Accessing values – how are you supposed to do it? Finance is mostly based on some or the other form of law of one price. This is the same deal for this book as well. The principle suggests that identical objects must sell at a similar rate in a same venue. Or else why would you make a purchase of the more costly stuff? The law of one price – is hence the principle upon which all costs are assigned.

It is thus important for you to realize the meaning of value in topic of finance is hence in a relative term. The reason for such determination is to analyze whether an item that costs moreover equal to than the alternate that sums up to an absolute true value.

Let us explain the above listed theory with an example. Say you are the owner of a Toyota Camry 2007 car. If you come across other identical car models – in the sole aspect of dimension – to your Toyota Camry car, it should have the same market value on selling it. Fortunately though, the value placed for a Toyota 2007 Camry is not difficult to fetch.

There will be many Toyota Camries 2007, Toyota 2006 Camries, Toyota Camries 2008, and Honda Accords 2007as well ready for a purchase. If however say there are existing ten other exact cars on your same area block for car selling purpose, the competition is tough and will result in reduction of your valuation.

Have you thought of what occurrence would take place if you put a wrongful market value on your Toyota Camry? If the value is too lowly set on the car, it would sell on a very low price. Hence the profit percentage will be less. If the value is put to be too high, the car may not sell at all. You will naturally wish to get hold of the correct value of your car.

A relative way of comparing your Toyota Camry to other alternate car models, is by assuming the “opportunity cost”. The ownership of your car does not come for free. You main motive must be to sell own Toyota Camry and to purchase another similar Accord or Camry with the money that you earned.

Assuming that the Honda accord is the ideal car and someone offered you a $1000 more than the Accord’s value for the Toyota Camry that you had put up for selling, that price that would be accounted as higher than the opportunity cost. In such a case, sell your Toyota Camry and buy the Honda Accord and earn an additional $1000 as profit.

The law or rule of price value hardly applies flawlessly. Mostly it applies as “almost”. Example, the Toyota Camry you are the owner of may have travelled 65,334 miles, and is located in the providence and also be green in color.

The other comparative cars might be far away in the East Coast and have travelled 30,000 to 50,000 miles and are of different colors. Law of one price fails to work in such a case. The value of your car might not be on a comparative scale to that of these adversary cars. With a few adjustments to the price deal, your car’s market demand may come up again.

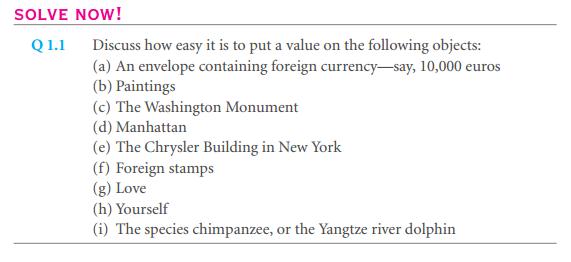

The ideal way that you access the value of an object is by relating to the price of similar objects. Thus not finding things to compare the valuation with, you may not analyze the cost efficiently. The perfect example stating this issue would be if you had to put a cost on your Toyota Camry based on your knowledge of the cost prices of plasma televisions, vacations, pencils etc. price will not be set correctly.

The reason for such is extremely simple. The more different the objects are, the more in comparability will arise in the comparison of values. Thus, it is easy to compare the rates of more closely related products than to compare entirely different products. Thus, it becomes easier to compare 2 products which may be difficult to compare.

Anecdote the joy of cooking: positive prestige flows and restaurant failures

Two among every five restaurants that are new close within a year of opening in New York City. There is an average estimate that suggests approximately 90% of these restaurants nationwide close within their initial 2 years. The successful restaurants earn a total return of 10%. The only possible reason why entrepreneurs keep on coming up with new restaurants every year is because they enjoy doing so and get a grandeur prestige that they get of owning such. If this is such a case then you must remember how much a restaurateur is happily paying for getting the feeling of prestige. This is just the way to hold the calculation of revenues that the particular restaurant generates.

Link of Previous Main Topic:-

Links of Next Financial Accounting Topics:-