The already learned and used NPV platform exists only in a perfect world. You will be translating the cash flows at various points that too in different time dimensions which alters as the variant that is present as that translates before it can be equaled or be in addition. The translation will be held in between the upcoming values and current values. The variant is added and the essential concept is finance.

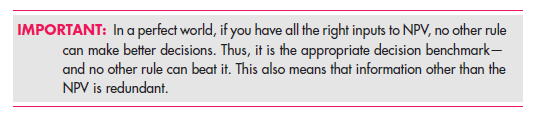

Why is the NPV the right investment for rule? The reason for such remains that the perfect world is filled with perfect information and that too as a progressive NPV project. This is very equivalent for the free money. Taking an example, the money that you borrow or lend may be used as the one where you get an investment option. That too for free.

If supposing you borrow a sum money at the investment cost of $1 and yields up to $1.09 at an interest rate of 8% then you can contract a receive of $0.01 on the following year that too for free. Thus, refusing to work on this particular project is going to be stupid.

On a similar note, anyone can sell the investment to someone else. That will of course be for a sum of $1. This will further be yielding a sum of only $1.07 in the coming year. So you earn only a $0.01 as completely free. As the rejection of this project will be that of making no sense.

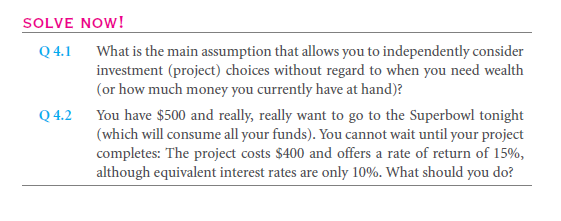

4.1a Separating Investment Decisions And Consumption Choices: Does Project Value Depend On When You Need Cash?

In the perfect world, must you choose to let on the preferences among the NPV projects and the timings of the cash flows that will eventually influence the life decisions? Maybe the ones that you want prefer are that you do not wish to incur as an upfront expense and also that the money is saved up for the future and along with that will you not want to make sure that your preferences.

The money that you must be parallel to your decisions and must defer in every possible way. Perhaps what you want is to make your decision and to save money for the future. This can be done by limiting the consumption and by saving the rest for future. Are not these all important factors that will work to make your projects better and this will further let you choose the projects that you undertake? If the answer to this question remains as a big no, then, the worth of the project at hand will be equivalent to the net present value. This will further be as a worthless position.

As taking the example of the perfect world and global market, the total amount of cash is not that big of a factor to the owner. You must be knowing about the total time value that is decided for the money. The cash that is of today’s is that the value of the money for the future. Just submit your money to the bank account and this will further be deposited to earn off the rate of interest. The money shift that is made is in fact between the transitory time periods which offer the proper ‘exchange rate’. This further shows the time value that you get for the money.

Assuming that someone has cash that of the value $150 has the exclusive hand in to the projects that anyone has a cost of $100 what you really want to do for the next year lays on your soul hands. This is in fact the shifting at your own will ordeal that will later explain the importance of having a claim to the ownership.

The return that you get is of $200 on the coming year. The rightful appropriate cost of capital that one gets with the interest rate is 10% what you would most likely be lively?

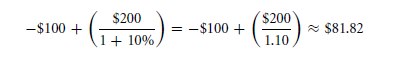

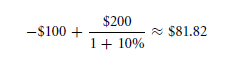

So by what rate do you wish to continue consuming this? What would take in the project as for the total NPV on the perfect ideal market? The total value will be:

- Selling of the area of project that you undertake will showcase the value of that perfect market that is of:

- Spending the entire of $150 + ($181.82 – $100) ~$231.82 at the present date. What you can be better off by taking the hand in project than consuming that will just $150 amount as cash in hand.

How and when will you consume the project that is at hand? Will you be taking this project? The answer lies as:

- Selling of the project that is in hand at the sustaining market, with a rate for:

- The $81.82 will be inserted in a bank head 10% of the present date. This will result into a total value of $90 on the coming year.

- With putting the $150 to the bank account with the interest rate of 10% again. The sum that will be received on the coming year, will be that of $165.

- The coming year will be consuming a total of $90 + $165 which is $255.

The simple solution can be taken into the starting of the project that is at hand. All that you need to do is invest the $50 to a bank account.

The entire point of discussion will be very simple. That is what ever being your decision for the project be, the grounding limit making all the initial investments. This further shifts the consumption bar whichever way that you want. The consumption decisions to the investment decisions.

The entire ordeal is called separation of the decisions. What you do is that you initially make the decisions surrounding the investment and this will be without accompanying the decisions of the preferences as a consumer. The separation decision does not hold back the ones of the imperfect market. This is the story that you get to experience when you borrow up amount in cash from various different interest rates.

So, come let us apply the rules that we read here. The thought of losing the money that they have taken from their clients many a brokers have this consumption truth that they experience. This realization is often that of a long term and not for the short term. This works negatively as the longer term of investment works in a smoother manner than the short term one. No matter how much the investor needs, the money is often given off as the proposition as that of the smaller investment that usually does not make sense and if anyone makes a purchase of it by making the lesser term to be a non-viable option. This and the broker will always make a purchase of the maximum of the NPV investments. Hence, clients get the most money out of this as if they cared most about the future consumption. Everyone can have a whole lot of cash by looking down at a NPV investment that is too high on the extra cash.

How Bad Are Mistakes?

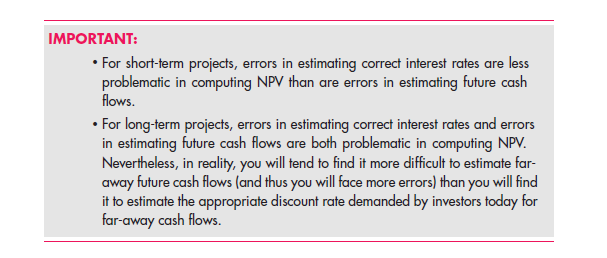

Errors In Cash Flows Versus Errors In The Cost Of Capital

Though the getting everything on a perfect note would be the better choice, this remains to be one of the most challenging. The estimations are pretty bad. The mistakes are accounted for a very crucial one. So how bad exactly is it? And is the whole affair worse than to make an error while estimating the cash flows? To provide an answer to this question, what we do is a simple scenario analysis. Here we will consider a very simple project that will change up the existing estimates. Scenario analysis is hence very important and is also an alternative outcome to the sensitivity analysis. (in chapter 12, this will become an important ratio when you will be working with true options.)

The short term projects:

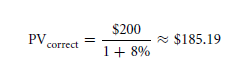

Let us assume that all the projects that you have on your hand gives off the amount of $200 in the coming year. The interest rate value will be such as that of the proper projects which offer 8%. Hence, the right value of the project will, be with the present value which is,

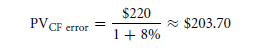

In case of a 10% error, the cash flow will be mistakenly that in the return rate of $220. Hence, the present value will be that of,

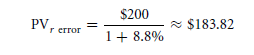

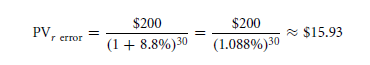

The total difference that is made in the total value of $203.70 and $185.19, we’ll be a total 10% on the present value. Which will in fact be contrasting to the 10% error made by you on the interest rate or the cost of capital. The expected interest rate will be of a 8.8%. this will be so rather than being a full 8% you will be using the present value that will be of,

The total difference will be in $183.19, being lesser than $2. Hence, a total of 1% error is created.

The long term projects:

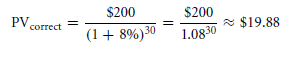

Taking the example of the above, assuming that cash flow is going to occur in that of 30 years duration. So the present value will be,

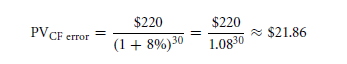

The total of 10% cash flow error is that of the entire present value. Which is,

The 10% present value is hence,

The calculation further shows a cash flow estimation as that of filled with various errors and the entire rate of interest rate will be very important. The long term projects will be of estimating the value instead of the correct rate of interest as for the political correctness, the argument remains to be very misleading. It looks more like a voodoo rather than science. The uncertainty will stick deep within and will bring very contrasting anomalies. The long term of the horizon will be a very deep one, one where there will be little righteous cost of the capital. The cash of flow estimation may be very difficult but, there seems to be no alternative. What you must do is try to make the best out of the prediction that is made.

Links of Previous Main Topic:-

- Introduction of corporate finance

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

Links of Next Financial Accounting Topics:-