapter outline

- Learning objectives and chapter outline for waiting line queuing theory