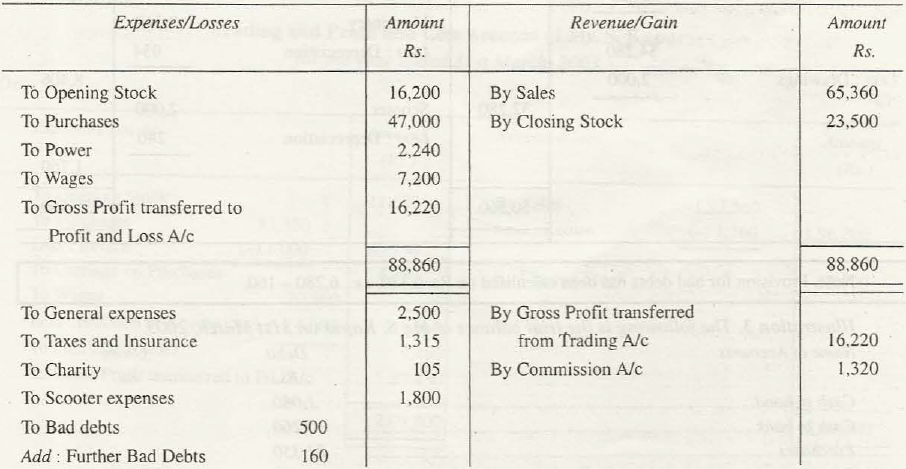

Since this categorically belongs to the item of adjustment, however it has no place in the Trial Balance. As per the rules followed by the accounting books, closing stock will always be placed on the credit side of Trading Account.

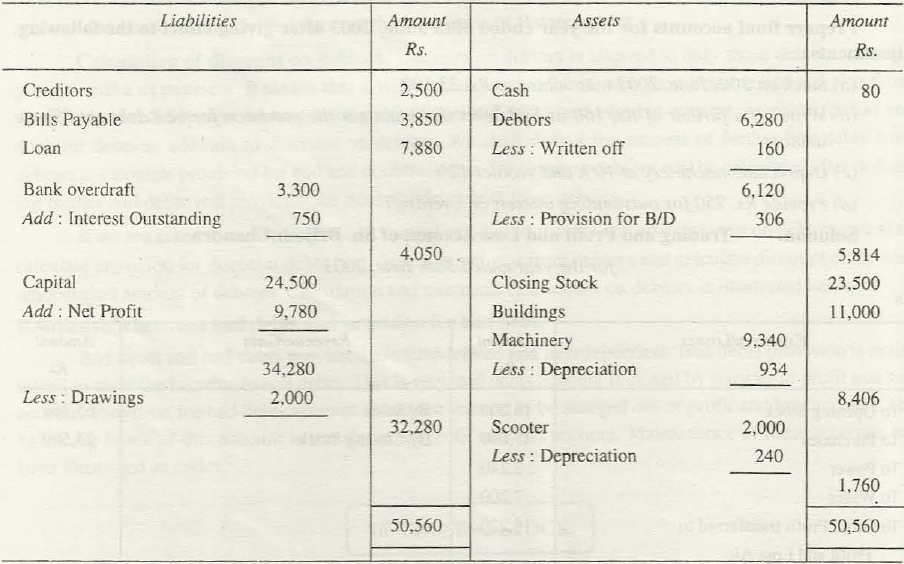

Also, it will specifically show debit balance that would be specifically written on asset side of the prepared Balance Sheet.

It may so happen that Closing Stock when considered in Trial Balance would only be written on Asset side of the Balance Sheet.

Links of Previous Main Topic:-

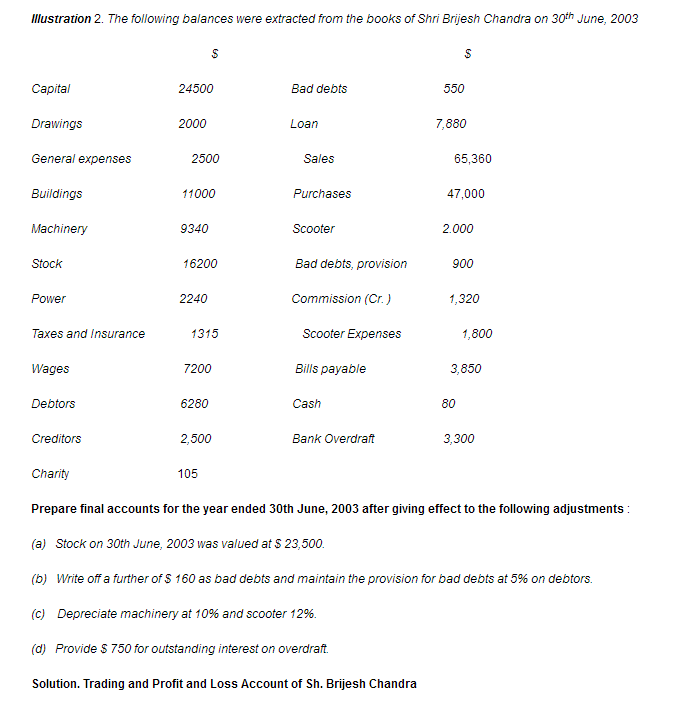

- Adjustments additional information in preparation of final accounts

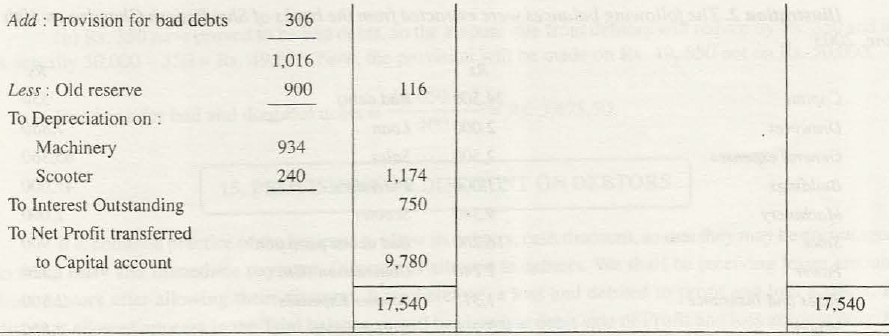

- Depreciation in the value of assets

- Appreciation in the value of assets

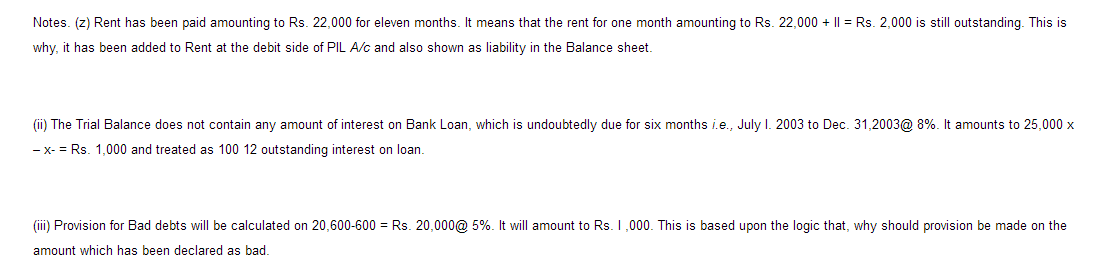

- Outstanding expenses

- Prepaid expenses

- Accrued or outstanding expenses

- Unearned income

- Interest on capital

- Interest on drawings

- Interest and dividend on investment

- Interest on loan

- Bad debts not in adjustment

- Provision for bad and doubtful debt adjustment

- Further bad debts adjustment

- Provision for bad and doubtful debts given in the trial balance

- Provision for discount on debtors

Links of Previous Main Topic:-