The concept of Source Documents or Vouchers:

Any document based upon which a financial transaction is recorded in the books of accounting is known as ‘source documents.’ Among these, the documents which show the amount and nature of a business transaction are known as ‘vouchers’.

Once a business sells its products, certain invoices are prepared for sending their goods out of the workplace, cash memos for cash sales and bills for denoting credit sales. While the original copy is sent or handed over to the buyer, a duplicate copy is set aside for recording it in the books of accounts. It is these duplicate copies which are known as source documents and are further used for recording it in the books of accountancy. Similarly, the original copy which a company receives while purchasing a good from some other company is also termed as source documents.

Vouchers are the cash memos, bills, receipts, traveling allowance bills, wage bills, salary bills, registration deeds, counterfoils of cheques, etc. These vouchers can be any form of written document which validates that a financial transaction has happened so that it can be considered as provable documents of that transaction.

Source documents are significant in everyday life too. For example- while paying house rent to a landlord, a receipt for the received rent is received. Electricity Supply companies, Insurance companies, Water Works issue a receipt for the received rent to their customers. Employees of a company affix their signature on salary bills and wages bills when they receive their payments in the form of salaries and wages. This depicts that monetary receipts are received for every form of payments in all sectors of life.

Thus, in the case of accountancy, the first step is identifying the foundation of a financial transaction. This is based on a documentary proof known as source documents.

Source Documents:

Meaning

Accountancy is a subject which deals with facts which take place and are further proved by written evidence which is termed as source documents. These documents act as evidence that a financial transaction has taken place. All entries in the books of accounting are based on the information which has been derived from these documents. It is a must that in the case of accountancy a financial transaction has to be supported by source documents which are known as vouchers.

Types of source documents

- Cash Memo

It is a source document which indicates the details, amount and date of cash sales and cash purchases of a company. It specifies the cash memos which have been issued by that company on cash sales and the cash memos received on purchases. It is based on this, that cash payment, cash sales and cash purchases are recorded in the accounting books.

- Cheques

Cheques can be issued for various payments, either self-withdrawal or payments. For recording in the books of accounting, it is either the notes on the chequebook or the counterfoil of cheques which are taken into consideration. The received cheques are deposited through Pay-in-Slip into the book.

- Invoices and Bills

Invoices and bills are documents which are used for credit sales and credit purchases. For credit sale, invoices and bills are received indicating the amount, date and details of the sale. In the case of credit purchases; invoices and bills are received with the details of the credit purchase.

These invoices get prepared in three copies. While the first is sent to the buyer, the second is send along with the goods and third is used for books of accountancy in the form of a source document.

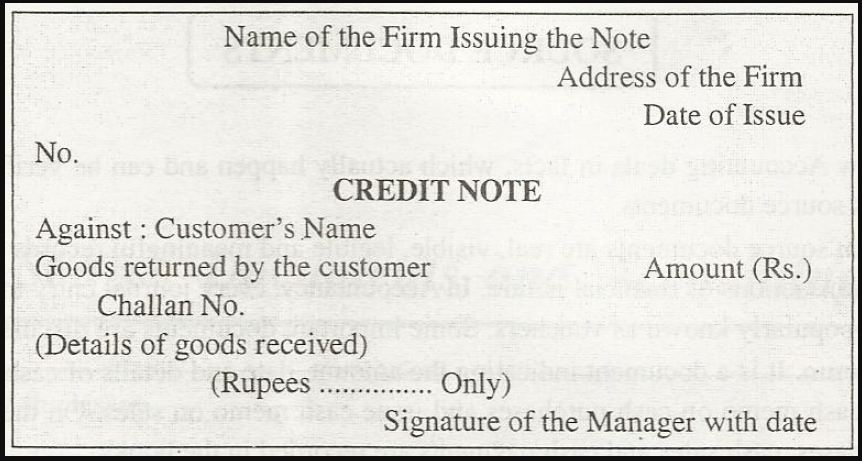

- Credit Note

Credit Notes are issued to customers in the event of sales return. Here, the customer’s account is credited with the sales return amount. These credit notes are further used as a source document.

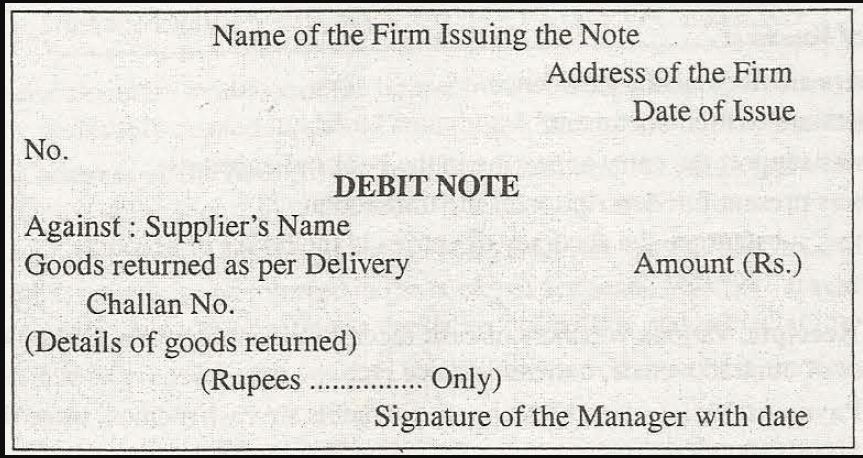

- Debit Note

Debit Notes are issued to sellers in case of return of goods which were purchased on credit. The seller’s account is debited with the amount of purchase return. Further, this debit note is used as a source document for recording about the purchase return in books of accounting.

- Pay-in-Slip

Pay-in-slip is filled up while depositing cheques and cash in the bank. While the main body of pay-in-slip is kept with the bank, the duly stamped and signed counterfoil is given to the consumer. This is further used for recording it in the accounting book.

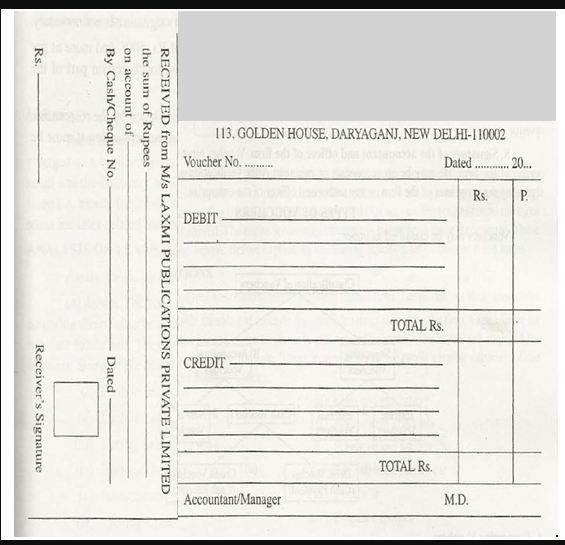

- Receipt

Whenever an amount is received or paid, the receiver issues a receipt to his payer. This indicates the date, amount and other details like the purpose of payment, payee details, etc. This receipt is used as a source document for the amount received or paid for recording it in the books of accounting.

- Miscellaneous

Other than the ones listed above, there are various other source documents like registration deeds, bills like electricity, salaries, wages, water, telephones, tickets, counterfoils which are also used and termed as source documents.

Vouchers:

Definition

Ronald A. Irish believes that a voucher can be an invoice, a written requisition slip, a receipt, agreement or any written proof which validates a financial transaction.

- R. Batliboi has defined voucher as a form of documentary evidence which is in support of an entry which has appeared in the books of accountancy.

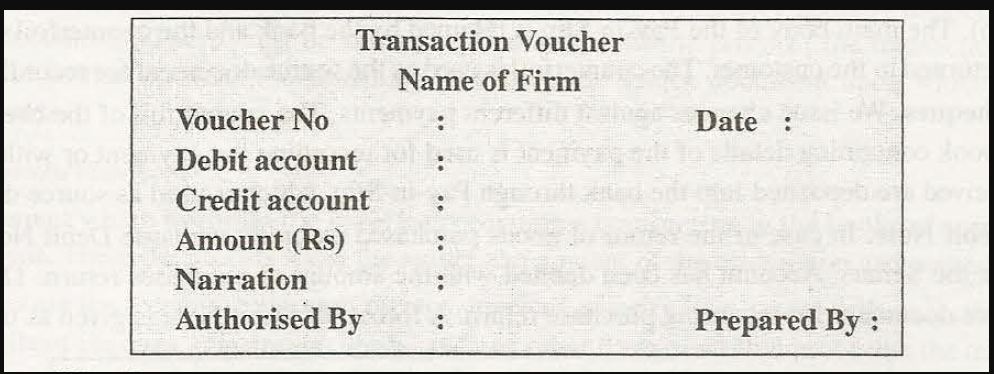

A voucher looks like-

Features of Vouchers

- These are written documents.

- These are a form of written evidence of any financial transaction.

- Vouchers validate an entry in the books of accounting.

- These authenticate that an entry in the books of accountancy is valid.

- These contain the full details of a monetary transaction like the date, amount and other financial details.

Examples of Vouchers

- Cash Payment- Vouchers like wage sheets, cash memos, correspondence, salary register copies of contracts, etc. are types of cash payments.

- Cash Receipts- Carbon copies, counterfoils of issued receipts, carbon copies of completed contracts, correspondence, etc. are various forms of cash receipts.

- Purchase Return- Letter of credit, goods outward book, correspondence, are examples of purchase return vouchers.

- Purchases- Vouchers regarding purchases are – copies of sent order, invoices, goods inward book, correspondence, etc.

- Sales- Vouchers like record of supplied goods, copies of received orders, correspondence, good outward book, etc. are sales vouchers.

Links of Previous Main Topic:-

Links of Next Financial Accounting Topics:-