There are different types of accounts. Each of them is prepared differently. They are found in main nominal ledger and supports different features. The five types of accounts are:

- Assets: These accounts show you debit balance and they are created due to assets which can retain their value.

- Liabilities: These accounts would reflect debt of business and would come with credit balance.

- Capitals: These are the accounts which would represent investment in your business.

- Incomes: These completely reflect sales and other income which would increase profit. They show credit balance and credited to profit and loss account.

- Expenses: These accounts deal with expenditure that can reduce profit. They will show debit balance and debited to profit and loss account.

The ledger accounts can also be classified as:

- Permanent ledger accounts: It has opening balance apart from start-up business. These are the accounts which would show closing balances that happens at end of financial year and finally carried forward to next year.

- Temporary ledger accounts: These does not come up with any opening and closing balance. The accounts get closed at the end of financial year by transferring it to profit and loss accounts.

Links of Previous Main Topic:-

- Balancing of ledger accounts

- Book keeping

- Meaning of gaap

- Origin of transaction

- The concept of debit and credit

Links of Next Accounting Topics:-

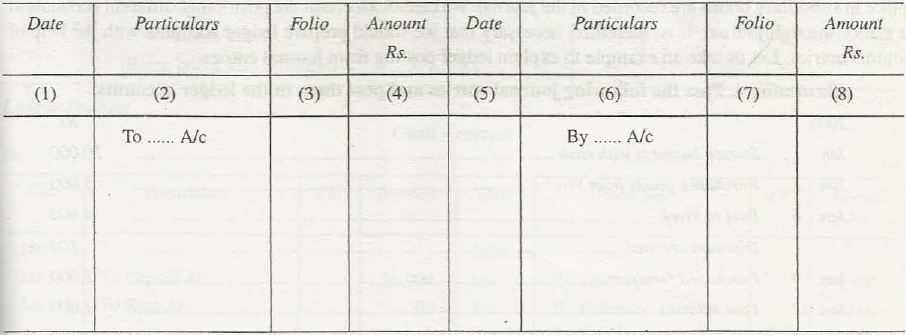

- Distinction between journal and ledger

- Importance or advantages of ledger accounts

- Ledger posting from cash book

- Ledger posting from journal entries

- Ledger posting from purchases book

- Ledger posting from sales book

- Meaning of ledger accounts

- Summary of rules of posting form subsidiary books

- Theoretical questions on ledger accounts