Project is the majorly basic thing that is involved in finance. Every project in finance is a completion of flow of money i.e. cash flows. Cash outflow is required in all projects (investment/ cost/ expense). This upfront flowing of cash is then thoroughly followed by cash inflow (payoffs/ returns/ revenues). Sell the Prada bags or haul garbage – it simply does not even matter. Money earned is the money you have.

Though it has to be made sure of that all the costs and benefits of such are inclusive in it. Even if you detest it, even if you haul trash, you need to translate the negative feeling. So, that you may get cash. This cash is noted as cash negative. The way to turn your cash into “positive”, is by taking the “fun” out of your joyful work. All the positive and negatives i.e. inflow and outflow, is taken from a project called “black box”. These projects are further undertaken and are converted into rightful terms that solve cash issues.

The emphasis that is being put on the capital and cash of a firm, does not lessen the importance of – manufacturing, sales,inventory, marketing, competition, payables, working capital, etc. in fact, these factors are very necessary in building up a process of cash flow. Knowing where these aspects come forward and collaborate in to give effective results in the given future, this gives a better result in getting the right cash flow.

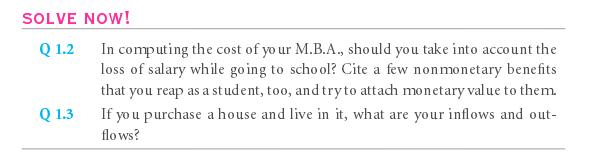

All projects are not physical. There may be a company for example, known as “customer relations”, that works with righteous cash flows for the present time and uncertain inflow of cash. You being the assumed project in this example are the project: thus, paying for education (cash flow) and earning in the future job (cash inflow).

You must incorporate a cash value in the degree if you have faith on the prestige it offers. This counts as one of the cash inflow medium. Quite a few payoffs from education are metaphysical than simply a physical adoration. For those who like to make friends in your school or if the education provides one with the knowledge then either from today or tomorrow, you can yield the positive value and get the cash flow. (The worth of such finance makes it very easy to put forward cash value numbers in exchange for other such emotional factors.)

For many pupils, the learning process can be very unappealing and must be further factored as a big cost number (equivalent cash flow) – however, I believe that you are not among them all. Such non-financial cash flows can be transferred into all cash equivalents i.e. when you get a grip on the good project valuation points.

A company is targeted as a group of certain projects in a financial statement. In this book, you will find that a firm’s value is nothing else but the entire costing of all the project net cash flows. The metaphor is thus extended on to any family by assuming that your family owns a house, car and have many tuition to make payments as well as educational investments so, the list goes on. These all are collectively termed projects.

The two main and individual sorts of projects that you could invest in are bonds, stocks which are also referred to as equity and debt. Firms usually sell these to investors referring to these as financial claims. You can further learn that he buying and selling of a bond is equivalent to lending of money to of course the cash issuer. A bond holder is hence, just a mere creditor.

For such example, one lender may purchase the $100 bond from a firm in the promise making of returning the borrowed amount with an extra $10 rate. i.e., the total amount summing up to $110. This is done on the next year. (The bond is and must be paid for initially in case the firm performs poorly, thus making it lowers in the temperature of risky for any investor rather than a firm’s equity. It is however limited to the upside.)

The firm has many additional obligations, like money which is to be paid to the suppliers (also called “payables”). If altogether, you are own all the outstanding such claims on a business company, and then it summed up into all the stock and obligation that means that you are the owner of the existing firm. This is not a very intense logic, rather it simply means that there is no one else, rather: “you are it.”

Being the 100% sole owner of the business enterprise, you possess the ownership of all the stocks, bonds, and other such obligations of the firm. Then your company does business and earns money, hopefully. The companies however, do not need any help to pay off its gradual earnings. Rather, it can even reinvest in the money. In spite of all the firms’ actions, you are the sole owner of it. Thus, this further states that you know the whereabouts of the total cash flow that your firm is earning, i.e., after adjusting all the necessary investments.

The other potion to glance at a business enterprise is to understand and perceive that there is a need to be recipient of the total cash flows which the company will eventually pay. That is in the form of interest dividends or payments, and by adjusting all of the money that all you may put in the business in the near future.

The total cash flows of a firm must be so equal to a firm’s total payouts and will immediately follow up with all the payments that satisfy stocks and liabilities. This entire list of equalities will all state a same thing, which is “value adds up.”

In this book, we will be spending a lot of duration in the discussion of claims, most importantly equity and debt forms of such financing – however, as for now one can easily consider that both equity and debt are simple and delicate investment projects.

The projects display the meaning: owner puts in money, and the investment projects pay the money back. For all the bond and stock investments, it is a reasonable affair to take into assumption that investors enjoy only the non-cash benefits like emotional attachments.

Links of Previous Main Topic:-

Links of Next Financial Accounting Topics:-