The primary objective that this book holds is that of teaching you all the concepts to apply on firms. Your goal must be such is to learn about how to determine projects and their values in respect to the given cash flows, if one is reading this particular book. So what is the only solid best law? This is easy; it is law of one price.

The example with a Camry is the ideal logic that even governs corporate allocations in the existing real life. There is an often close comparable which make the relative valuation point very feasible. Let us take an example, supposedly, you wish to invest value on the new factory that one wish to build on Rhode Island, one get many alternatives. Alternatives such as: you have the freedom to determine the costing that would be needed to buy a factory in Massachusetts, or either, you can consider to determine the cost in Mexico.

You could also analyze the cost it would befall if you simply purchase a total output of the factory from a different company. Or you can even determine total costing that you must invest in the stock market instead. You can even choose the liability to invest the money in the savings account. The entire decision to whether build a company or not is upon you that is if you know how as to estimate the factory’s worth which is relative to other opportunities. However, all such projects are not easy to be valued in relative spectrum.

Like for example, the worth of construction of the tunnel across Atlantic ocean, calculation of such a number is very difficult. Or what would be the worth value to control global warming and or even to terraforming the mars to make or create it even remotely habitable for the human beings. There hence is no easy go to alternative object to bring in such comparison such large projects, so the valuation is basically haphazard in nature.

If and only if any corporation determines the worth of certain projects, only then it must take up or even decide to pass them over. Here, in the book, we will learn of that all projects have unique worth and that firms must taking all projects which add up to a certain value. This of course, is in account of the world being perfect. Later, as the book progresses, we will explain the world in a realistic demeanor, where you will be taught to recognize that all projects can all have worth different than other firms. And in such cases, you will have to take position of a business organization into account on the decision making of project approvals.

The owners of companies are mostly not a manager, this is an interesting factor of the corporate decision making strategies. Managers are in fact hired professionals. Decision to hire managers for such a publicly trading corporation with millions of shareholders is not that of the owners, rather, it is made as the representatives and other managers.

However, as the unfortunate rule, managers are not granted with the free will to randomly ask their owners to fulfill their desires. A basic knowledge about the firm life is that these owners have the expectation that the managers are to maximize such a firm’s worth. In an ideal world, managers know what to do, you will learn so. In the practical world that we reside in, this determination is mostly difficult.

The expected manager behavioral – how should it be if the manager dislikes investing in a pack of cigarettes is a difficult thing to access. Many owners may believe so that the firm can get a hold of many opportunities if it sells green tea. Many owners may believe that there is a need to invest and build warships.

Many business owners may want to invest money in a bank, while many firm owners have their hopes set on getting their invested money being returned them as profit. All these fellow problems will be addressed in this book by the through explanation that we cover.

The interesting ethical questions that are raised on the point of need for the managers to decide upon for appropriate objectives is beyond this scope of syllabus that we cover in this book. To mention on one in any case, I would state he following. The standard default view of corporations which are set out is to maximize owners wealth. The rest of the legalities are rested upon the lawful hands of a government to make up such rules which are able to put up with only ethically appropriate methods and boundaries of the business corporations. This results in some of the public institutions lining the frame work t passing laws that induces the reduction of sale of harmful products like cigarettes, and not on the role that corporates to restraining of sale.

The common point of argument that these lawful institution produces is that even if your firm does not sell them, other constitution may sell them. (It is the view point that the world has adopted. This is just a certain framework to help students in understanding the moral beautiful obligations that are faced.)

As a matter of fact, the selling of harmful products is not only the difficult part, these restraining and moral laws are passed on by legislators those who get the two way donations from various tobacco corporations. (The intention of a two way “communication” is hence intentionally is set up by public institutions.)

So what will the various obligations “moral” that tobacco firms have? You first and for mostly need to know about the worth maximization before moving to the set of tougher questions. As, for the maximum part, we will stick to the value of maximization as a corporation main objective in this book.

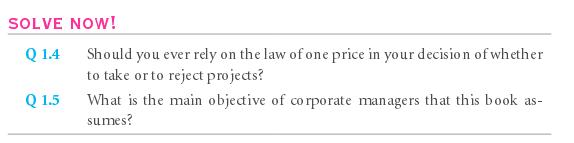

So let us begin by giving a look on how to estimate the project value.

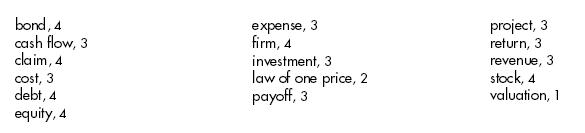

Key terms

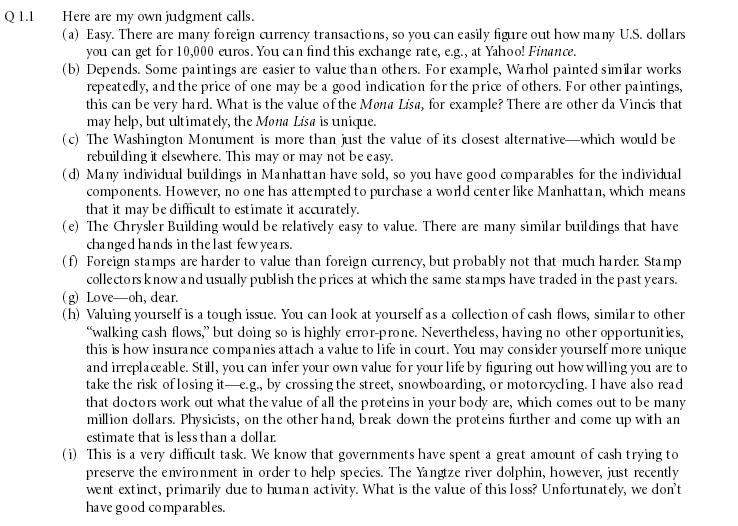

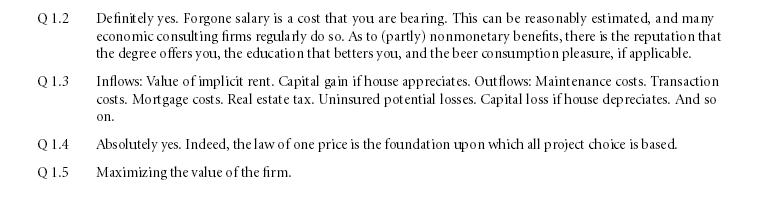

Solve now! Solutions

Problems

Links of Previous Main Topic:-

Links of Next Financial Accounting Topics:-

- The time value of money and net present value

- Stock and bond valuation annuities and perpetuities

- A first encounter with capital budgeting rules

- Working with time varying rates of return

- Uncertainty default and risk