Instead of the multilayer leases, the lease versus the annual rent is a something that needs to be compared. So, let us compare the leases for a time period of three years as that of the entire previous section which is to the entire five year lease. Let us first take a note which is before the asking of question, you must consider the use of the leased building. In case you however, need such for a time period of 3 years only, then you must choose the duration of three year lease. In a situation you have the need the building for a span of 5 years, and then you have to understand that the lease must be obtained for a time span of two more extended years. If however, you need to make it simpler, then you must never care for the sign of three or even five year mortgage rent. What you must care for only the lowest cost.

Focusing on the factor, a certain of a three year lease will cost $2,128.10. As for the case of a total five year leasing, it will cost $3,184.93. The entire three year lease plan is obviously not cheap. So does that three year lease accumulate as to a better option? Obviously that is not so, the 5 years lease is better than the 3 year lease plan as the lease for five years gives a better chance to you to access to the building for 5 years. Hence this is the reason why the 5 year old lease is much more expensive deal. So how could someone compare the 2 types of leases?

There are 2 methods for you, choose the one that you want. However, they will have the rightly equal answer:

Repeated leases: both leases can be repeated by you until they both remain left with the exact same duration of years. Example, compare a three year old lease with that of the old one. This will lead you to work out with a 15 years of leases all total on the cost section. This would be the one to compare a total three years consecutively for 5 years.

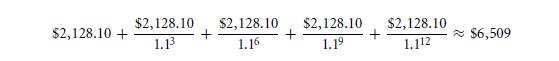

As we have worked on the method of lease beginning at a cost of $2,128.10, then the previous one will cost up to a cost of $2,128.10 of the duration of 0 years. You would hence perform repetition in the year 3, costing anyone another set of $2,128.10. This must be repeated in 6th year, 9th year, and also on the 12th year. The present value for the 15th year lease would be,

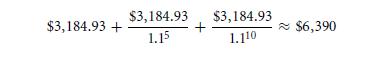

The alternative that you get for the span of 5 year, is that of the cost of $3,184.93 and that too in the year of 10. Thus the entire costing would be,

The method will work very tediously. If you even then had to put a compare the leases that are made, one will have to definitely work on the lease cost over the 1,155 year duration.

Work out on the more equivalent total annual costs: comparing the leases to each other can be tedious, so thus it is better to calculate the ones with equivalent total annual rents that would be compared to these. So, when you work on at least one out of the two leases, it will work out just fine. EAC’s total three year lease rounds off to a total sum amount of $777.95. As for the EAC, that is for the five year lease will be $763.80. Thus, a total five year contract will be a lot more cheaper than that which is on a yearly basis. (If the use of the year ends payment would be that of a year-end total payment of the EAC with the cheaper rate. The cost will be of 10% and higher.)

Plus, in addition to these, this value to compare can be used with that of the total contracts numbers. There will be no use to work on the total number of technology at a total cost of thousand years.

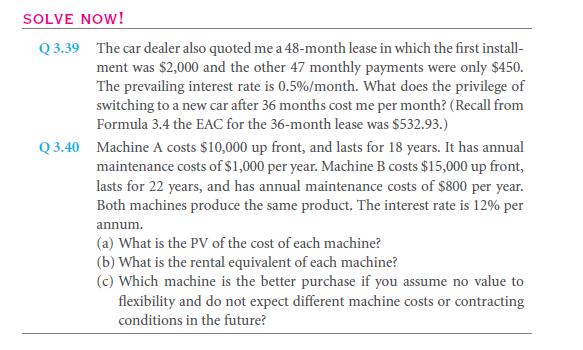

The equivalent rate value problems will arise if you compare the EAC value with different companies – this is an example, that you can make a purchase of a machine which is moreover likely that is to be that of eighteen years and hence, everyone must still compare it with the other machines that are likely to remain intact for a duration of over twenty two years. The method that is included in the solving of such problems would be that of the exact same value. So, try out the next questions.