Test Questions in Job Costing

- What do you understand by the meaning of job costing?

- What are the various benefits associated with job costing?

- Explain in detail the meaning of batch costing.

- State various limitations of job costing.

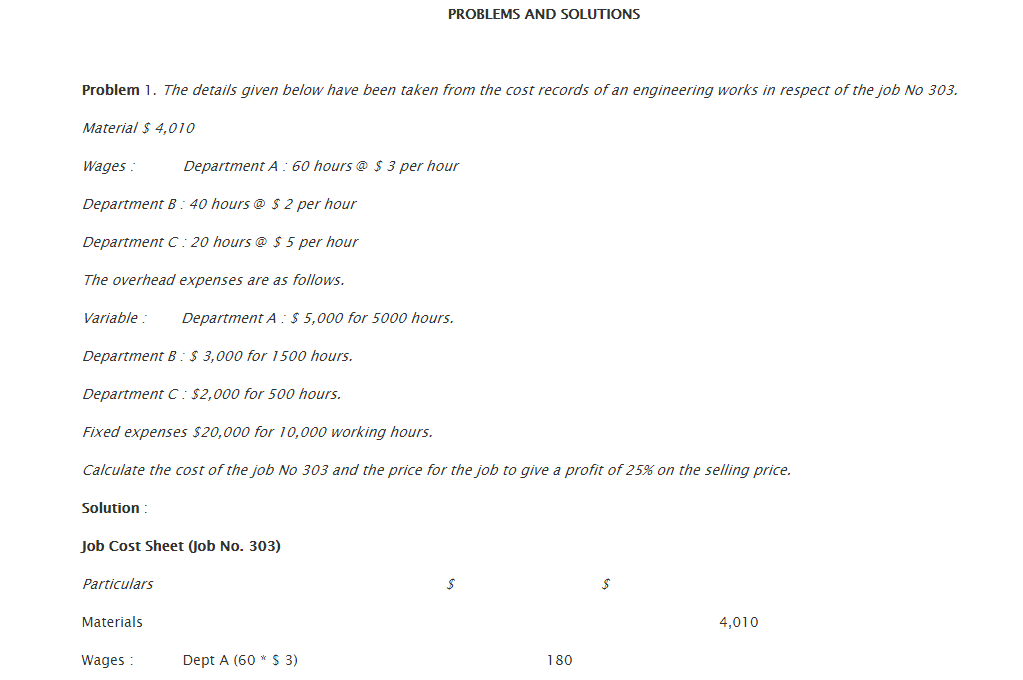

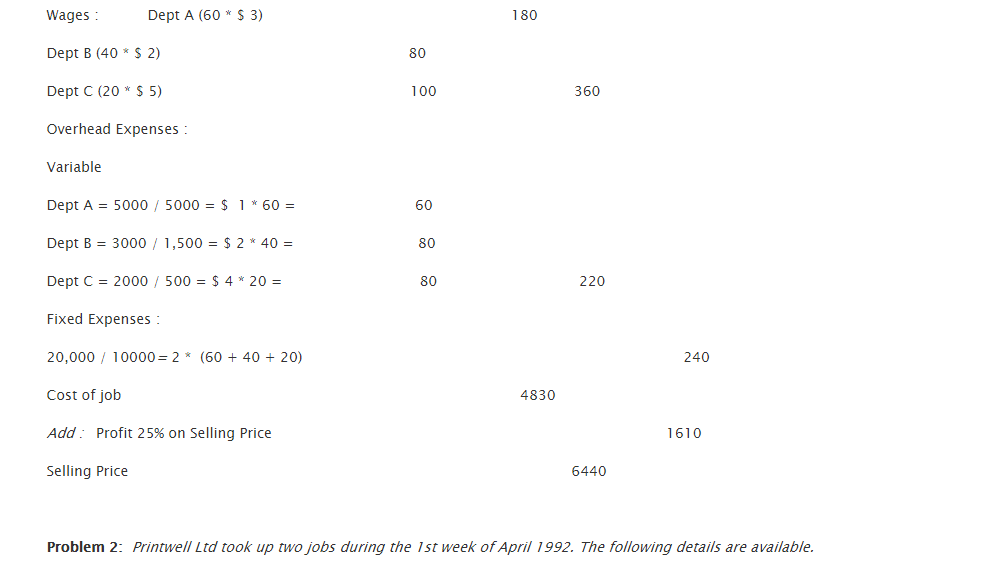

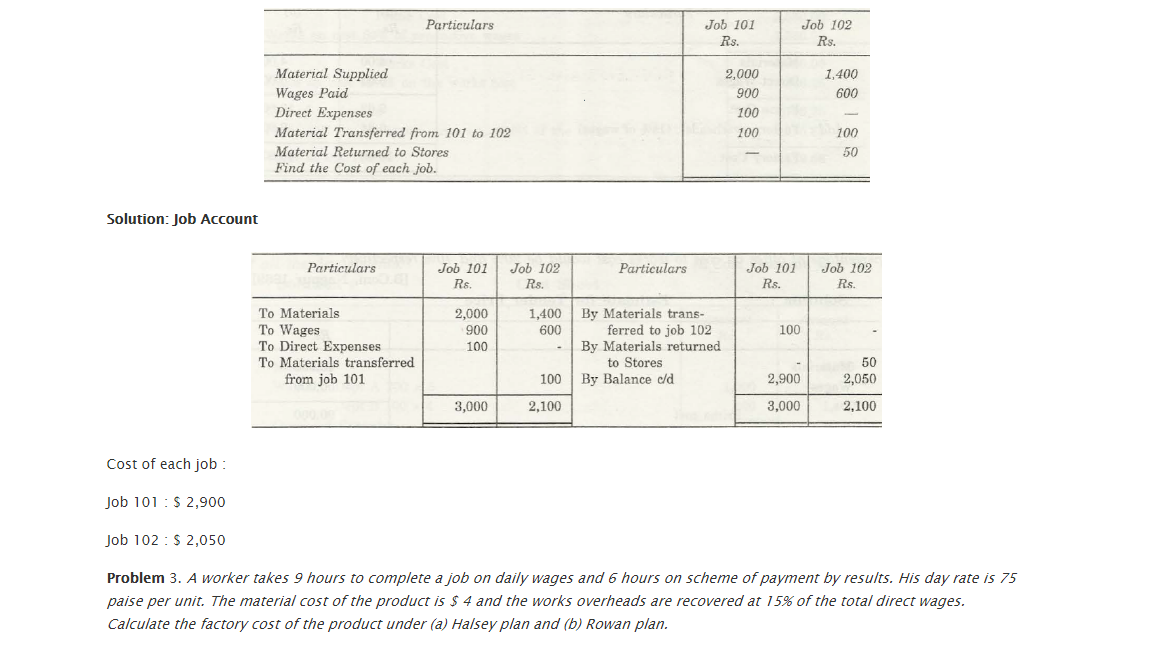

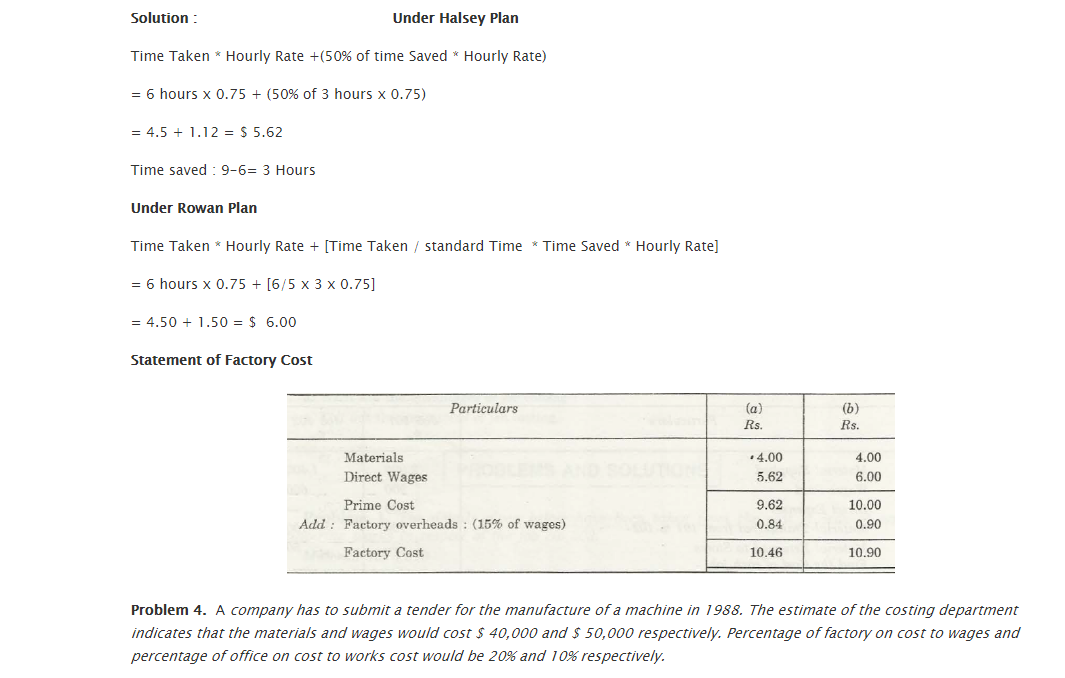

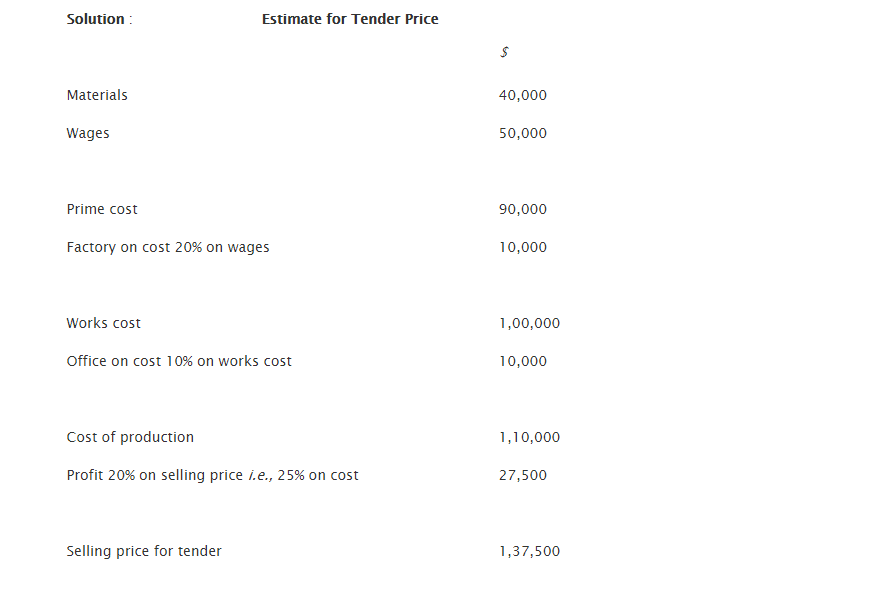

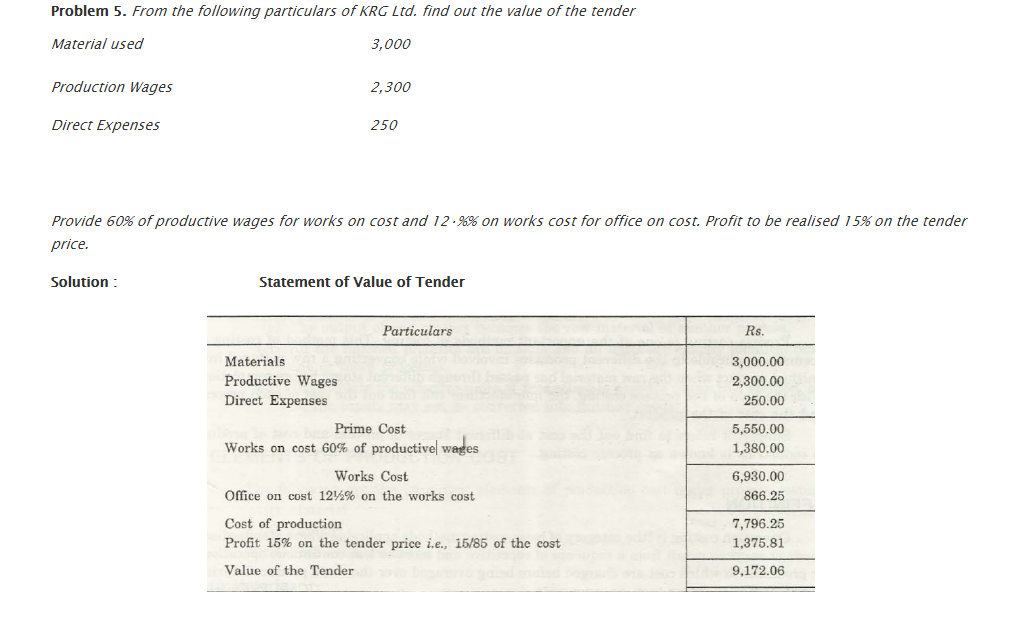

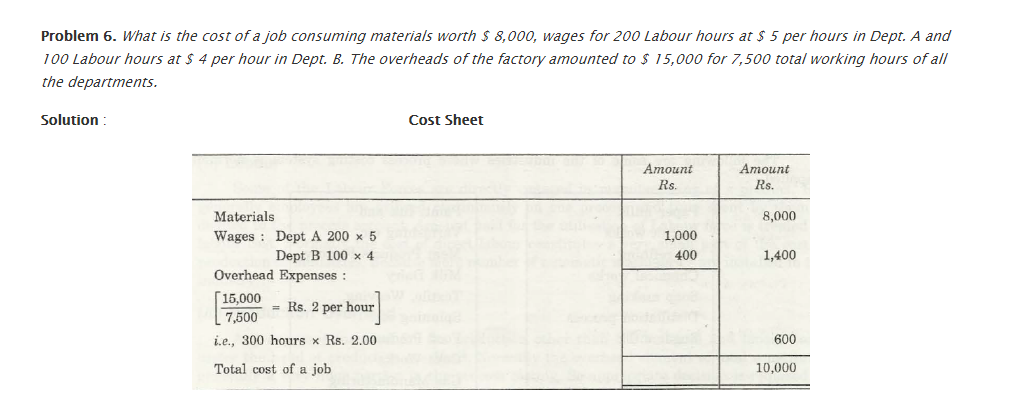

Problem and solution related to job costing

There are 6 steps which should be used for solving problems in job costing. Those six steps are:

- Identification of selected job which is picked as the object of costing.

- Point out direct rate associated with

- For allocation of indirect cost to the work, select appropriate cost-allocation medium for use.

- Categorise the collateral cost of individual cost-allocation medium.

- Calculate rate per unit of distinct cost-allocation medium which is used for distributing the indirect cost to trade.

- Calculate overall job cost by computing every cost which is direct and indirect and is commissioned to the work.

Links of Previous Main Topic:-

- Introduction to accounting and branches of accounting

- Preparation of final accounts

- Introduction of fund flow statement

- Introduction cash flow statement

- Ratio analysis significance of ratio analysis

- Fixed assets and depreciation meaning causes objectives methods and basic factor

- Cost accounting concept objectives advantages limitations general principles and cost sheet

- Job costing

- Limitations of job order costing

- Batch costing

Links of Next Finance Topics:-

- Activity based costing introduction concept and classification

- Introduction inventory pricing and valuation

- Standard costing introduction

- Management accounting

- Marginal costing

- Relevant cost for decision making

- Budget and budgetary control

- Limitations of historical accounting

- Introduction to responsibility accounting