Proper knowledge of opening journal entry and closing journal entry

Importance of Opening Journal Entry

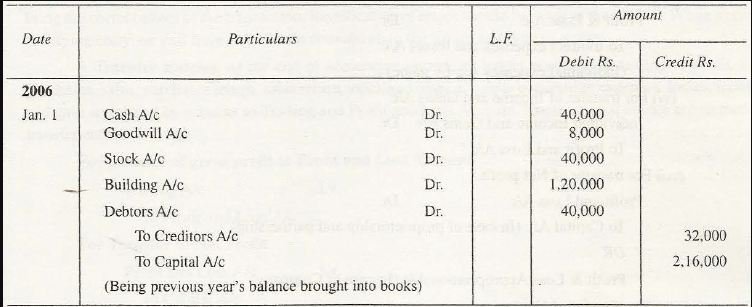

The Journal entry is the prime need of financial accounting. After completion of one accounting year, each section starts with a new accounting year. However, it is important for a business to carry the liabilities as well as assets in the current year. So, carrying the journal of the last year to the current year is taking place. Thus, opening a journal entry means the perfect record passing of the last accounting year of the current accounting year. Now, there are three important factors associated with this as –

- Assets

- Liabilities

- Capital Account

Asset always shows balance in debit form and thus accounts get debited. However, Liabilities, as well as capital account, shows credit balance.

Closing Journal Entry

Closing Journal Entry indicates that all records related to goods as sales, sales return, purchases, purchase return, expenses related to stock and various others as a loss, gain transfers to close the accounts. The transfers are done into loss account or gain account or trading account. These entries are known as closed journal entries. These entries connect with the debit and credit side and thus Trading, and profit and Loss are associated with it. These entries are different than opening entries as these do not have any opening entry.

Rectifying Entries

“Man makes errors.” It is true that errors can take place while entering the transactions and it is also true that modification, in that case, is very important. Many times an accountant is unable to understand the exact data, but at the time of preparation of balance sheet or any report for a particular period the error gets trapped by him. The reason is the proper balance of debit part and the credit part. It is very important for a transaction report to have an equal value of the debit part as well as credit part. When an error occurs, then unequal debit and credit amount indicates that there is an error. So, it becomes important to rectify these values to make a proper adjustment.

Adjusting Entries

Opening, as well as closing entries, are the simple terms through which an entry gets its actual motto, either the transaction gets closed, or it carries to the journal account of the current year. Now, there are many entries which are very important, but the accountant can neither carry nor close. Suppose sales on credit of goods of the last year of accounting before closing account provides a good profit to the business, but it becomes impossible to make a proper transaction at the same time. Moreover, this should not be shown in the journal entry or close journal entry. The opening journal entry cannot place it on the record, and this is the main reason that some transactions need to be adjusted. So, this kind of entries is known as adjusting entries. This adjustment takes place in the current accounting year; however, the profit has been taken place earlier.

Entries are there to make the accounting transactions perfect, but it becomes difficult sometimes to enter the records in accounting. So, an adjustment needs to be done very carefully. It is very important to make a proper entry, which is not possible. Now, it is clear that why the adjustment is important.

Some items are not allowed to get entries in subsidiary books

There are certain areas where entries are arranged in a different manner. Go through some following points to know it in a better way –

- Interest – When interest on capital needs to be entered, then it does not have a place in any kind of subsidiary books because the capital account of the proprietor gets credited. Thus, journal proper is used to enter an interest on capital.

- Purchases on credit – Some articles or items are not related to the business goods or business products, but the company purchases these articles to use as assets. This is the main reason that anyone cannot enter these items in any type of subsidiary books. However, goods related to business are needed to be entered in purchases on credit journal. So, journal normal is important here.

- Sales – Sometimes sales of assets need to have proper entry and journal proper is the right place, because it is not a sale of articles on credit. Moreover, it is different than cash transactions, so it is important to keep every record in journal general.

- Personal use or charity or funds – Articles provided to the charity or for personal use do not match for any particular subsidiary books. So, journal normal is an exact place for this.

Transfer Entries

Whatever entries are made during a complete period of an accounting year gets closed with proper transfer. The transfers are done to know about value of trading in a proper way, and Profit or Loss is determined. Thus, each entry in the subsidiary book is known as transfer entries. Henceforth, sales return, purchase return, sales, purchases concern the exact gain, income, or loss. So, all these entries are known as transfer entries.

Perfect knowledge of Debit note or Credit note

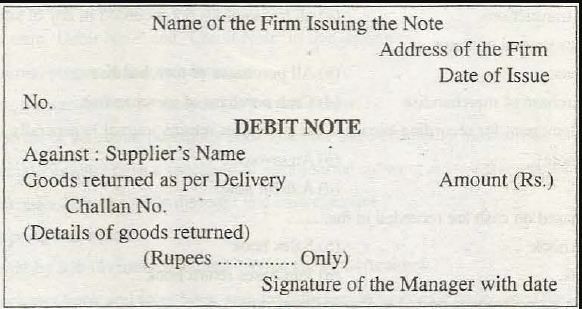

When purchases return takes place, then the amount in the seller’s account get reduced. It means the transaction in subsidiary books on purchases sales on credit gets its entry, but in case the seller gets a return from the purchasers, then the credit account of the purchaser will not be the same. So, purchaser’s account gets credited, and seller’s account gets debited technically at the same time. But, a debit note is important here from a purchaser’s side to acknowledge about the debit. Debit note has great value as it takes place to maintain the subsidiary books in a proper way.

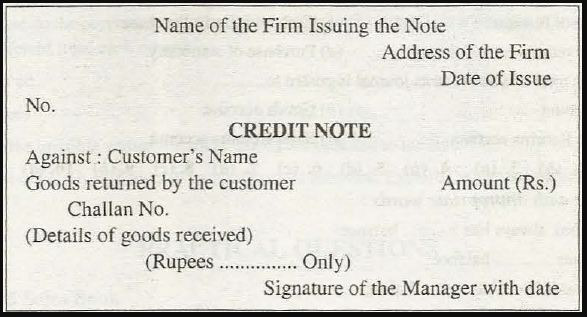

When sales take place, an account of purchaser is debited, and the account of seller is credited. However, in case of returning to the materials account of seller gets debited and purchaser gets credited. At this time Credit Note is important, and seller sends to purchaser to maintain the records in a proper way.

Credit notes are sent to the purchaser and purchaser sends debit note against it. In this way, records can be kept properly. Maintaining record is important for subsidiary book and if difficulties take place, then balance sheet, and other problems can be seen. So, proper knowledge of subsidiary books along with exact knowledge of credit notes and debit notes are significant. In case or wrong invoice, addition of goods amount and defective of goods, return is possible and in that case credit notes is provided by the seller.

This is an exact description through which anyone can easily understand about how to know the various phases of journal entry.

Links of Previous Main Topic:-

Links of Next Accounting Topics:-

- Balancing of ledger accounts

- Meaning of trial balance

- Balance sheet in final accounts without adjustments

- Adjustments additional information in preparation of final accounts

- Meaning of bank reconciliation statements

- Bills of exchange concept of bills of exchange

- Errors affecting or disclosed by trial balance introducing the concept

- Meaning of depreciation