The prime objective of financial management is maximizing the wealth of investors and its shareholders. This can be possible if the company earns profit in a considerable amount. As this profitable structure completely depends on sale, the sale volume cannot be directly converted into cash at aninstant.

This is simply because of time gap- A time gap that is created between theselling of products and obtaining of the cash. During this time, every company requires some amount of money to keep on the flow of production on a regular basis. This amount is termed as ‘working capital’. If the company does not have anadequate amount of working capital, then it will be hard to remain in the same position after acertain interval of time.

In other words, working capital means the amount of money that is required for daily expenses of any organization. It can also be defined as the capital that is circulated or revolved around the organization on a daily basis.

- S. Mill has defined working capital as the total current asset that is required for businesses.

According to Shubin, “Working Capital is that amount of money which is necessary to cover the operating cost of an enterprise.”

According to Gesterrberg, “Working Capital is the excess amount that is required over current liabilities.”

Thus,

Net Working Capital = Current Assets – Current Liabilities

Types of Working Capital

Working Capital is categorized into two on the basis of time. This includes:

- Permanent Working Capital or Core Current Assets

- Temporary Working Capital

- Permanent Working Capital

It can be defined as the capital asset that is required to run an organization on a regular basis. Permanent Working Capitalis also termed as Core Working Capital.In other words, it can be explained as the minimum amount of money that is investedin running a business at its minimum level of production on a permanent basis.

- Temporary Working Capital

Sometimesorganization requires capital investment on a seasonal basis. This investment of money is considered to be the Temporary or Seasonal Working Capital. Or, with the increase in demand for some product, an organization needs to invest more. This amount of money is termed as Temporary Working Capital.

In other words, it can also be defined as the amount of money that fluctuates from time to time and depend upon the business activities is called Temporary or Variable Working Capital.

Concepts of Working Capital

The concepts of working capital are divided into two categories:

- Gross Working Capital

- Net Working Capital

Gross Working Capital

It refers to the amount of money that represents the investment. This investment will be for current assets that include inventories, bills receivables and marketable securities.

Net Working Capital

It refers to the excess amount of money over the current liabilities. It is mostly considered simply as ‘Working Capital’.

Operating Cycle

In the modern business strategies, every company faces severe competition to survive in the global market. Each of them produces goods as per the demand. In this context, it is difficult to get the sale of all the products and get back the cash immediately.

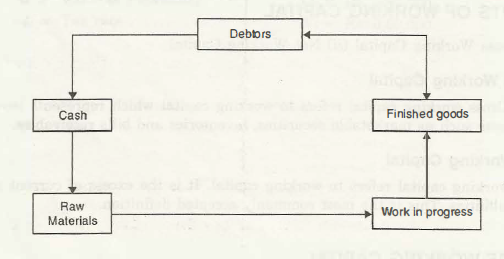

Starting from the purchase of company’s raw material to its cash generation process, there remains a gap. This time gap is usually called as the Operating Cycle of the business.

Different Stages of Operating Cycle:

- Conversion of cash into the raw material

- Conversion of raw material into the work in progress

- Conversion of work in progress into the finished goods

- Conversion of the finished goods into the debtors

- Conversion of debtors into the cash

Links of Previous Main Topic:-

- Introduction to accounting and branches of accounting

- Preparation of final accounts

- Introduction of fund flow statement

- Introduction cash flow statement

- Ratio analysis significance of ratio analysis

- Fixed assets and depreciation meaning causes objectives methods and basic factor

- Cost accounting concept objectives advantages limitations general principles and cost sheet

- Job costing

- Introduction process costing

- Activity based costing introduction concept and classification

- Introduction inventory pricing and valuation

- Standard costing introduction

- Management accounting

- Marginal costing

- Relevant cost for decision making

- Budget and budgetary control

- Limitations of historical accounting

- Introduction to responsibility accounting

- Introduction to financial management

- Introduction and types of dividend

- Concept of cost of capital

- Capitalization meaning

Links of Next Finance Topics:-