A voucher is a written document which is used by the company’s accounts payable department to gather and file all supporting documents which are required for approving the payment of a liability. Since it is the documentary proof of a financial transaction, it needs to be prepared cautiously and carefully. Further, it is preferable to have printed copies of vouchers.

A voucher contains several details. These are as follows-

- Name and address of the company

A voucher needs to have the name and address of the company printed right at its top.

- Date

The date in which the voucher is being prepared should be written. It should bear the exact date, month and year of the transaction.

- Voucher Number

A voucher needs to bear a serial number so that it can be identified easily, distinguished with other vouchers and even referred in the books of accounting. These are numbered serially and this number is cited against the posting in the cash book, ledger and subsidiary books.

- Details of the party who needs to be credited

When a payment is done through Cheque or Bank Draft or Cash, the Cash account or bank account is recorded with the date and number of the cheque or bank draft which has been issued. The account which is to be credited can even be used in the credit column.

- Details of the party who needs to be debited

It should bear the name and address of the party to whom the payment is to be made. Further, the details and purpose of the payment too need to be recorded there. All big business organizations prepare vouchers for each of their transaction these days.

These enterprises contain the name of the party (to whom the payment is to be made)

on the debit side. It even contains the head of accounts department against which the payment has been made. This can be Assets Account, Purchases Account and Expenses Account.

- Revenue Stamp

On every payment of $ 5001 and more, the company should affix revenue stamp. According to the law, a document is legal only if it contains a revenue stamp. Further, the receiver’s signature should cover certain parts of the revenue stamp.

- Proof of the amount received

When the payment is made through cash, his signature should be obtained with full amount details, the date and purpose of payment which he has received. However, when the payment is made in the form of a crossed account payee cheque, the signature of the receiver’s is not mandatory.

- Signature of the officer and accountant of the company

It is important that the voucher bears the signature of the person who is responsible for the company. He can either be the manager or accountant. Once it is verified, the proprietor of the company needs to sign it. In the absence of the owner, any other authorized officer can do the signature.

Various types of vouchers

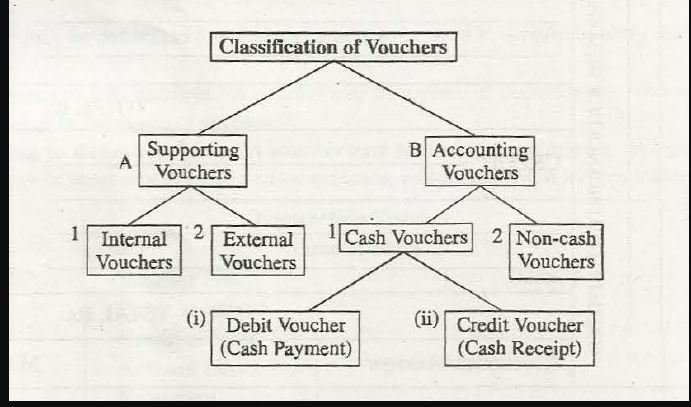

Vouchers can be classified into two categories-

- Supporting Vouchers

- Accounting Vouchers

These categories can be further sub-divided into several types.

Supporting Vouchers

- Internal Supporting Vouchers

Though such vouchers are prepared by the company itself, these are verified and authenticated by the third parties. These are counterfoils of challan, pay-in-slip, etc.

- External Supporting Vouchers

External Supporting Vouchers are prepared by third parties and then sent to companies. These are vouchers like cash memo, bills, invoices received from goods suppliers. It can even be receipt of rent which has been received from the landlord, credit note and debit note.

Accounting Vouchers

Accounting vouchers are the secondary or subsidiary vouchers which are made on the basis of other supporting vouchers that were issued by third parties. Once the accountant or manager prepares these vouchers, they are signed by the authorized person of the company.

Accounting Vouchers can be classified into two types- cash vouchers and non-cash vouchers.

Cash Vouchers

Cash vouchers are the written proof of cash receipts and cash payments. These can be classified into two parts.

- Credit Voucher

Also known as receipt vouchers, these are the written evidence of cash receipt. Credit vouchers can be cash sales of assets, goods and investments, borrowed loans, money withdrawn from bank, collection from debtors; cash receipt of rent, interest or any other mode of income, etc.

- Debit Voucher

Debit vouchers are payment vouchers which act as the documentary proof of cash payment. Debit vouchers are based on other supporting vouchers. In the absence of supporting vouchers, the receipt area of that voucher is filled in for using it as the supporting voucher.

This can be cash purchase of various goods and assets, a cash payment of wages and salaries and payments made to the bank, employees and creditors. However, it should be taken into consideration that in case the payment is of more than Rs. 500, a Re.1 revenue stamp should be affixed.

Links of Previous Main Topic:-

Links of Next Accounting Topics:-