Introducing the concept

In this present fast-paced life, individuals are exposed to various risk factors like tough competition, unpredictability and various other risks. With technology impacting human lives in a never before way, there has been a rise in automatic competition among individuals and organizations. This has resulted in competitors being unable to understand the preferences of their customers among the several products available in the physical market.

It is in such cases that the need of a proper planning emerges. An important part of effective management, planning deals with what to do, how to do, when to do and where to do. This leads to an effective scheduling of the future course of action. Thus, if you have a pre-determined budget planned, it will help in eradicating the unwanted expenditures, adjust with every change in financial situation and accomplish your financial goals without any hassle.

Defining the concept

According to The Chartered Institute of Management Accountants of England, budget is a monetary plan prepared from beforehand for a definite duration depicting planned income in a way that achieves a certain objective. Basically budget helps in prioritizing the expenditure and managing the money.

Why is Budgeting needed?

Without a proper budget it becomes impossible to attain specific targets and have performance evaluation. Whether it is a business organization or a government or an individual, everyone needs to have budgeting for effective operations.

Once a company sets its targets, a performance evaluation is needed where a desired target performance needs to be compared with that of actual performance.

About Budgetary Control

As per The Chartered Institute of Management Accountants of England, budgetary control is the initiation of budgets in relation to the responsibilities of an executive as per the policy and constant differentiation of actual results with that of the targeted one.

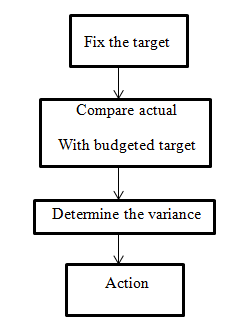

The steps to have an effective budgetary control are-

Step-1: Setting a target

Step-2: Comparing the derived result with that of the pre-determined target

Step-3: Evaluating the difference between these two

Step-4: Taking suitable action

Budgetary Control- Its advantages

The advantages of having budgetary control are as follows-

- Better efficiency

Budgeting brings efficiency and promotes economy in the company. Moreover, it is an effective way of having control over unnecessary costs.

- Co-ordination

This brings forth co-ordination among various divisions and departments of a company. Employees have a sense of mutual co-operation and team spirit among themselves.

- Profit Maximization

By having proper utilization of resources and control over costs, it aims in increasing the profit percentage of a company.

- Responsibility

This creates responsibility among various divisions and departments of a company. Thus, everyone knows what they are expected to do. Through this, the management of a company further decentralizes its responsibility without worrying about the operations of their business organization.

- Proper Communication

While framing a budget, the feedback provided by lower authority levels of a firm is also considered. This is because each department prepares a budget of its own by consulting with the staff of its department. This leads to two-way communication in an organization.

- Evaluates Performance

By comparing the achieved performance with that of the pre-determined goal, the performance of an organization is determined. It highlights the weak spots of the organization.

- Forecasting the need of credit

With a well-structured budget, the organization operates in a way that it can raise ample credits from various financial resources. A pre-determined budget enables the finance manager to forecast the need of credit from beforehand so that he can make necessary arrangements.

- Reduces Cost

Budget leads to an increase in efficiency and cost reduction. Thus, the production costs decrease by increasing the volume of production. Further, reduction in cost also helps in incurring better profits.

- Balanced Capital Structure

A well-developed budget helps in achieving a balanced capital structure. Neither does it lead to over capitalization nor under capitalization.

Limitations of Budgetary Control

- Inaccurate Estimates

Budgets are developed as per estimations and forecasting of needs. However, its success depends on the level of accuracy of these budgets as there are chances of the estimates being fully accurate.

- Human efficiency

For a budget to be successful, it is important that the people working in an organization have team work and co-operation among them. Unless and until there is proper efficiency among the employees, a budget will not be effective.

- Other factors

Factors like sudden changes in the government policies, inflation, deflation and economic policies affect the effectiveness of a budget.

- Not a substitute for effective management

It is true that budgetary control forms to be an important tool of decision making in an organization. It even helps the top-authority to take right decisions. But it cannot be a substitute for a management with lack of administration. Unless and until it is read, understood and implemented, it cannot work.

- Time-consuming process

A budget cannot start showing actions immediately. It is a time consuming process and thus it takes time to show results.

What are the Pre-requisites for an effective Budgetary Control?

For making the budgetary control a success, there are certain essentials which need to be fulfilled. These requirements are-

Support of top-management

The top-management needs to have faith in the significance of budgetary control. For utilizing the budget, it is essential that the top authority of the company supports it.

Proper Co-ordination

It is important that there is effective co-ordination among the people of an organization for the budget to work.

Flexibility

Budgets should be made in a flexible way. If the business condition starts differentiating from that which was expected, it is important that the monetary plan is recast quickly.

Authority and Responsibility

For making this budget a success, it is essential that the company has a well organized setup along with responsibility and authority.

Motivation

Staff of an organization needs to be strongly motivated towards the fulfillment of a budget. This will lead to better achievement of goals.

Goal Orientation

The budget needs to be a reflection of the objectives of that company. Further, the goals should be clearly specified for better fulfillment.

Efficient Organization

To achieve success in budgeting, it is important that the company has a proper organization structure. A company needs to have fixed budget committee, responsibility centres and budget controller.

Links of Previous Main Topic:-

- Introduction to accounting and branches of accounting

- Preparation of final accounts

- Introduction of fund flow statement

- Introduction cash flow statement

- Ratio analysis significance of ratio analysis

- Fixed assets and depreciation meaning causes objectives methods and basic factor

- Cost accounting concept objectives advantages limitations general principles and cost sheet

- Job costing

- Introduction process costing

- Activity based costing introduction concept and classification

- Introduction inventory pricing and valuation

- Standard costing introduction

- Management accounting

- Marginal costing

- Relevant cost for decision making

- Budget and budgetary control

Links of Next Finance Topics:-