Earlier pensions were not given much importance, but with the recent developments and more demands from the employees, pensions have become the most important of all pays. Pensions used to be at the end of the pay list for the HR department as employees were interested to gain more while working rather than worry about their old-age income. But due to various developments and advancements, it has gained a top priority for employers, government and various trade unions. There are a number of reasons that have led employers to provide pensions along with other incentives; the primary reason being a regular source of old-age income.

In the UK the dependency ratio and a longer lifespan have led the government to think of different schemes so that they can provide adequate income to the retired people. Most people see pensions as a constant source of income after their retirement, and thus the amount should be able to meet the requirements of the person. The ratio between working and retired people (dependency ratio) continues to fall every decade, and further decline can cause severe issues for the Government to fund the pension schemes. At present, it stands at 3.3:1, and by the year 2030, it is expected to be 2.7:1 and keep falling for next 20 years according to a study by Hopewood (1994). A good way is to make people realize that they need to save for their own future. Nobody wants to spend their old age trying to work and make both ends meet. When a person spends less today, he can save more for tomorrow. Similarly, by keeping away a part of the income as retirement money, a person will be able to be secure and have an organized retired life. Those who are employed in the government sector have a way out as the state makes sure that its officials can enjoy a stress-free retirement. However, the biggest problem is with the big organizations who do not look much at the worker’s welfare as much they care about profits for their business. They have retirement plans, but the amount is not enough to for the old-age retirees. If employers bring out better ideas and at the same time ask employees to contribute, it will be beneficial in both ways. The main idea is to have a care-free retirement, and that can only be possible when all are on the same page. The state pension age may be increased to 70 years in the years to come, but till then, employers, employees, trade unions and the government has to devise strategies to make it even better. As a result, overseas immigration is seen as a way of hope to make the pension system better and is being encouraged by the government. The government also has to make changes in the taxation procedures so that it can provide better pension schemes for a large number of retired people. However, it is of the working class to look out for their future, and they need to understand that as long as they can help themselves, the better-retired life they can have. In spite of all these measures, in the recent years, it has come to notice that the employers do not contribute enough to the employees’ pension funds. The occupational pension schemes cover only a portion of the working class sector and that too with meagre amounts. This has put the pressure on the workers as they have to bear the burden of investment risks as well as save enough for the retired life.

State schemes

State schemes

The state pension plans work on pay-as-you-go principle. This indicates that the pensions that people receive are derived from the existing taxes and national insurance contributions. There are no funds specifically kept to provide pensions benefits. This means that the people who are contributing to the pension schemes for the present pensioners will not get any part of their contributions. Once they become pensioners, they will receive the contributions made by the future workers and their employers. So in short, what you contribute will be paid to the present retirees, and when you are in need of pension, it will be the future work forces’ contribution. Due to this reason, it becomes a matter of concern as to how the next government will meet the retirement needs without having any funds specifically for the retired individuals.

There are two types of pension schemes under the state which include a basic plan and the State Second Pension Scheme, commonly known as S2P. Under a basic plan, the employee needs to contribute a certain amount of pension which is 60 years for women and 65 years for men. The age for receiving a pension will be revised to 65 years for both males and females by the year 2020. According to S2P, a person earning more than a certain amount fixed by the state which was£10,800 in 2003 and has to make a payment through the national insurance contributions. The scheme is also entitled to pay a fixed rate pension to the employees whose retirement falls after April 2006 and 2007 (IDS 2002a, pp. 22–3). The S2P replaced the State Earnings Related Pension Scheme (SERPS) in 2002. The SERPS was similar to S2P only that it had another state pension which was determined by the amount of money contributed by the retired person. The one advantage that was available to workers who contributed under the SERPS was that the benefits that they received were protected under it.

Occupational schemes

Occupational schemes are much different than the state projects. Here the pensioners do not get pensions according to the pay-as-you-go principle, but through a separate pension fund that is managed by the business. There are a few public sector companies who do use the theory of state schemes, but most private firms prefer the occupational scheme. The reason why the pension fund is managed separately is due to the fact that in any circumstances if the company goes bankrupt, the pension fund will remain untouched and cannot be used to pay the debts. In most cases, the money in the fund is kept to be utilized by the employees when they retire by investing in various sources. Big organizations, however, can make good use of the pension funds and therefore hire a fund manager to take care of it. The manager knows how to make the best use of the resources by investing in various stocks and bonds in the market. At the same time, he/she ensures that the money will be available to pay the benefits and pensions of the employees whenever the need arises. Small organizations on the other hand use insurance companies and banks to help them manage the insurance funds.

Around 10 million pensioners in the UK use occupational schemes, and around 8 million others use the government funds (Government Actuary’s Department 2003). The UK has 150,000 different pension schemes in operation which is£600 billion worth of combined assets. This makes the occupational scheme the best and most sought after pension system among all countries. The reason why employers use the occupational schemes over the state schemes is that they curb the extra costs. Also, the schemes provide additional income to the pensioners in addition to the government schemes along with great flexibility. They have much more benefits than the state pensions and are preferred among a lot of retired people. Irrespective of the fact that men and women still continue to be fared differently according to their terms of employment and longer life expectancy, the scheme is equally applied to both. The added advantage of an occupational scheme is that both the genders have equal access to it and the rules are also applied equally since 1990. These kinds of plans are mostly preferred by the government and large organizations, but nowadays small businesses have also started running these schemes due to the enormous benefits that come with it. Most of the people who make use of such occupational schemes are managers and professionals.

A lot of investments made in the stock market are made through the investment funds. This is because they fetch a higher value in the market and seem profitable for the sponsoring companies. The 90s saw a huge rise in the value of stocks and bonds and the pension funds reaped huge profits. This proved beneficial for the employers as they did not have to put any amount in the funds during that time. However, this did not last long, and with the economic downfall, the stock markets have crashed many times, taxes levied on goods has increased, as has the life expectancy rates. Due to this reason by the next decade, the majority of the FTSE100 companies saw their pension funds suffering shortage. This resulted in a 93% fall in the annual operating profits of the large corporations which were close to approximately £77 billion. The smaller companies were hit even harder with a 130% fund deficit in the operating profits. Various new regulations and policies such as FRS17 standards have predicted worse scenarios in the next few years. Due to this reason after 2005, it has become mandatory for companies to include the details of their pension funds along with the deficits in the balance sheet. As a result, the private sector enterprises have made considerable changes in their pension funds of the employees. Since the stock market is unpredictable, the employers have to face an extra cost which in turn hampers the profitability of their business. Economists, however, believe that after 2004, the stock market seems to have stabilized, but it is yet to be seen in actual.There are basically three types of occupational pension schemes- defined benefit schemes, defined contribution schemes and hybrid schemes.

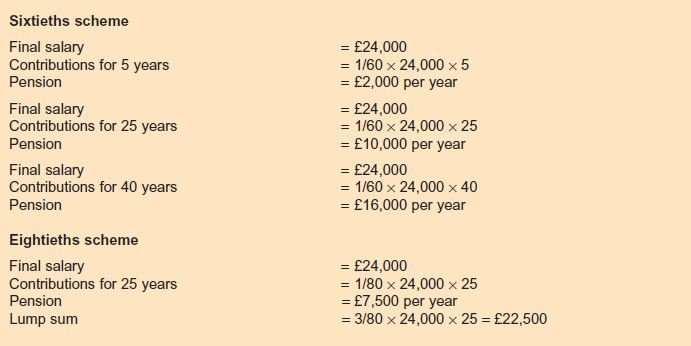

Defined benefit schemes– For almost 5 decades, this plan had ruled most of the organizations, with a majority of public sector schemes being build in this form. However, it has seen a gradual decline in the past two years as many people have stopped using such plans. According to National Association of Pension Funds 2003, only 42% of the schemes are offered by the private sector employers, and the operation of other organizations has also declined to 66%. In this type of scheme, the workers make their contribution into a fund which is then invested by the fund manager on behalf of the employees. The retired employees can take their pension from such fund based on a precise formula which is different in private and public sectors. The amount of pensionrelies on the term of the scheme membership of the employee, and the maximum pension he/she can get is 2/3 of the final salary. In the private sector, the formula is calculated as 1.67% or 1/60th of the employee’s final salary multiplied by the number of pensionable years. While in the public sector it is 1/80th of the final salary multiplied by the number of years of completed pensionable service. The public sector employees are also entitled to receive a tax-free lump sum amount in addition to the retirement bonus. The final salary calculations can be better explained with the following examples

Apart from the retirement pay calculation on final salary in defined benefit scheme, there is another type of calculation as well. Here, the pension is calculated on the basis of average salary that is earned over a period of up to 20 years before the retirement. However, this scheme is less beneficial when compared to the total salary earned as regards to the total pension paid. This kind of plan proves to be useful for the government employees as well as those in the finance and banking sectors. Most of the schemes in this context are a result of the contribution made by both the firm and employee. While the employee contributes a fixed percentage of his/her annual salary which is also tax-free, the employer, on the other hand, has to pay an adequate amount in order to keep the scheme debt-free. But due to several changes in the stock market, there are chances that the pension funds may have a surplus or may be suffering loss. As the market is unpredictable, the contribution of the employer towards the pension fund also varies every year. According to NAPF 2003, the employers contributed around 15-16% of the annual salary. In such cases, the employer is responsible for doing the needful. In case the pension funds have a surplus cash, the firm can enjoy what is called a ‘contribution holiday’, where there is no need to make any contributions. On the other hand, if there is a deficit of funds, the employer has to make up for the loss. There are other organizations where it is not obligatory for the employee to contribute to the pension fund but can withdraw a calculative amount from it.

Apart from the retirement pay calculation on final salary in defined benefit scheme, there is another type of calculation as well. Here, the pension is calculated on the basis of average salary that is earned over a period of up to 20 years before the retirement. However, this scheme is less beneficial when compared to the total salary earned as regards to the total pension paid. This kind of plan proves to be useful for the government employees as well as those in the finance and banking sectors. Most of the schemes in this context are a result of the contribution made by both the firm and employee. While the employee contributes a fixed percentage of his/her annual salary which is also tax-free, the employer, on the other hand, has to pay an adequate amount in order to keep the scheme debt-free. But due to several changes in the stock market, there are chances that the pension funds may have a surplus or may be suffering loss. As the market is unpredictable, the contribution of the employer towards the pension fund also varies every year. According to NAPF 2003, the employers contributed around 15-16% of the annual salary. In such cases, the employer is responsible for doing the needful. In case the pension funds have a surplus cash, the firm can enjoy what is called a ‘contribution holiday’, where there is no need to make any contributions. On the other hand, if there is a deficit of funds, the employer has to make up for the loss. There are other organizations where it is not obligatory for the employee to contribute to the pension fund but can withdraw a calculative amount from it.

Defined contribution schemes– These types of systems are different than the defined benefit schemes in the context that both the employer and employee need to contribute a fixed amount to the pension fund. The percentage is generally capped at 5-6% and need to be paid on a monthly basis. The catch on this type of scheme is that the earnings on the pension funds are directly proportional to the investments made. This means when the investments are profitable, the employee gets a good amount and when the investment fails, there is very less to gain. Therefore, these schemes are not too beneficial when seen from the point of view of an employee. Since the market is uncertain, the worker will not know how much amount he/she will get at the end of this employment term. Whatever amount the employees get as a retirement bonus, they use it to buy an annuity from an insurance company. This entitles them to receive a weekly/monthly income throughout their life but not a fixed amount. The annuity rates change every year, and every insurance company has its own set of policies and rules that define the amount an employee receives as a pension. There are various limitations to this kind of schemes but are favored among other due to the flexibility and ease of transfer. Thus, such schemes are beneficial to those people who are self-employed, change jobs frequently and are at the start of their career.

The schemes are also known as money purchase schemes due to their unique behavior. Such schemes are no doubt riskier than the defined benefit schemes but tend to attract more people due to other features. As a result by early 2003, almost 62% of all schemes in the UK were of this kind as compared to a mere 5% in 1990 (study by National Association of Pension Funds 1992 and 2003). Recently more and more employers have started using the defined contribution pension schemes and have almost stopped the ones that calculate pension on the final salary. The reason being that under this kind of offers are useful for the employers because they just have to pay the fixed amount and not worry about the changes in the investments. This helps them reduce their debts and at the same time help the business to stay financially stable. As a result by the year 2003, only 19% of the employers were using the final salary scheme. In order for the money purchase plan to work on behalf of the employees, the investments have to work extraordinarily well in times of inflation to achieve the best benefits. With all these drawbacks and high risks involved, they still tend to attract much re people every year.

Hybrid schemes– These schemes are a combination of the defined benefit and defined contribution principles. These kinds of projects bring up the advantages of the other two and make one plan that is both flexible and at the same time gives sufficient benefits to the pensioner. Recently they have gained a lot of attention but are yet to find their place among the other UK pension funds. They take the generous, predictable and secure retirement aspect from the final salary scheme and combine it with the flexibility of the money purchase scheme. The end result is a provision that benefits both the employer and the employee.

Group personal pensions

Group personal pensions

People who are self-employed also need to think about their old-age as they too want to spend a stress-free life when they do not work anymore. Such people go for a personal pension where they make a fund with an insurance company and keep a certain amount in their own private pension fund. This is done because the self-employed people are excluded from the provisions of SERPS and S2P. Personal pensions have seen a steady rise since the 1980s as more people have started being concerned about their retirement. Since many individuals change their jobs time and again, a personal pension is a right choice for them. The employer can also contribute to such funds, but there are very few who actually make any contribution. Instead of contributing to a personal pension fund, many companies feel it is better to operate a Group Personal Pension Plan (GPP). It is a collection of personal pensions which is arranged by the employer for the workers to keep aside a tax-free amount for their retirement.

Here the members can make a contribution to their personal funds and save for their retirement. It is a way in which the employer tries to help the employees to save for their own future. The GPP has the same tax and legal aspects of a personal pension fund, however since it includes a number of members, the employer is able to get a discount. For an employee, however, it is less beneficial than the occupational scheme; but a better choice than the one where there is no employer contribution. A Group Pension Plan is also opened with an insurance company and includes the input of both the employer and the employee. This type of pension funds are mostly favored by small organizations over the occupational pension schemes, but few big firms also make use of such provisions. The calculations are done based on the defined contribution schemes but give fewer returns as the employees need to pay the insurance company for the services.

Stakeholder pensions

Stakeholder pensions

Stakeholder pensions were introduced in the UK in 2001. They represent a way to small amounts so that an employee can benefit from his/her retirement years. These were presented by the government to decrease the dependency of employees in state-run pension schemes. They plan to prove beneficial to the middle-income group, i.e. employees who earn around £10,000-£20,000 a year. The middle-income earners make up close to 5 million people in the UK, and this is a good way for them to have a secure future.

A stakeholder pension scheme can be set up by any big or small organizations under the regulation of an established authority. The operator can be any employer or trade unions that need to follow the minimum charges standards set by the government. The member, i.e., the employee who wishes to join the scheme can ask the employer to add him/her. The employers do not directly contribute to the fund but make a payment through the employees’ payroll.

The question that arises here is whether or not these 5 million people are actually benefitting from such schemes. The reason being around 600,000 plans have already been set up, but investments are yet to be made. Many critics are of the opinion that these are all just name sake and almost 80% do not have any amount invested in them yet. If they do not benefit the target group, they do not have much use as such. This becomes a major issue of concern as the stakeholder’s schemes were meant to operate in place of money purchase schemes.