Prepaid expenses going by general terms are those expenses that are to be incurred in future but have already been paid in advance. Thus, it can be taken that these expenses have not been utilized in a particular manner and it still has its expiry date left. Hence, it can be used in future for further plans and expenses.

It is not only used in business domains but also placed in high importance in areas as insurance and paying for premium amounts.

Example: In this case,insurance premium is taken at $2500, and paid on April 1, 2005, for a whole year. Though Accounting period ended in December 2005, premium has been paid till March 31st, 2006. So, it is taken that monetary amount has been paid for January 2006 to March 2006, though it belongs to the next Financial year. This can be stated as premium amount of insurance for 3 months have been prepaid or paid in advance, and its value has still not been completely expired.

Presentation in Final Accounts:

In final accounts presentation, there are two points that need to be taken into consideration.

- Prepaid expenses in adjustments:

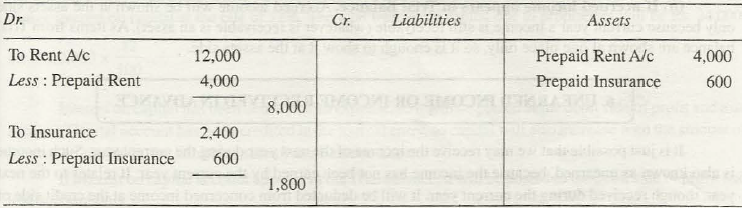

When prepaid insurance is taken into consideration, a debit balance is depicted and that too on assets side of the Balance Sheet. The prepaid insurance, in this case, would be depicted from insurance on debit side of profit and loss account.

Known as unexpired expenses from where monetary benefits can still be drawn, this is associated with expenses of the next year that can be used.

Example: Taking the Financial year into consideration, say rent for a financial year has been paid at $12,000 on the May 1, 2005. Thus, rent for 8 months, till December 2005 is taken into consideration, and is related to 2005. While the extra payment for the next 4 months, that is from January to April 2006, has also been made and this is considered as unexpired value. Hence, this is known as asset.

So, it can be said that $12,000 would be placed on debit side of profit and loss account.

- Prepaid expenses in Trial Balance:

In certain cases, counting can be made in Trial Balance sheet where monetary amounts as prepaid insurance or prepaid rent can be taken into consideration. Here the factors as unexpired rent as well as prepaid expenses would be shown only in assets side.

Links of Previous Main Topic:-

- Adjustments additional information in preparation of final accounts

- Depreciation in the value of assets

- Appreciation in the value of assets

- Outstanding expenses

Links of Next Accounting Topics:-

- Accrued or outstanding expenses

- Unearned income

- Interest on capital

- Interest on drawings

- Interest and dividend on investment

- Interest on loan

- Bad debts not in adjustment

- Provision for bad and doubtful debt adjustment

- Further bad debts adjustment

- Provision for bad and doubtful debts given in the trial balance

- Provision for discount on debtors

- Closing stock

- Summarized presentation of adjustments

- Theoretical questions final account