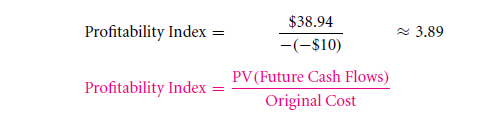

A measurement that forms as that of the used method in the concept of capital budgeting makes and takes the position of profitability index. The ones that gives a total of future cash flow value, then it will divide the factors. This will make the initial cash flows that is mostly negative.

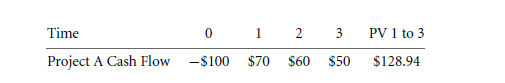

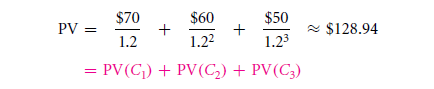

In the aspect that supposedly the project that you are handling, is with a certain cash flow with a massive cash flow with the particular 20% that is made on the yearly value. this would be firstly computed into the PV of the cash flow in the future,

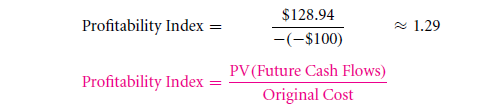

When you extract the $100 cash value from the NPV that is $28.94, the PI or profitability index will be,

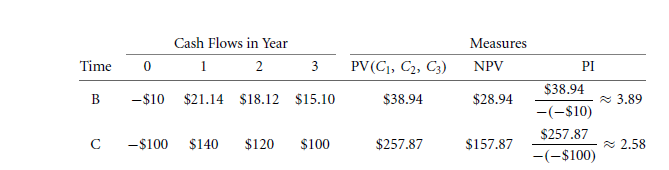

Many managers will be intrigued with the basic idea of following up on a basic relative performance with many cash flow positive.

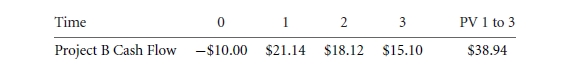

In the above given example, you will notice that the NPV is of a value $28.94. This value is the same as in that of the original aspect. Though the NPV is just like the secondary capital, it may even be less of a risky deal. It can even be very deceptive to the outward look of the investor.

This will however not be a specified value as the risk that you live in is of the future cash flows.

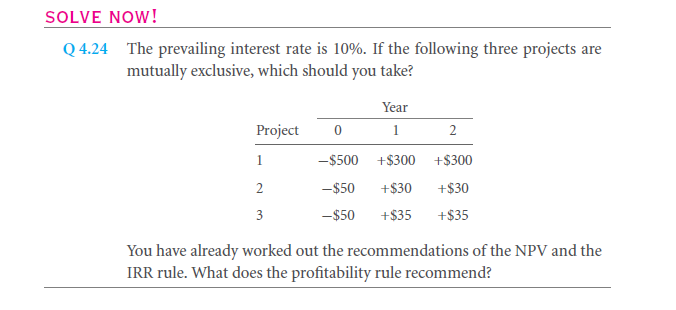

Just like an unfortunate anomaly, this particular feature makes up for the major disadvantage that is created in the entire area of advantage. No one can use the PI in the calculation of the various projects that are in hand. Let us take for an example, supposing the first project of yours gives a return that is twice that of the cash flow that too all in the future period. Hence, the project in hand is a much better option at hand.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Net present value chapter 4

- The internal rate of return irr

Links of Next Financial Accounting Topics:-